- France

- /

- Construction

- /

- ENXTPA:DG

Vinci (ENXTPA:DG): Assessing Valuation After Strong Q3 Airport Traffic Growth and Cambodia Expansion

Reviewed by Kshitija Bhandaru

Vinci (ENXTPA:DG) just released its third quarter traffic results, showing VINCI Airports handled 94 million passengers, which is a 4% climb from last year. Expansion into Cambodia’s Techo International Airport also contributed to this growth.

See our latest analysis for Vinci.

Vinci’s recent traffic gains come as the share price has climbed 21.8% year-to-date to €121.4, with momentum picking up after new airport projects and increased passenger volumes. Over the longer term, Vinci’s 3-year total shareholder return of 60.3% and nearly doubling over five years highlight steady value creation for investors.

If Vinci’s steady rise has you watching transport and infrastructure leaders, it could be the perfect moment to uncover what’s happening with other major players via our See the full list for free.

The question now for investors is whether Vinci’s recent momentum signals an undervalued opportunity that could deliver further gains, or if the market has already factored in all the company’s future growth prospects.

Most Popular Narrative: 12% Undervalued

With Vinci’s fair value estimate set at €138.24 and a recent share price of €121.4, the difference offers an intriguing case for further upside. The widely followed narrative hinges on a robust global push for infrastructure upgrades and climate adaptation, potentially laying the groundwork for Vinci’s long-term growth story.

Accelerating global infrastructure investment, notably for decarbonization and energy transition projects, is driving significant order intake and backlog growth (order book at record highs, major wins in renewables, high-voltage transmission, and PPP electrical distribution), supporting forward revenue visibility and potential for sustained top-line growth.

Want to know the growth blueprint behind this high valuation? The key driver is ambitious global expansion into resilient, future-focused infrastructure. Guess what else sets this price target apart? Uncover the bold assumptions and bullish earnings projections that underpin this figure, but only in the full narrative.

Result: Fair Value of €138.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, looming regulatory changes and weakness in France’s property sector could create headwinds that challenge Vinci’s earnings momentum and long-term growth narrative.

Find out about the key risks to this Vinci narrative.

Another View: Testing the Numbers with a Different Lens

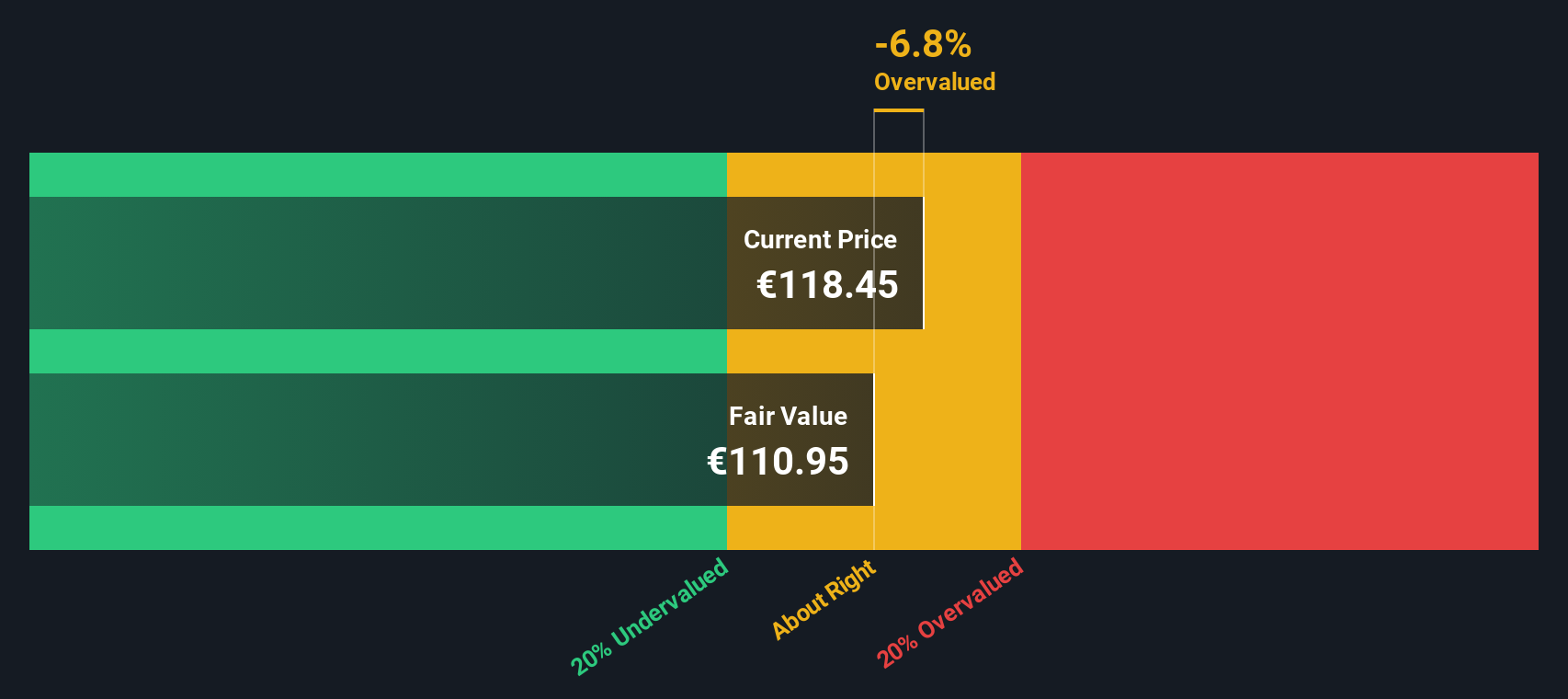

Although many see Vinci’s fair value as €138.24, our DCF model suggests something different. The SWS DCF model puts Vinci’s fair value very close to its current price, which implies it may be fairly valued and not deeply undervalued. Is the consensus too bullish, or is the market missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vinci for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vinci Narrative

Feel like there’s more to the Vinci story or want to dig into the numbers yourself? You can dive in and craft your own analysis in just a few minutes. Do it your way

A great starting point for your Vinci research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that untapped opportunities don't wait. Put your strategy ahead of the crowd and see what’s possible with these powerful stock themes:

- Turbocharge your growth hunt by targeting undervalued companies poised for a re-rating via these 875 undervalued stocks based on cash flows.

- Maximize your income potential by tapping into these 18 dividend stocks with yields > 3% with reliable yields above 3%.

- Ride the AI wave and pinpoint emerging leaders through these 24 AI penny stocks before they capture the mainstream spotlight.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:DG

Vinci

Engages in concessions, energy, and construction businesses in France and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives