- France

- /

- Aerospace & Defense

- /

- ENXTPA:AIR

Airbus’s Record A320 Deliveries and Turkish Airlines Order Shift Could Be a Game Changer For Airbus (ENXTPA:AIR)

Reviewed by Sasha Jovanovic

- In early October 2025, Airbus surpassed Boeing’s 737 as the world’s most-delivered passenger aircraft, delivering a record-breaking A320 to Saudi carrier Flynas and solidifying its global leadership in narrowbody jet deliveries. Meanwhile, Turkish Airlines signaled it may redirect a large jet order from Boeing to Airbus if engine supplier negotiations for the 737 MAX remain unresolved, highlighting a potential further shift in global market share.

- This milestone not only marks an industry leadership transition but also underscores airlines’ growing confidence in Airbus's delivery reliability and flexibility amid ongoing supplier challenges in the aviation sector.

- We’ll now explore how Airbus's delivery record and Turkish Airlines’ order considerations may influence its investment narrative and future growth prospects.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Airbus Investment Narrative Recap

To be a shareholder in Airbus, you need to believe in the sustained strength of global air travel demand, the company's ability to maintain a record-breaking delivery pace, and its operational resilience amid supplier challenges. The recent milestone of surpassing Boeing’s 737 in total deliveries could reinforce Airbus's competitive edge, but the most important short-term catalyst, production ramp-up, remains fundamentally tied to engine supplier reliability. Persistent supply chain risks, especially delays from critical engine partners, are still the largest threat; this news highlights market momentum, but the core risk is not materially changed.

Among recent announcements, Turkish Airlines' potential shift of a 150-jet order from Boeing to Airbus is especially relevant. Should this move materialize, it not only boosts Airbus’s backlog but also underscores growing airline confidence in its delivery capabilities, a key catalyst for future growth. However, fulfilling any large new orders will require smooth supply chain execution and further tests Airbus's ability to scale production amidst ongoing pressures.

In contrast, investors should not overlook persistent engine supply chain vulnerabilities that could still disrupt Airbus’s delivery schedule and financial targets...

Read the full narrative on Airbus (it's free!)

Airbus' narrative projects €98.7 billion revenue and €7.9 billion earnings by 2028. This requires 12.1% yearly revenue growth and a €3.0 billion earnings increase from €4.9 billion today.

Uncover how Airbus' forecasts yield a €203.25 fair value, in line with its current price.

Exploring Other Perspectives

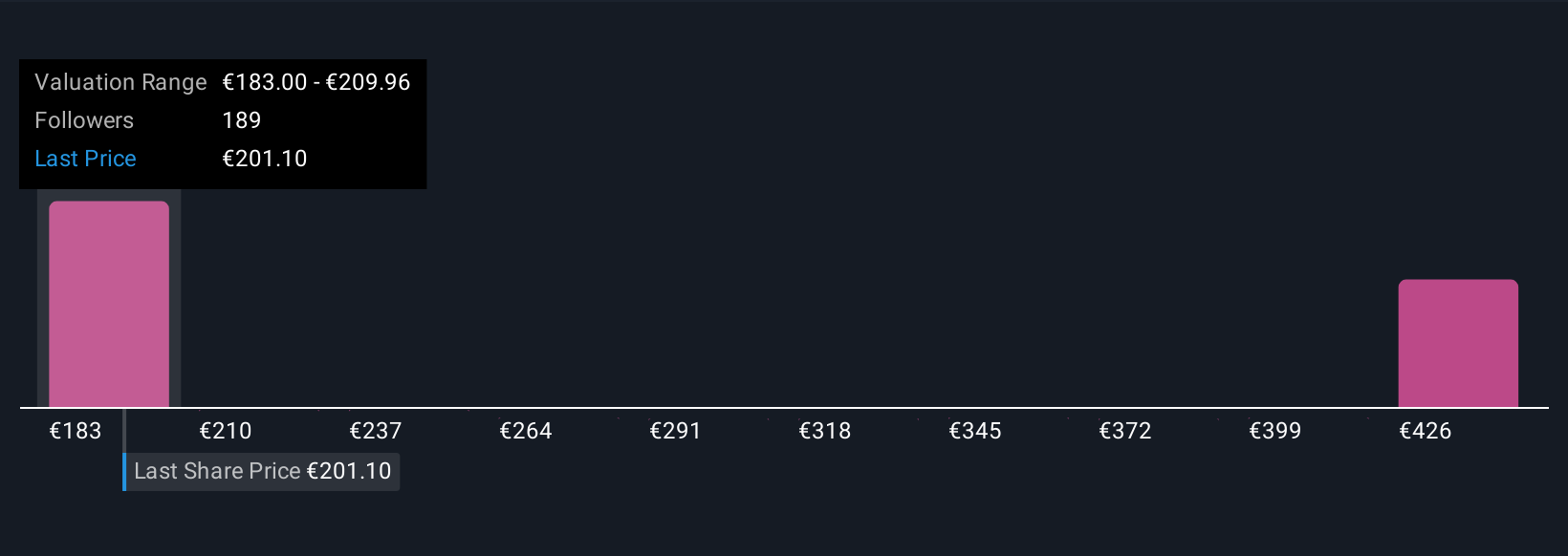

Twenty-four members of the Simply Wall St Community estimate Airbus’s fair value between €183 and €450.82. Against this wide backdrop of expectations, Airbus’s continued ability to ramp up production and secure critical supplies will shape perceptions and results going forward, offering plenty of room for differing viewpoints.

Explore 24 other fair value estimates on Airbus - why the stock might be worth 11% less than the current price!

Build Your Own Airbus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Airbus research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Airbus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Airbus' overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AIR

Airbus

Engages in the design, manufacture, and delivery of aeronautics and aerospace products, services, and solutions worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives