To the annoyance of some shareholders, Vergnet SA (EPA:ALVER) shares are down a considerable 75% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 100% share price decline.

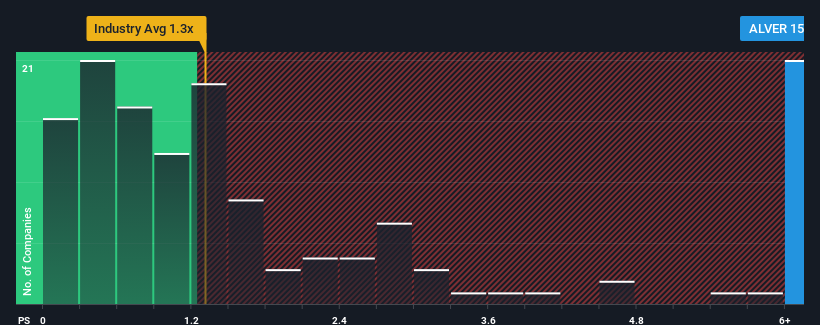

Although its price has dipped substantially, when almost half of the companies in France's Electrical industry have price-to-sales ratios (or "P/S") below 1.5x, you may still consider Vergnet as a stock not worth researching with its 15.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Vergnet

What Does Vergnet's Recent Performance Look Like?

Vergnet certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Vergnet's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Vergnet's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 42% gain to the company's top line. The latest three year period has also seen an excellent 65% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 2.5% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this in consideration, it's not hard to understand why Vergnet's P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Final Word

Even after such a strong price drop, Vergnet's P/S still exceeds the industry median significantly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Vergnet revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

You should always think about risks. Case in point, we've spotted 5 warning signs for Vergnet you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALVER

Vergnet

Designs, develops, and installs renewable energy solutions in France and internationally.

Moderate and slightly overvalued.

Market Insights

Community Narratives