Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Attractive stocks have exceptional fundamentals. In the case of Bouygues SA (EPA:EN), there's is a financially-sound company with a a strong history of performance, trading at a discount. In the following section, I expand a bit more on these key aspects. For those interested in understanding where the figures come from and want to see the analysis, read the full report on Bouygues here.

Good value with proven track record and pays a dividend

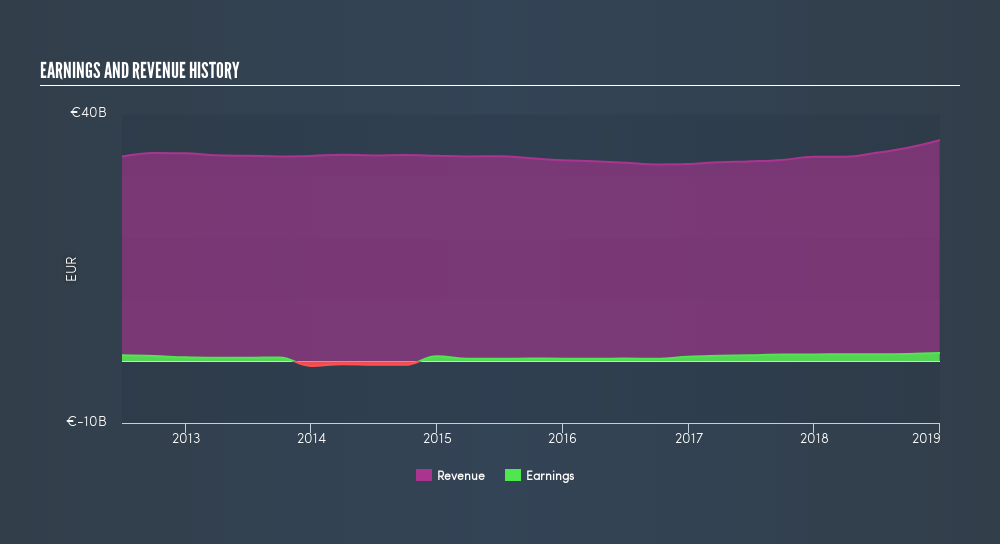

Over the past few years, EN has demonstrated a proven ability to generate robust returns of 4.0% Unsurprisingly, EN surpassed the industry return of 4.0%, which gives us more confidence of the company's capacity to drive earnings going forward. EN appears to have made good use of debt, producing operating cash levels of 0.34x total debt in the prior year. This is a strong indication that debt is reasonably met with cash generated. Debt funding requires timely payments on interest to lenders. EN’s earnings sufficiently covered its interest in the prior year, which indicates there’s low risk associated with the company not being able to meet these key expenses.

EN's shares are now trading at a price below its true value based on its discounted cash flows, indicating a relatively pessimistic market sentiment. This mispricing gives investors the opportunity to buy into the stock at a cheap price compared to the value they will be receiving, should analysts' consensus forecast growth be correct. Also, relative to the rest of its peers with similar levels of earnings, EN's share price is trading below the group's average. This supports the theory that EN is potentially underpriced.

Next Steps:

For Bouygues, there are three essential factors you should further examine:

- Future Outlook: What are well-informed industry analysts predicting for EN’s future growth? Take a look at our free research report of analyst consensus for EN’s outlook.

- Dividend Income vs Capital Gains: Does EN return gains to shareholders through reinvesting in itself and growing earnings, or redistribute a decent portion of earnings as dividends? Our historical dividend yield visualization quickly tells you what your can expect from EN as an investment.

- Other Attractive Alternatives : Are there other well-rounded stocks you could be holding instead of EN? Explore our interactive list of stocks with large potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTPA:EN

Bouygues

Operates in the construction, energy, telecom, media, and transport infrastructure sectors in France and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives