- France

- /

- Construction

- /

- ENXTPA:EN

Is Bouygues Still Attractive After 43% Price Surge and Strong Construction Pipeline in 2025?

Reviewed by Bailey Pemberton

If you are eyeing Bouygues and wondering whether now is the time to buy, sell, or just hold, you are not alone. With every upswing and dip, investors want to know what is really driving this stock, and is it still a bargain? Over the past year, Bouygues has delivered an impressive performance. The stock is up 8.4% in just the past week, 11.2% over the last month, and an astonishing 43.1% for the year to date. Looking back even further, returns have compounded to 77.7% over three years and 75.4% over five. There is clear evidence of momentum and resilience, and much of this can be tied to shifts in market sentiment around infrastructure, construction, and telecom, which are the core of Bouygues’ diversified business.

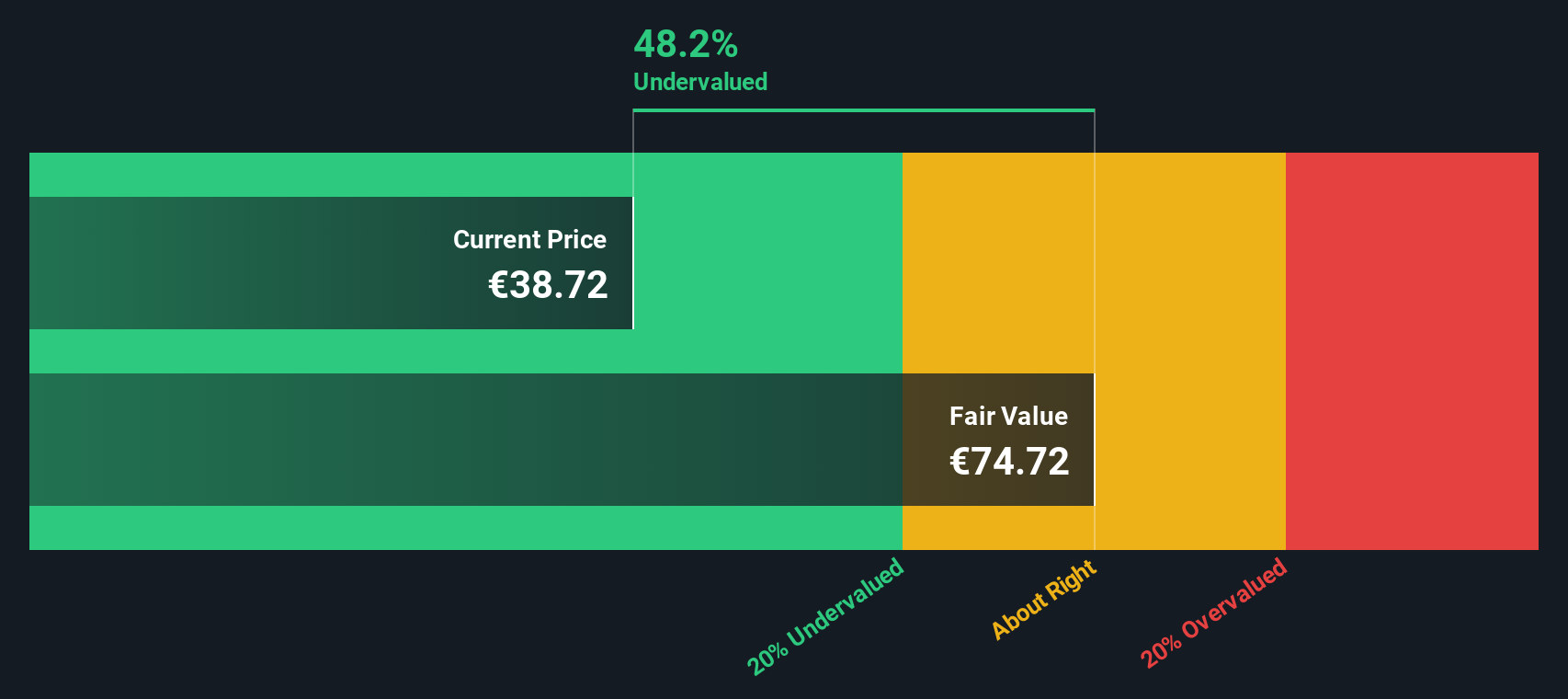

Of course, share price growth often makes investors cautious about value. Is Bouygues now too expensive, or is the market still undervaluing what the company has to offer? That is where our valuation score comes in. Based on six key checks, Bouygues earns a value score of 4, indicating it remains undervalued in most areas that matter. Still, these numbers only tell part of the story. Let us dive into the different ways analysts approach valuation. Then, I will share a smarter perspective on how you can judge value for yourself.

Approach 1: Bouygues Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s true value by projecting its estimated future cash flows, then discounting those back to today's terms. This approach is widely used because it focuses on the cash a business actually generates rather than just its accounting earnings.

For Bouygues, the latest reported Free Cash Flow (FCF) stands at €2.65 Billion. Analysts forecast FCF growth over the next five years, with projections reaching €2.56 Billion by the end of 2029. Beyond that, Simply Wall St extrapolates moderate growth, reflecting typical long-term economic conditions. These projections anchor the DCF valuation, which in this case employs a 2 Stage Free Cash Flow to Equity model.

Based on these cash flow forecasts and the time value of money, Bouygues’ estimated intrinsic value lands at €76.41 per share. Compared to recent share prices, this equates to a 46.0% discount, strongly indicating the stock is undervalued according to this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bouygues is undervalued by 46.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Bouygues Price vs Earnings

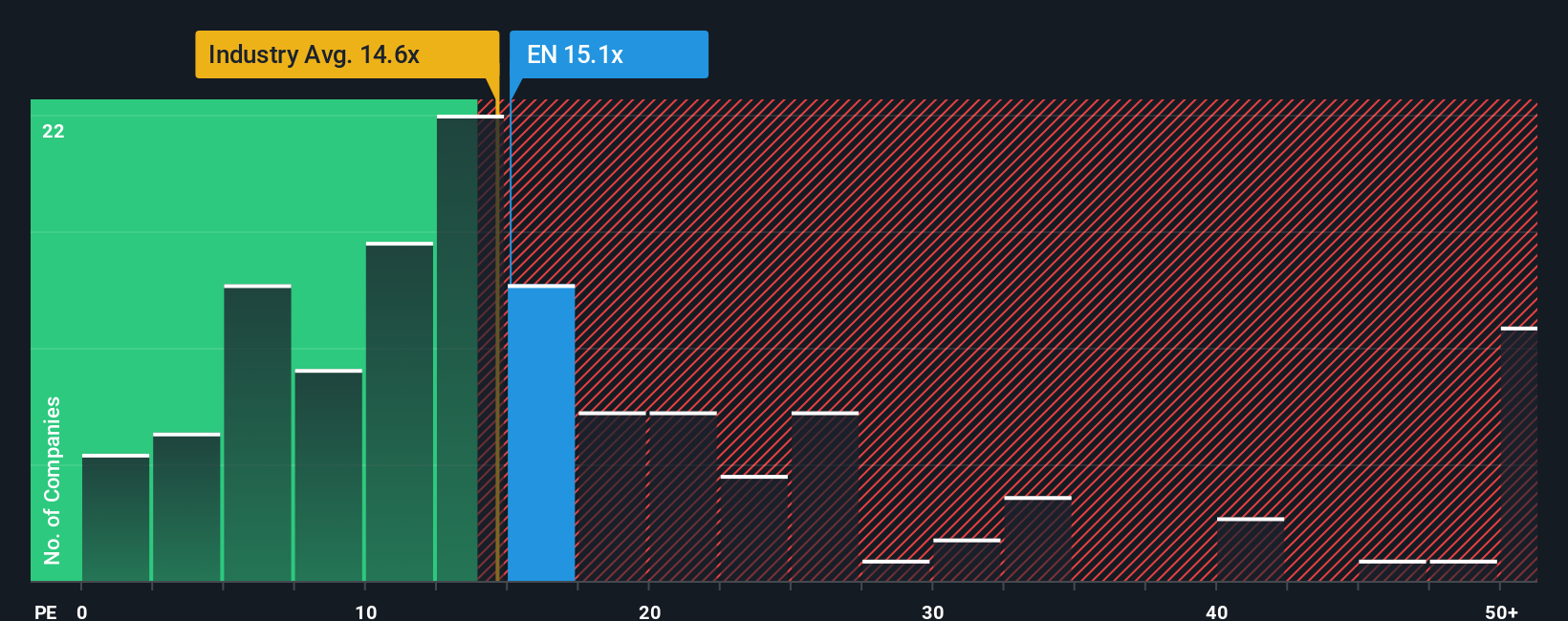

The Price-to-Earnings (PE) ratio is a simple, widely trusted way to value established, profitable companies like Bouygues. Since PE tells you how much investors are willing to pay for each euro of earnings, it works best for businesses with a solid profit track record. This makes it a relevant benchmark here.

A "normal" or "fair" PE ratio is not fixed. It is shaped by market expectations for future growth and the risk profile of the company. Businesses with stronger profit growth or lower risk typically command higher PE ratios, while slower or riskier firms see lower multiples.

Right now, Bouygues trades at a PE ratio of 15.1x. This is just below the Construction industry average of 15.9x and significantly lower than the average among its closest peers, which is 32.4x. However, raw comparisons can be misleading if they do not account for the company's unique positioning and prospects.

Simply Wall St's "Fair Ratio" adds that missing context by estimating the multiple you would expect given Bouygues’ earnings forecast, industry, profit margins, size, and risks. In Bouygues’ case, the Fair Ratio is 20.5x, giving us a more tailored target than generic industry or peer benchmarks. This approach accounts for nuances in the business and market and provides clearer guidance than standard comparisons.

Based on its Fair Ratio, Bouygues’ current PE of 15.1x indicates the stock is undervalued by this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bouygues Narrative

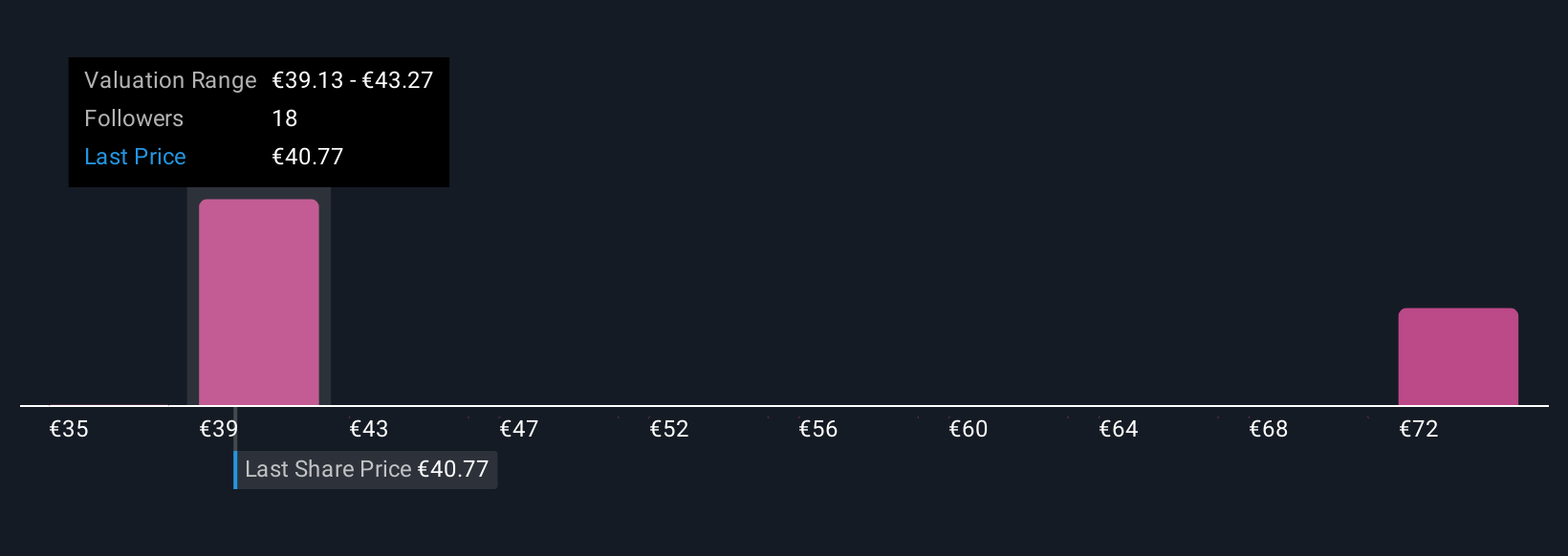

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is your own story and outlook for a company, connecting what you believe about its business, the numbers behind those beliefs, and the fair value those expectations produce. Instead of relying only on historic ratios or consensus estimates, Narratives let you express your perspective on Bouygues’ future, such as expected revenue, profit margins, or the impact of green infrastructure, and see exactly how those translate into a forecast and a fair value.

Narratives are intuitive and easy to create on Simply Wall St’s Community page, where millions of investors are already sharing their analysis and evolving their views as new news or earnings reports come in. This means your Narrative is not static. It dynamically updates with real company developments, so your fair value estimate stays in sync with the latest information.

By comparing your Narrative fair value with Bouygues’ current share price, you can quickly decide whether to buy, sell, or hold, all based on your own assumptions. For example, some investors see Bouygues reaching a high of €56 by banking on significant margin expansion and ongoing order growth, while others take a more cautious view with targets as low as €35, reflecting concerns over industry competition and cyclical risks.

Do you think there's more to the story for Bouygues? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bouygues might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EN

Bouygues

Operates in the construction, energy, telecom, media, and transport infrastructure sectors in France and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives