- France

- /

- Aerospace & Defense

- /

- ENXTPA:AIR

Airbus (ENXTPA:AIR): Exploring Share Valuation After Recent Gains and Strong Investor Optimism

Reviewed by Kshitija Bhandaru

Airbus (ENXTPA:AIR) shares have seen momentum lately, drawing attention from investors interested in the company’s trajectory. Recent trading activity highlights a steady climb in performance, prompting many to examine what could be fueling the shift.

See our latest analysis for Airbus.

Airbus shares have steadily edged higher, and the company now trades at €203.55. Momentum has been building, supported by a solid run of annual revenue and net income growth, with the 1-year total shareholder return coming in at 63% and longer-term returns tracking a similar upward trend. Investors appear increasingly optimistic about Airbus’s growth outlook as the company delivers both on operational targets and shareholder value.

If the aerospace sector’s resilience interests you, you might also want to scan the latest opportunities with our curated list in See the full list for free.

With such impressive returns over the past year, investors are now weighing whether Airbus shares remain undervalued at current levels, or if the market has already accounted for its future growth. Could there still be a buying opportunity?

Most Popular Narrative: Fairly Valued

Compared to its recent closing price of €203.55, the most widely followed narrative believes Airbus is now fairly valued, with the consensus fair value closely matching the market figure. This sets up an interesting debate on whether expectations have caught up with reality.

Sustained growth in global air travel, particularly from emerging markets and rising middle-class populations, continues to drive robust order intake and long-term backlog growth for Airbus, supporting higher potential future revenues and operational leverage.

Curious what fascinating assumptions underpin this balanced valuation? There is a focused bet on booming demand, game-changing margins, and ambitious profit metrics. Want a peek behind the curtain? The quantitative leap in expectations might surprise you. Discover which financial levers drive this consensus and why some believe the rally could still have legs.

Result: Fair Value of €203.25 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent supply chain hurdles or regulatory snags in key supplier acquisitions could constrain production. This could challenge the bullish outlook on Airbus’s growth momentum.

Find out about the key risks to this Airbus narrative.

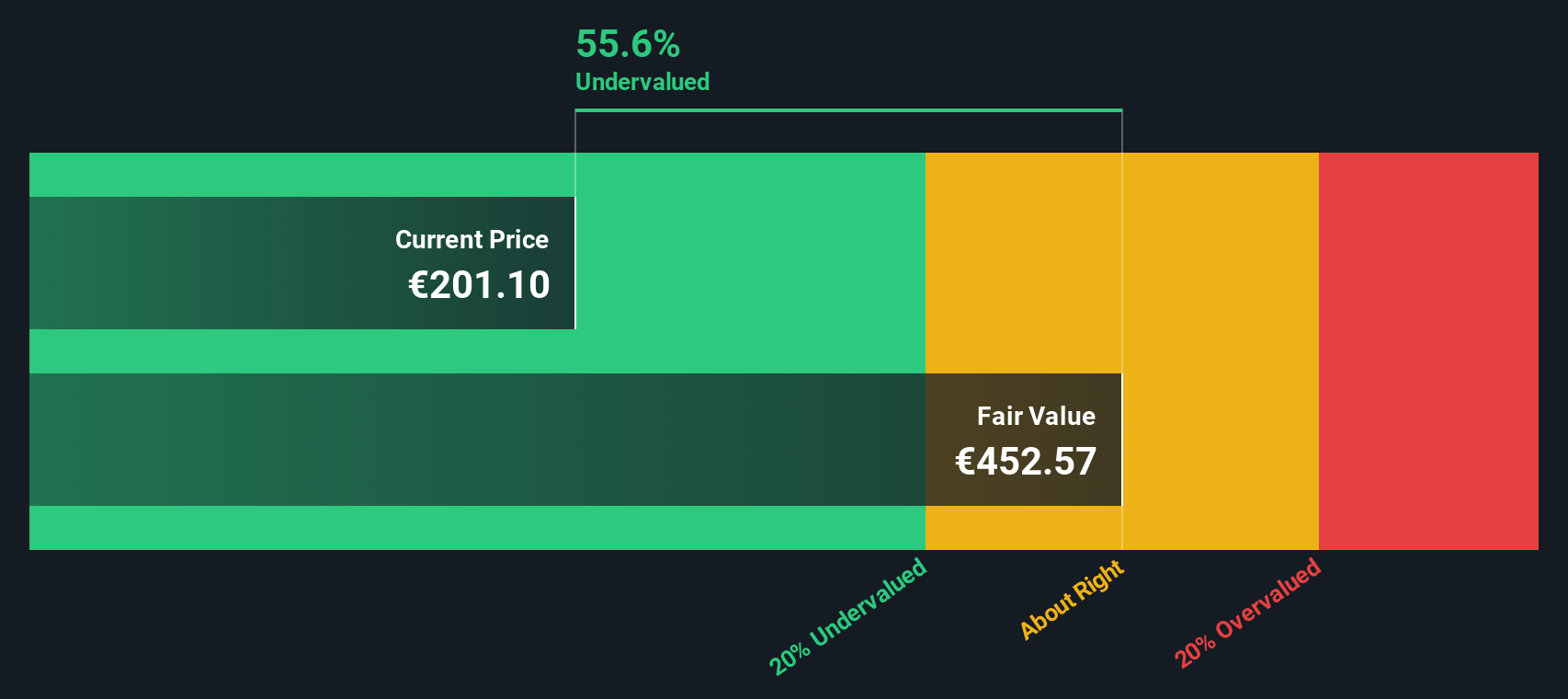

Another View: SWS DCF Model Signals Undervaluation

While the market and analysts view Airbus as fairly valued using price-to-earnings and other common metrics, the SWS DCF model offers a much different perspective. According to this method, Airbus’s shares are trading well below their intrinsic value, which points to significant upside if future cash flows deliver as expected. Could the market be underestimating the company’s true long-term potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Airbus Narrative

Feel free to explore the latest data and forge your own view on Airbus. The narrative is yours to build in just minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Airbus.

Looking for more investment ideas?

If you want an edge in today's fast-moving market, don't settle for the obvious. Act now and uncover where smart money is moving next.

- Unlock opportunities with steady income potential by tapping into these 19 dividend stocks with yields > 3%, which offers attractive yields above 3%.

- Accelerate your growth strategy by exploring these 25 AI penny stocks, fueling breakthroughs at the heart of artificial intelligence innovation.

- Get ahead of the curve and ride the quantum revolution by analyzing these 26 quantum computing stocks, a leader in future-defining technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AIR

Airbus

Engages in the design, manufacture, and delivery of aeronautics and aerospace products, services, and solutions worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives