- France

- /

- Electrical

- /

- ENXTPA:ALDBT

There's No Escaping DBT SA's (EPA:ALDBT) Muted Revenues Despite A 82% Share Price Rise

DBT SA (EPA:ALDBT) shareholders would be excited to see that the share price has had a great month, posting a 82% gain and recovering from prior weakness. But the last month did very little to improve the 96% share price decline over the last year.

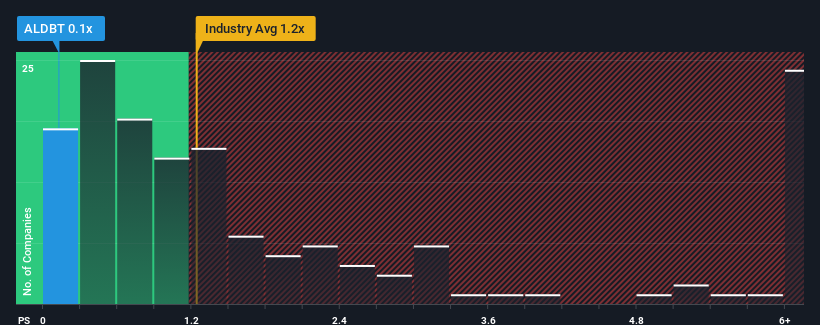

Although its price has surged higher, considering around half the companies operating in France's Electrical industry have price-to-sales ratios (or "P/S") above 1.3x, you may still consider DBT as an solid investment opportunity with its 0.1x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for DBT

How Has DBT Performed Recently?

With revenue growth that's superior to most other companies of late, DBT has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on DBT will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

DBT's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 165% last year. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 22% during the coming year according to the only analyst following the company. With the industry predicted to deliver 2.5% growth, that's a disappointing outcome.

In light of this, it's understandable that DBT's P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does DBT's P/S Mean For Investors?

DBT's stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that DBT's P/S is on the lower end of the spectrum. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 5 warning signs for DBT (4 are concerning!) that we have uncovered.

If these risks are making you reconsider your opinion on DBT, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALDBT

DBT

Provides charging solutions for electric vehicles, retractable terminals for access control and dissuasion, distribution terminals for power and current transformers in France and internationally.

Moderate with mediocre balance sheet.