- France

- /

- Construction

- /

- ENXTPA:ALESE

After Leaping 29% Entech SA (EPA:ALESE) Shares Are Not Flying Under The Radar

Despite an already strong run, Entech SA (EPA:ALESE) shares have been powering on, with a gain of 29% in the last thirty days. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 5.6% over the last year.

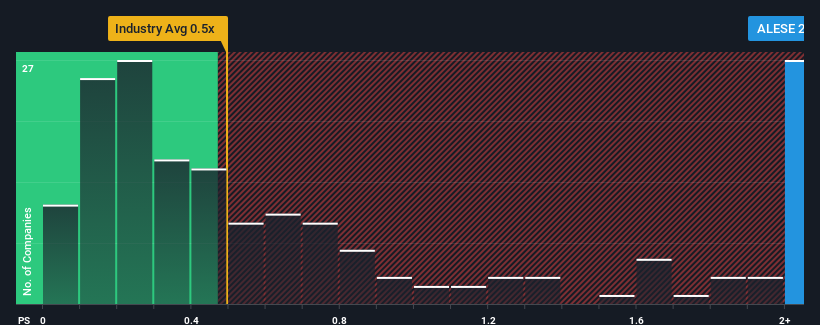

After such a large jump in price, when almost half of the companies in France's Construction industry have price-to-sales ratios (or "P/S") below 0.4x, you may consider Entech as a stock not worth researching with its 2.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Entech

What Does Entech's P/S Mean For Shareholders?

Recent times have been advantageous for Entech as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Entech's future stacks up against the industry? In that case, our free report is a great place to start.How Is Entech's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Entech's is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 38%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 44% per year over the next three years. With the industry only predicted to deliver 8.0% per annum, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Entech's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Entech's P/S Mean For Investors?

Entech's P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Entech shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Entech (1 is a bit unpleasant!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Entech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALESE

Entech

Engages in the storage, conversion, and management of renewable energies in France and internationally.

High growth potential with adequate balance sheet.