Positive Sentiment Still Eludes Gaussin SA (EPA:ALGAU) Following 47% Share Price Slump

Gaussin SA (EPA:ALGAU) shareholders won't be pleased to see that the share price has had a very rough month, dropping 47% and undoing the prior period's positive performance. For any long-term shareholders, the last month ends a year to forget by locking in a 72% share price decline.

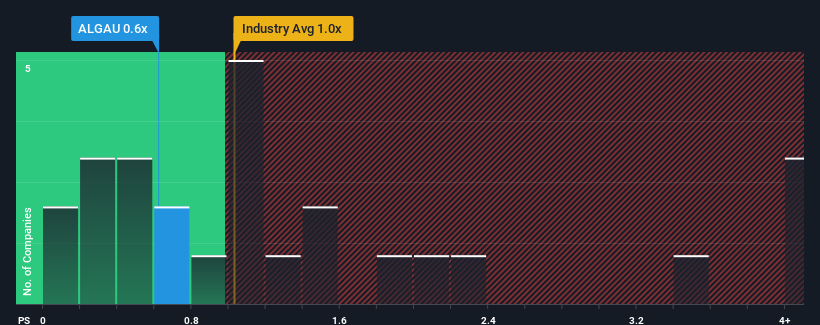

In spite of the heavy fall in price, it's still not a stretch to say that Gaussin's price-to-sales (or "P/S") ratio of 0.6x right now seems quite "middle-of-the-road" compared to the Machinery industry in France, where the median P/S ratio is around 1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Gaussin

How Has Gaussin Performed Recently?

Revenue has risen at a steady rate over the last year for Gaussin, which is generally not a bad outcome. One possibility is that the P/S is moderate because investors think this good revenue growth might only be parallel to the broader industry in the near future. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

Although there are no analyst estimates available for Gaussin, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

Gaussin's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 6.2% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 218% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 11% shows it's noticeably more attractive.

In light of this, it's curious that Gaussin's P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Following Gaussin's share price tumble, its P/S is just clinging on to the industry median P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

To our surprise, Gaussin revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 4 warning signs for Gaussin (2 are potentially serious!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALGAU

Gaussin

Designs, assembles, and offers zero-emission, smart, and connected vehicles for freight transportation and people mobility worldwide.

Low with weak fundamentals.