- France

- /

- Aerospace & Defense

- /

- ENXTPA:AIR

Airbus Valuation in Focus After A320 Becomes Most-Delivered Jet in History

Reviewed by Bailey Pemberton

If you are weighing your options on Airbus stock, you are not alone. The world’s largest aircraft manufacturer is having a moment, and recent gains have many investors wondering if the momentum will last. The numbers paint a picture of sustained strength. Airbus closed recently at 202.45, with short and long-term returns that are hard to ignore: up 2.6% over the past 7 days, 10.1% for the month, and a remarkable 63.8% over the past year. If you held on for five years, you would be sitting on a 240.2% surge. That kind of run tends to make people sit up and take notice.

What’s fueling this impressive trajectory? Much of it comes down to Airbus’s dominance in the single-aisle aircraft market. Just this month, the A320 family became the most-delivered jetliner in history, overtaking Boeing’s legendary 737 and marking a symbolic victory for the company. Meanwhile, Boeing is still grappling with quality and safety issues, and even planning a new model to regain lost ground. That puts Airbus in the pilot’s seat for now. However, headlines around engine replacements and fume incidents serve as a reminder that risk always lingers in aviation.

So, is Airbus stock still undervalued after such a strong climb? According to a recent analysis, the company scores a 5 out of 6 on key valuation checks, where a higher score means more signs of being undervalued. In other words, Airbus isn’t just riding a wave—it might actually be offering real value. Up next, we will dig into each valuation method, but we will also go beyond the checklist to discover if there is an even smarter way to assess what the stock is really worth.

Approach 1: Airbus Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by forecasting its future cash flows and then discounting them to today’s value. This method tries to capture what an investor might reasonably expect to receive in euros over time from holding Airbus shares, given current and projected cash generation.

For Airbus, the latest twelve months’ Free Cash Flow stands at €2.72 Billion. Analysts forecast steady growth, projecting Free Cash Flow to reach €11.61 Billion by 2029. For years beyond, projections are based on trend estimates, with the outlook for 2035 reaching over €20 Billion, though these further-out numbers carry a typical degree of uncertainty. All these flows, measured in billions of euros, are then discounted back to reflect their present value using a 2 Stage Free Cash Flow to Equity approach.

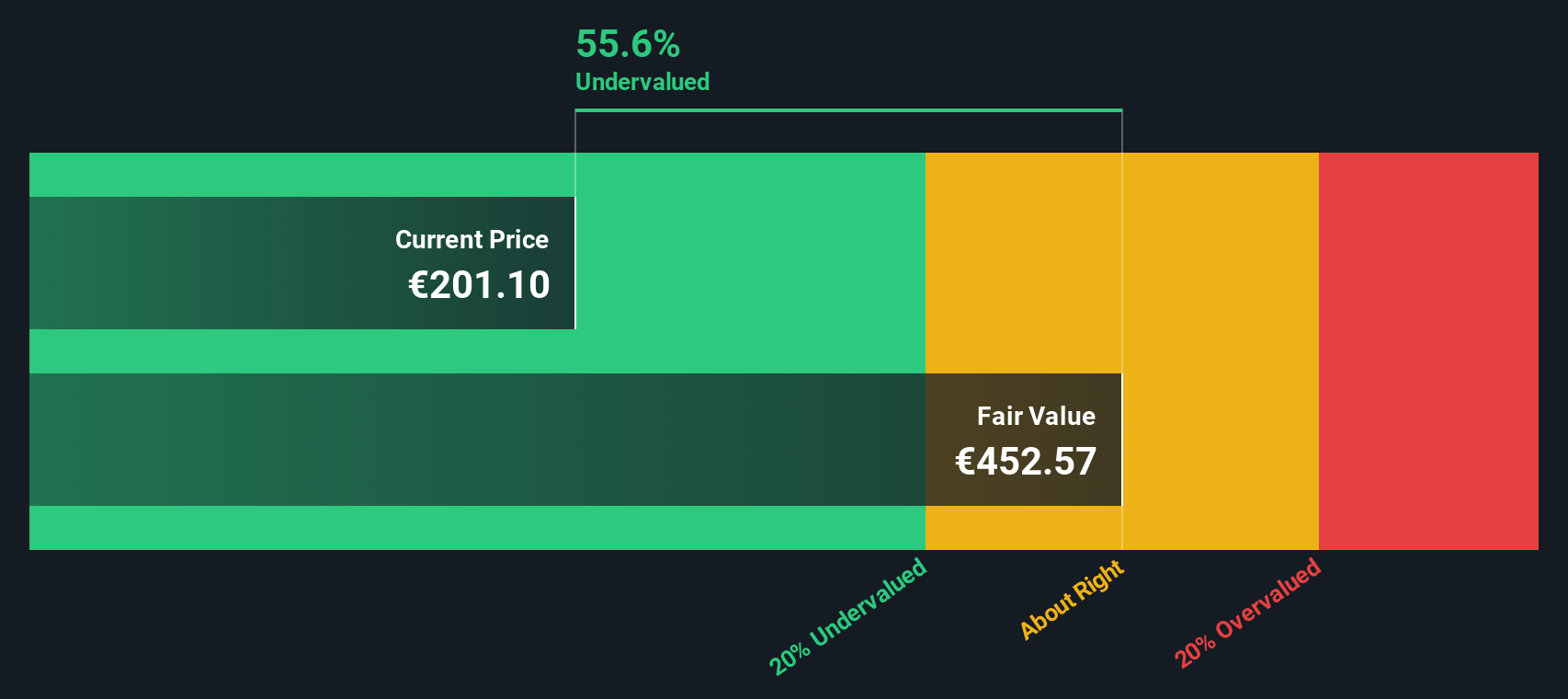

The result is an estimated intrinsic value of €452.04 per share. Compared to the recent price of €202.45, the DCF implies the stock is trading at a 55.2% discount to its intrinsic value. This suggests considerable upside for investors who believe in the accuracy of these projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Airbus is undervalued by 55.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Airbus Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is one of the most reliable ways to assess the valuation of profitable companies like Airbus. It tells investors how much they are paying for each euro of earnings, making it especially useful when evaluating firms with consistent profitability.

Deciding what counts as a "normal" or "fair" PE ratio involves taking into account the company's growth prospects and risk. Companies expected to grow quickly and deliver steady profits typically command higher PE multiples, while higher risk or slower growth warrants lower ratios.

Currently, Airbus trades at a PE ratio of 32.48x. To put this in context, the Aerospace & Defense industry average sits much higher at 47.58x, while the average among Airbus's direct peers is 35.25x. On first glance, Airbus appears to be valued below many of its rivals.

But direct comparisons can miss the details. That is where Simply Wall St's "Fair Ratio" comes in. It is a custom benchmark tailored specifically to Airbus, considering earnings growth, profit margins, company size, industry conditions, and risk factors. For Airbus, the Fair Ratio is 34.78x, reflecting its unique combination of growth and quality.

This approach gives a deeper perspective than basic peer or sector averages, as it adapts to changes in the company's outlook and business environment over time.

With the current PE of 32.48x slightly below the Fair Ratio of 34.78x, Airbus stock is mildly undervalued according to this framework.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Airbus Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply the story you build about Airbus, what you believe will drive its future growth, profitability, and value, paired with your best estimates of where its revenue, margins, and fair price may land.

Narratives connect the dots between the company's unique situation, the financial forecasts that flow from your expectations, and a true "fair value" that reflects your perspective. Unlike fixed models, Narratives bring investing to life, letting you combine everything you know and read, including news and market developments, into one connected decision framework.

Millions of investors on Simply Wall St use Narratives via the Community page. It is an easy and accessible tool that helps you track why you think Airbus is a good buy (or not), compare your scenario to others, and see when your Fair Value signals a buying opportunity versus the current share price. Because Narratives update dynamically with each new earnings report or major headline, you always stay one step ahead.

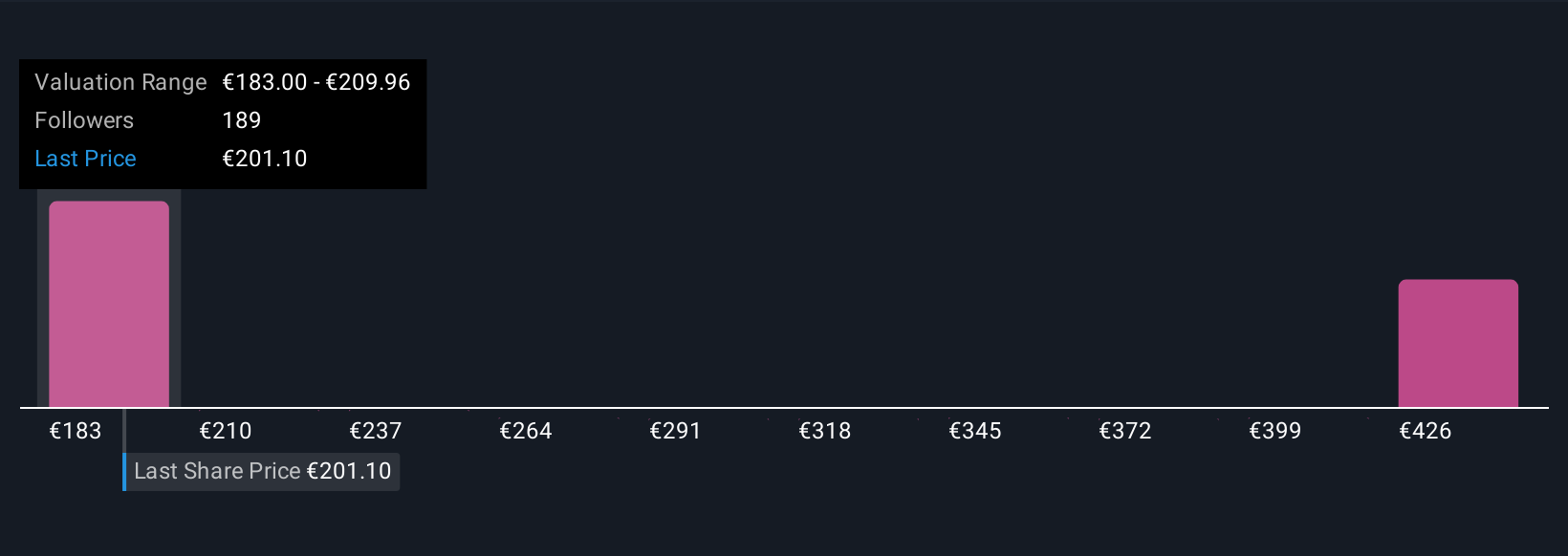

For example, some investors see Airbus’s decarbonization and emerging-market growth potential as reasons to expect a fair value over €244, while others, concerned about supply chain challenges, think €140 is more realistic. Your Narrative is your edge, and it evolves as fast as the news.

Do you think there's more to the story for Airbus? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AIR

Airbus

Engages in the design, manufacture, and delivery of aeronautics and aerospace products, services, and solutions worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives