Investors Who Bought BIO-UV Group (EPA:ALTUV) Shares A Year Ago Are Now Up 87%

If you want to compound wealth in the stock market, you can do so by buying an index fund. But investors can boost returns by picking market-beating companies to own shares in. For example, the BIO-UV Group S.A. (EPA:ALTUV) share price is up 87% in the last year, clearly besting the market decline of around 2.2% (not including dividends). That's a solid performance by our standards! We'll need to follow BIO-UV Group for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

See our latest analysis for BIO-UV Group

BIO-UV Group wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year BIO-UV Group saw its revenue grow by 55%. That's stonking growth even when compared to other loss-making stocks. While the share price gain of 87% over twelve months is pretty tasty, you might argue it doesn't fully reflect the strong revenue growth. If that's the case, now might be the time to take a close look at BIO-UV Group. Since we evolved from monkeys, we think in linear terms by nature. So if growth goes exponential, opportunity may exist for the enlightened.

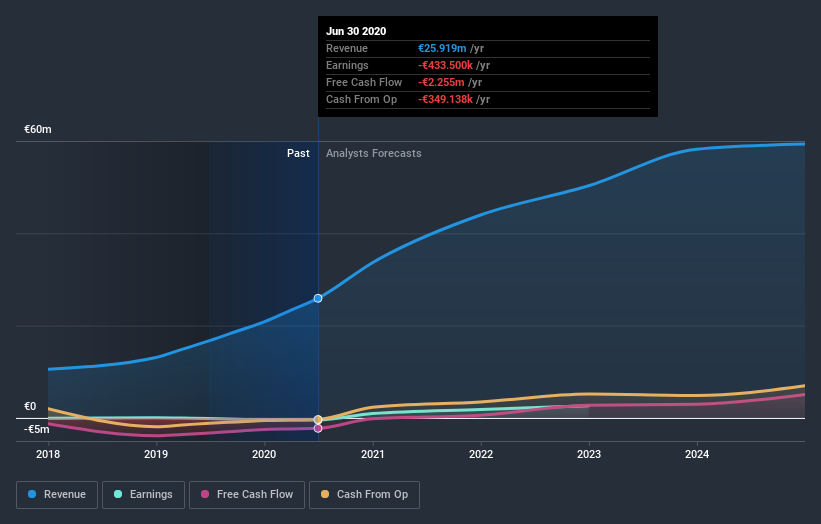

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

BIO-UV Group shareholders should be happy with the total gain of 87% over the last twelve months. That's better than the more recent three month gain of 16%, implying that share price has plateaued recently. It seems likely the market is waiting on fundamental developments with the business before pushing the share price higher (or lower). It's always interesting to track share price performance over the longer term. But to understand BIO-UV Group better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with BIO-UV Group , and understanding them should be part of your investment process.

Of course BIO-UV Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

When trading BIO-UV Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if BIO-UV Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:ALTUV

BIO-UV Group

Designs, manufactures, and markets ultraviolet light water treatment and surface disinfectant devices for individuals and professionals in France, rest of Europe, Asia, the Middle East, the United States, and internationally.

Good value slight.

Market Insights

Community Narratives