- France

- /

- Aerospace & Defense

- /

- ENXTPA:AIR

Airbus (ENXTPA:AIR) Advances Fuel Cell Technology With Advent—How Will This Shape Its Clean Energy Ambitions?

Reviewed by Simply Wall St

- Advent Technologies Holdings, Inc. recently announced a significant technological breakthrough in its collaboration with Airbus, completing a key milestone in advancing high-temperature Proton Exchange Membrane (HT-PEM) fuel cell technology for aviation.

- This partnership highlights ongoing innovation in clean energy solutions for aerospace, with Advent’s HT-PEM platform now validated for high-demand aviation and broader mobility sectors.

- To assess what this means for investors, we'll explore how Airbus’s push into advanced fuel cell technology could influence its long-term growth narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Airbus Investment Narrative Recap

Airbus shareholders need to be confident in the company's ability to deliver on growing global demand for next-generation, fuel-efficient aircraft while managing supply chain and production ramp-up risks. The recent HT-PEM fuel cell technology milestone with Advent Technologies supports Airbus’s long-term decarbonization narrative, but does not materially impact the most pressing near-term catalyst: securing reliable engine and component deliveries to support targeted production increases. Persistent supply chain vulnerabilities and integration of new technologies remain the most significant risks for free cash flow and earnings visibility.

Among recent announcements, Avolon’s order for 75 A321neo and 15 A330neo aircraft stands out, reaffirming strong demand for Airbus’s latest fuel-efficient models. This aligns closely with industry trends towards sustainability and fleet renewal, which support the business catalyst of higher backlog and revenue potential if supply chain execution challenges can be successfully addressed.

Yet, before considering any position, investors should be aware that if supplier delays worsen or remain unresolved...

Read the full narrative on Airbus (it's free!)

Airbus' outlook anticipates €98.7 billion in revenue and €7.9 billion in earnings by 2028. This implies a 12.1% annual revenue growth rate and a €3.0 billion increase in earnings from the current €4.9 billion level.

Uncover how Airbus' forecasts yield a €197.11 fair value, in line with its current price.

Exploring Other Perspectives

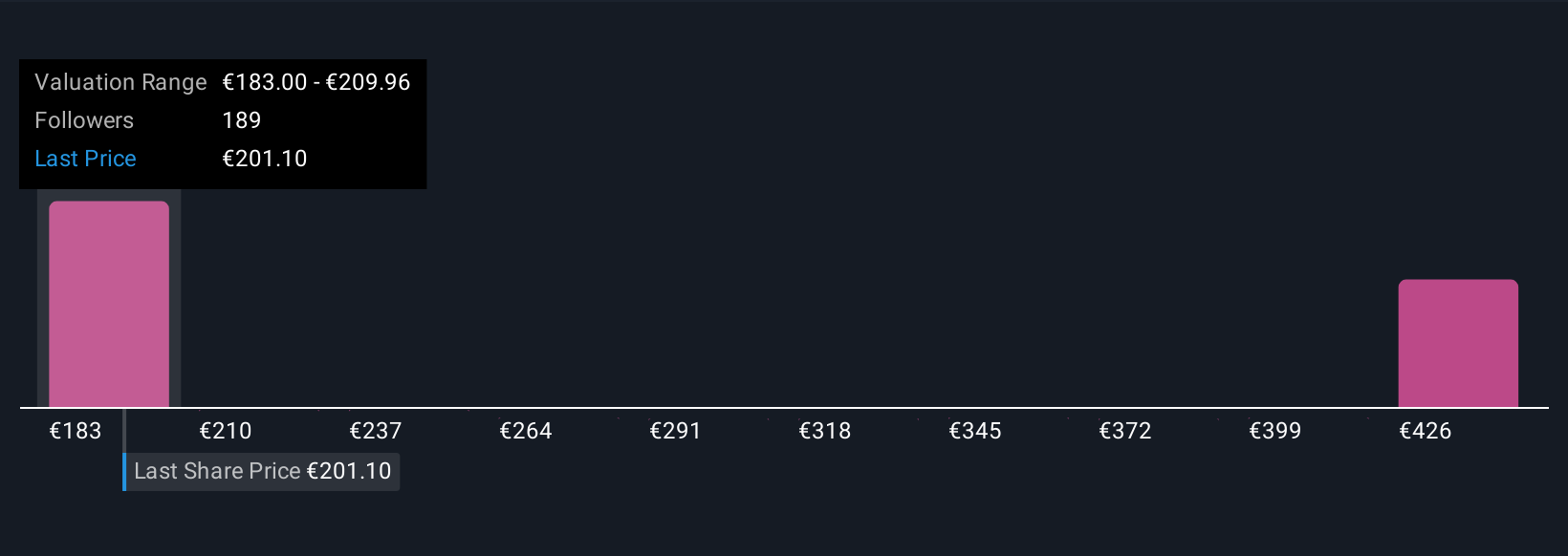

Twenty-three individual fair value estimates from the Simply Wall St Community range from €183 to €455, highlighting wide differences in outlook on Airbus shares. With supplier reliability and production execution still the critical focus, you can explore these varied viewpoints to better understand how consensus and divergent expectations could affect outcomes.

Explore 23 other fair value estimates on Airbus - why the stock might be worth over 2x more than the current price!

Build Your Own Airbus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Airbus research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Airbus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Airbus' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AIR

Airbus

Engages in the design, manufacture, and delivery of aeronautics and aerospace products, services, and solutions worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives