- France

- /

- Aerospace & Defense

- /

- ENXTPA:AIR

Assessing Airbus After Strong 2024 Rally and DCF Suggesting Further Upside Potential

Reviewed by Bailey Pemberton

- If you are wondering whether Airbus remains attractive after its big multi-year run, or if most of the upside is already priced in, this breakdown is for you.

- Despite short-term volatility, with the share price down about 3.5% over the last week and 7.4% over the past month, Airbus is still up roughly 23.0% year to date and 31.2% over the past year, building on even stronger multi-year gains.

- Those moves sit against a backdrop of major aircraft order wins, ongoing ramp-ups in commercial jet production and continued focus on decarbonization technologies such as sustainable aviation fuels and hydrogen concepts. Together these themes have reinforced Airbus' position as a key long-term exposure to global air travel and defense demand, even as investors weigh execution risks and cyclical swings.

- On our checklist of six valuation tests, Airbus scores a solid 5 out of 6 for being undervalued. We will unpack this using different valuation lenses before finishing with a more intuitive way to think about what the market might be missing.

Find out why Airbus's 31.2% return over the last year is lagging behind its peers.

Approach 1: Airbus Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model takes Airbus' expected future cash flows and discounts them back into today's euros to estimate what the entire business is worth right now. It is essentially a way of asking what those future euros are worth in today's money.

Airbus generated about €3.8 billion of free cash flow over the last twelve months, and analysts expect this to rise sharply as production ramps up. Consensus and extrapolated estimates point to free cash flow climbing toward roughly €19.6 billion by 2035, which implies a strong multi year growth trajectory in cash generation.

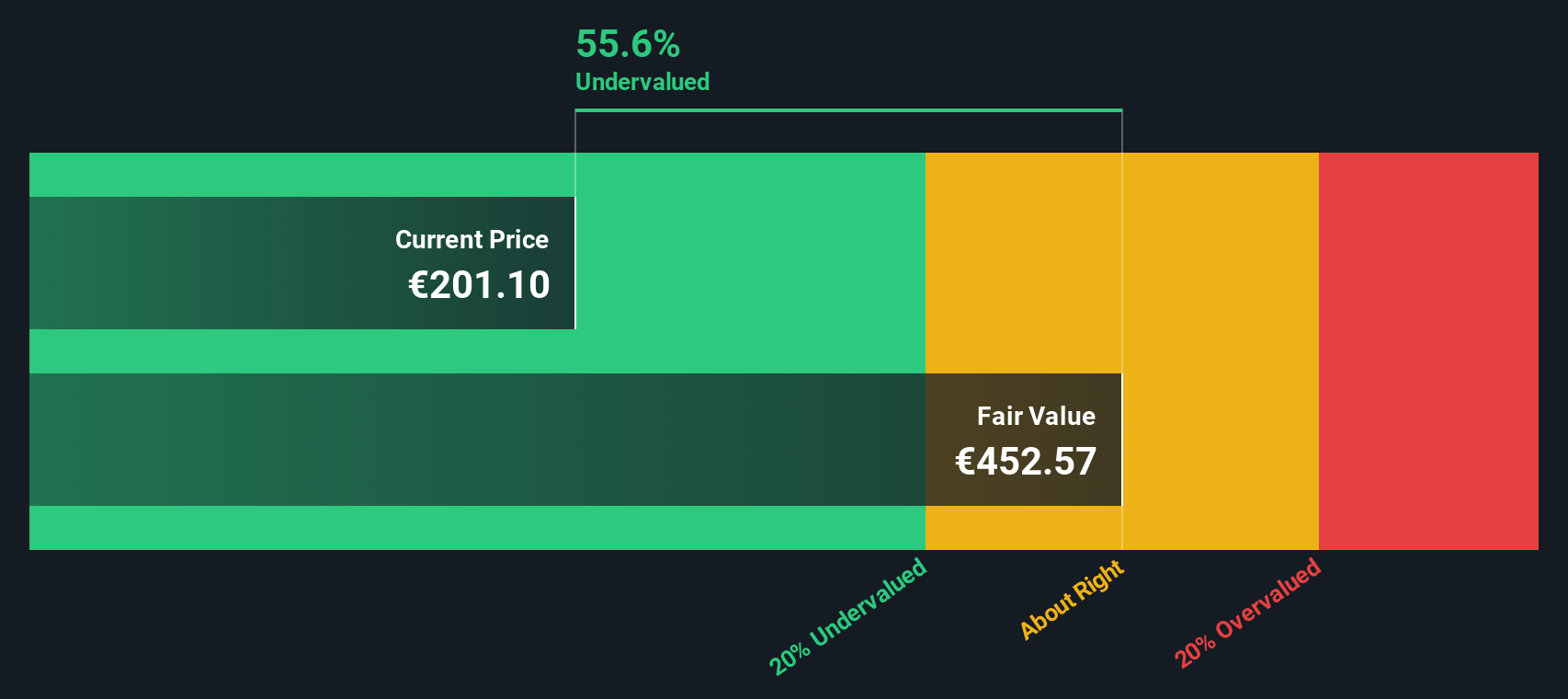

Using a two stage Free Cash Flow to Equity DCF, these annual cash flows are projected out and discounted, producing an estimated intrinsic value of about €441.78 per share. Compared with the current market price, this implies the stock trades at roughly a 55.4% discount to its DCF fair value, which suggests that investors are heavily discounting Airbus' long term cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Airbus is undervalued by 55.4%. Track this in your watchlist or portfolio, or discover 913 more undervalued stocks based on cash flows.

Approach 2: Airbus Price vs Earnings

For a profitable business like Airbus, the price to earnings, or PE, ratio is a practical way to gauge how much investors are paying for each euro of current earnings. In simple terms, higher growth and lower perceived risk generally justify a higher PE, while slower growth or greater uncertainty should translate into a lower, more conservative multiple.

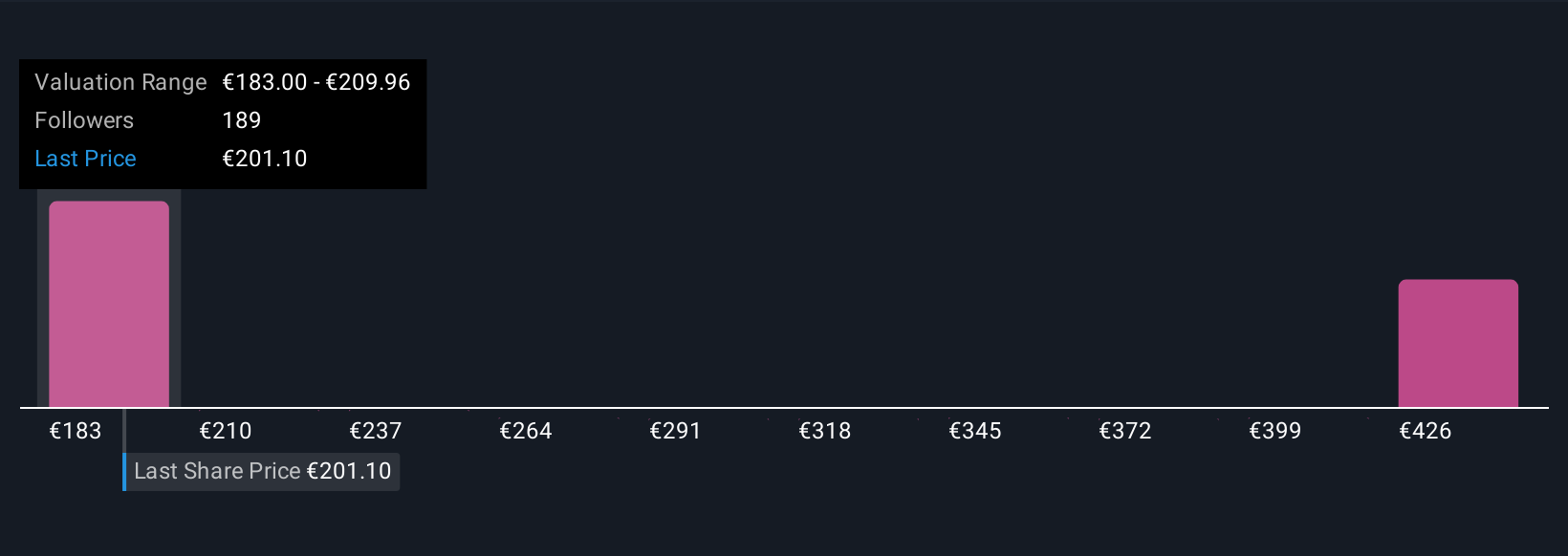

Airbus currently trades on about 30.7x earnings, which sits below the broader Aerospace and Defense industry average of roughly 45.6x and also under the peer group average of around 34.2x. Simply Wall St’s proprietary Fair Ratio framework goes a step further than these blunt comparisons by estimating what PE Airbus should trade on after accounting for its earnings growth outlook, profitability, scale and risk profile.

On this basis, Airbus’ Fair Ratio is estimated at about 34.6x, modestly above where the stock trades today. This indicates that the market is not fully reflecting the company’s growth and quality, even after its strong run.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Airbus Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Airbus' story to a concrete forecast and Fair Value, available on Simply Wall St's Community page and used by millions of investors. A Narrative is your own explanation for what drives Airbus, translated into numbers like future revenue, earnings and margins, which then flow through to a Fair Value estimate you can compare directly to today’s share price to decide whether to buy, hold or sell. Because Narratives on the platform update dynamically as new news, results and guidance come in, your Fair Value and key assumptions stay aligned with reality instead of going stale. For Airbus, one investor might build a bullish Narrative around sustained 12 percent plus revenue growth, margin expansion and a Fair Value closer to the most optimistic analyst targets near €240. Another might focus on supply chain, execution and geopolitical risks, using more conservative assumptions that lead to a Fair Value nearer the low end of analyst targets around €140. Narratives help both investors see clearly how their story translates into numbers and a price.

Do you think there's more to the story for Airbus? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AIR

Airbus

Engages in the design, manufacture, and delivery of aeronautics and aerospace products, services, and solutions worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026