- France

- /

- Construction

- /

- ENXTPA:DG

Vinci (ENXTPA:DG) Valuation in Focus as €600m Share Buyback Signals Confidence, Regulatory Risks Loom

Reviewed by Kshitija Bhandaru

Vinci (ENXTPA:DG) just announced a share buyback programme worth up to €600 million. This move often signals management’s belief in future performance. Investors are weighing this against regulatory risks and upcoming concession expirations.

See our latest analysis for Vinci.

Vinci’s share price has slowly gathered steam in recent months, with a 1-month share price return of 2.1% reflecting resilient investor confidence even as the company faces regulatory uncertainties and the countdown on major French concessions continues. The overall trend suggests steady momentum backed by enduring operational strength, and the 1-year total shareholder return of 17.2% points to solid performance over both the short and long term.

If this steady momentum has you thinking bigger, now is the perfect moment to discover fast growing stocks with high insider ownership.

So with shares ticking upward and management clearly backing future prospects, does Vinci offer a genuine bargain for new investors, or is the market already factoring in all the upside?

Most Popular Narrative: 14.7% Undervalued

The current narrative places Vinci’s fair value at €138.24, noticeably higher than its latest close of €117.95. This gap is generating plenty of speculation around Vinci’s potential runway, with the following key driver in focus.

Expansion in high-margin concessions, energy transition projects, and digitalization should enhance operating margins and diversify income streams.

Want to know the growth blueprint behind this high valuation? The narrative leans on bold forecasts for Vinci’s profits and margins, including ambitious long-term projections most investors are ignoring. Curious to see exactly how these financial assumptions stack up? The drivers behind Vinci’s “undervalued” label might surprise you.

Result: Fair Value of €138.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory changes and looming concession expirations could derail Vinci’s growth outlook. These factors could also lead to greater earnings volatility than current forecasts suggest.

Find out about the key risks to this Vinci narrative.

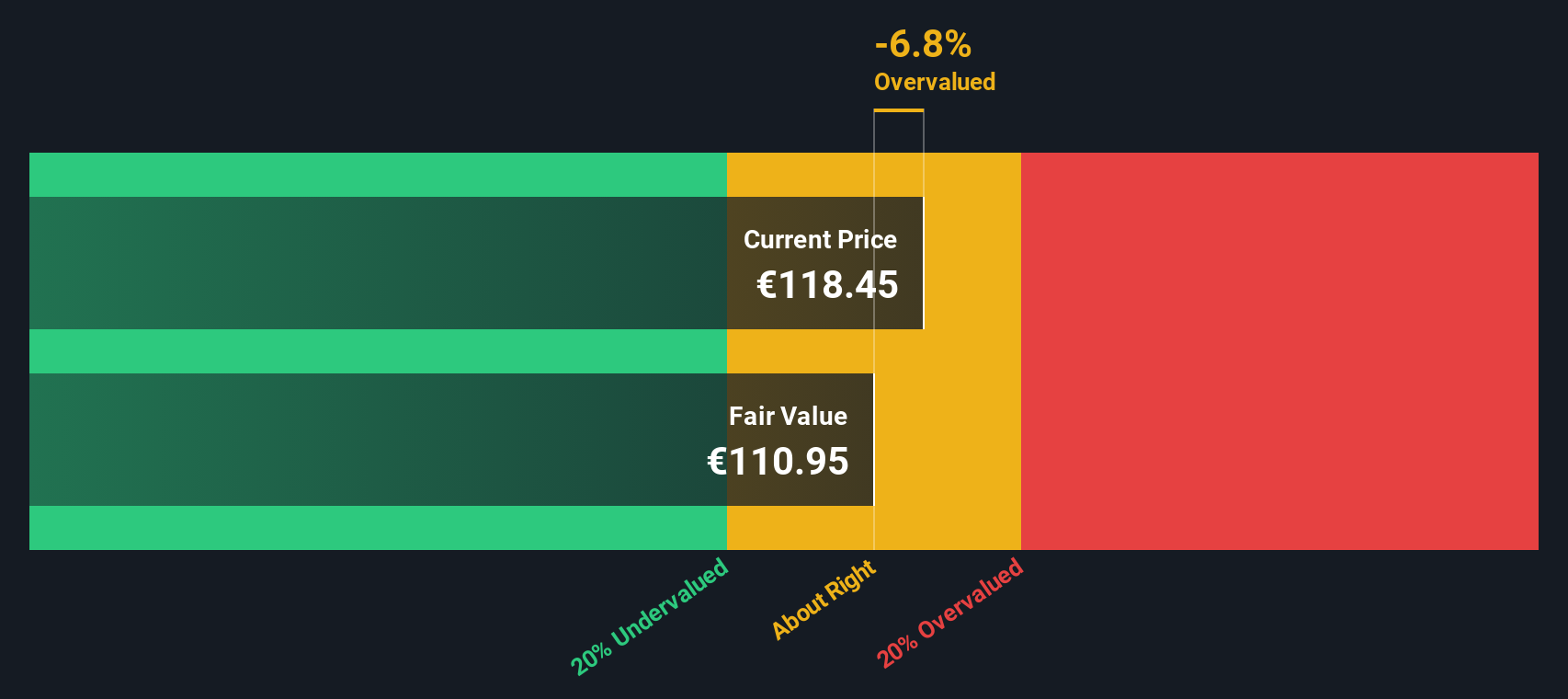

Another View: DCF Points to Modest Downside

While many see Vinci as undervalued based on profit outlooks, our SWS DCF model estimates a fair value closer to €110.69. This is slightly below today’s price, which suggests that some growth optimism could already be reflected in the valuation. Which method do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vinci for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vinci Narrative

If you see Vinci’s story differently or want to dig into the numbers yourself, you can craft your own take in under three minutes, Do it your way.

A great starting point for your Vinci research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

You don’t want to miss your chance to spot tomorrow’s winners before the crowd. The right tools put you a step ahead. These tailored picks make it easy to find your next opportunity.

- Boost your search for companies with strong cash flows and uncover valuable choices by tapping into these 896 undervalued stocks based on cash flows.

- Stay ahead of tech trends by tapping into high-potential sectors using these 24 AI penny stocks.

- Tap into markets delivering reliable income with these 19 dividend stocks with yields > 3% for consistent yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:DG

Vinci

Engages in concessions, energy, and construction businesses in France and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives