A Look at Alstom (ENXTPA:ALO) Valuation Following CEO Transition Announcement

Reviewed by Kshitija Bhandaru

Alstom (ENXTPA:ALO) has named Martin Sion as its next CEO, with the transition scheduled for April 2026. The decision follows a period of careful succession planning and signals stability at the company’s top levels.

See our latest analysis for Alstom.

Alstom’s share price has been relatively steady this year, with a recent uptick as attention turned to its leadership changes and strategic direction. The 1-year total shareholder return of nearly 7% hints at improving investor sentiment. In the bigger picture, momentum is recovering after a tough five-year period, which could set the stage for renewed interest if growth prospects begin to strengthen.

If you’re looking to see what else the market offers as leadership evolves, take this chance to discover fast growing stocks with high insider ownership.

With shares hovering slightly below analyst price targets and a muted value score, the key question is whether Alstom is trading at a discount that anticipates future gains, or if markets are already reflecting upcoming growth in the price.

Most Popular Narrative: 5.3% Undervalued

With Alstom’s narrative-based fair value set above the latest closing price, the most popular outlook points toward the market undervaluing its turnaround potential. This valuation forms the basis for a bullish case on Alstom’s future margin and order quality.

The company is conducting industrial restructuring to optimize its manufacturing setup, which aims to enhance operational efficiency and potentially improve net margins and earnings. Significant future opportunities lie in Alstom's strong order pipeline, especially in Europe, the Middle East, and Asia Pacific, with €200 billion expected in orders over the next three years. This could enhance revenue.

Want to know what’s driving this optimism? The numbers behind this valuation rest on an aggressive blueprint for future earnings, expanding profitability, and major wins from global contract flows. Which specific assumptions tip the scales in this narrative calculation? The surprise is found within the financial projections—click through to uncover what’s fueling the bullish outlook on Alstom now.

Result: Fair Value of $23.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent supply chain challenges and delays in legacy contracts could hinder Alstom’s earnings recovery and dampen the current bullish outlook.

Find out about the key risks to this Alstom narrative.

Another View: Multiples Tell a Different Story

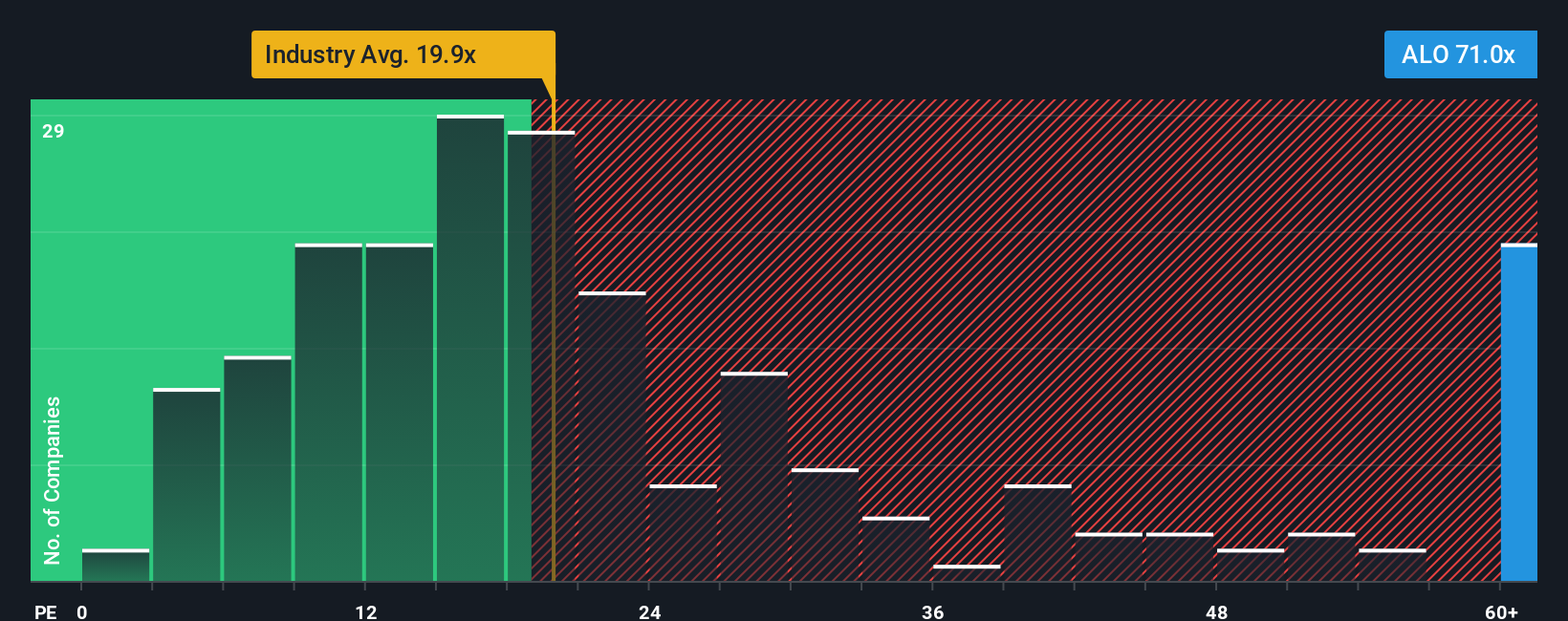

Looking from the lens of price-to-earnings ratios, Alstom appears expensive. Its ratio stands at 71x, much higher than both the European Machinery industry average of 19.9x and the peer average of 17.3x, as well as its own fair ratio of 39x. This gap raises questions about valuation risk. Could the market be too optimistic?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alstom Narrative

If you’d rather follow your own thesis, you can quickly dive into the numbers and shape a custom view on Alstom’s future in just a few minutes, Do it your way.

A great starting point for your Alstom research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Smart investors always keep an eye on tomorrow's trends. Take action now and expand your portfolio with these handpicked ideas that could put you ahead of the curve.

- Boost potential income by targeting high-yield opportunities through these 18 dividend stocks with yields > 3%, which consistently reward shareholders above market averages.

- Tap into the massive growth wave in artificial intelligence with these 24 AI penny stocks, featuring companies leading the next stage of technological innovation.

- Stay ahead by searching for rare value in the market with these 877 undervalued stocks based on cash flows, focusing on businesses the market may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALO

Alstom

Provides solutions for rail transport industry in Europe, the Americas, the Asia Pacific, the Middle East, Central Asia, and Africa.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives