- France

- /

- Aerospace & Defense

- /

- ENXTPA:AIR

The Bull Case For Airbus (ENXTPA:AIR) Could Change Following Major IndiGo A350 Order Expansion

Reviewed by Sasha Jovanovic

- IndiGo has finalized an order with Airbus, converting 30 purchase rights into firm commitments for A350-900 widebody aircraft, effectively doubling its total A350-900 order to 60 units as of October 2025.

- This substantial order from India's largest airline represents a major boost for Airbus in the competitive widebody segment and strengthens its position in the rapidly expanding Indian aviation market.

- We'll look at how winning IndiGo’s major A350 order could shape Airbus’s long-term growth outlook, especially in emerging markets.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Airbus Investment Narrative Recap

Airbus’s long-term value story depends on its ability to convert robust demand for fuel-efficient aircraft, driven by fleet renewal and emerging market growth, into sustained production and profitable deliveries. IndiGo’s doubling of its A350-900 order affirms Airbus’s foothold in India’s booming aviation market and supports its backlog, but it does not directly resolve the largest current risk: persistent delivery delays from ongoing supply chain vulnerabilities and reliance on key engine and component suppliers.

Among recent developments, the Avolon order for 75 A321neo and 15 A330neo aircraft also reinforces continued strong demand for Airbus’s next-generation jets. These announcements underpin near-term growth catalysts, yet real progress depends on Airbus’s ability to align supplier output with ambitious production targets and convert orders into timely deliveries.

However, investors should be alert to the growing risk that, if supply chain disruptions persist, especially with engines and critical parts, Airbus’s path forward could…

Read the full narrative on Airbus (it's free!)

Airbus' narrative projects €98.7 billion revenue and €7.9 billion earnings by 2028. This requires 12.1% yearly revenue growth and a €3.0 billion earnings increase from €4.9 billion today.

Uncover how Airbus' forecasts yield a €204.75 fair value, in line with its current price.

Exploring Other Perspectives

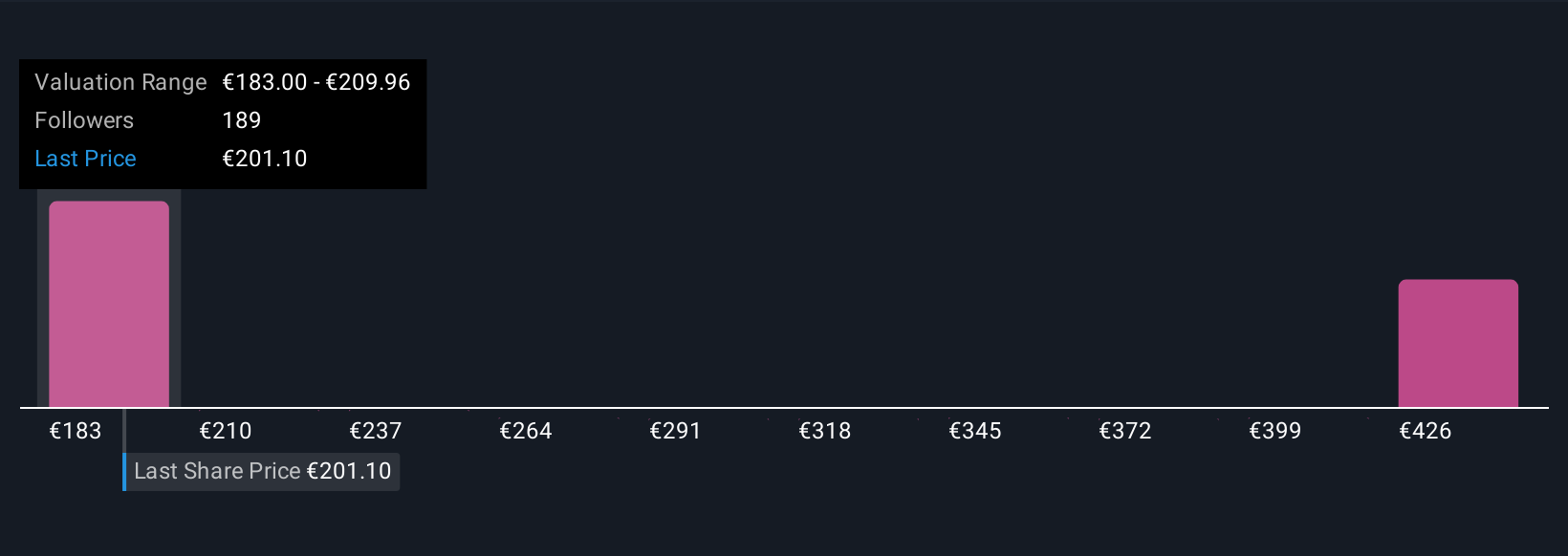

Twenty-four private investors in the Simply Wall St Community estimate Airbus’s fair value between €181.63 and €447.29 per share. While most expect accelerating demand to support the share price, persistent supply chain challenges remain a core issue that could affect future profitability, so consider a range of views before deciding where you stand.

Explore 24 other fair value estimates on Airbus - why the stock might be worth over 2x more than the current price!

Build Your Own Airbus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Airbus research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Airbus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Airbus' overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AIR

Airbus

Engages in the design, manufacture, and delivery of aeronautics and aerospace products, services, and solutions worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives