- France

- /

- Trade Distributors

- /

- ENXTPA:ALHRG

Benign Growth For Herige (EPA:ALHRG) Underpins Its Share Price

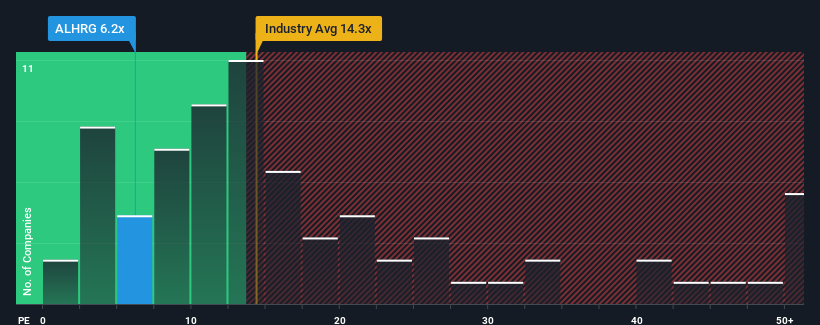

When close to half the companies in France have price-to-earnings ratios (or "P/E's") above 16x, you may consider Herige (EPA:ALHRG) as a highly attractive investment with its 6.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

We've discovered 3 warning signs about Herige. View them for free.Recent times have been advantageous for Herige as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Herige

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Herige's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 18%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 44% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 135% as estimated by the only analyst watching the company. That's not great when the rest of the market is expected to grow by 15%.

With this information, we are not surprised that Herige is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Herige's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Herige maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Herige (1 is a bit concerning!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Herige, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Herige might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALHRG

Herige

Engages in the trading of building materials for professional and DIY customers primarily in France.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives