EssoF And 2 Other Undiscovered Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index recently rebounded with a 2.69% increase, optimism has been fueled by hopes for interest rate cuts amidst slowing business activity. In this environment, identifying promising stocks can be crucial for investors looking to enhance their portfolios, particularly those that may benefit from economic shifts and emerging market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In France

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| EssoF | 1.19% | 11.14% | 41.41% | ★★★★★★ |

| Gévelot | 0.25% | 10.64% | 20.33% | ★★★★★★ |

| VIEL & Cie société anonyme | 54.02% | 5.66% | 19.86% | ★★★★★☆ |

| ADLPartner | 120.47% | 9.86% | 16.17% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| CFM Indosuez Wealth Management | 239.60% | 10.01% | 13.52% | ★★★★★☆ |

| La Forestière Equatoriale | 0.00% | -50.76% | 49.41% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative | 391.01% | 4.67% | 17.31% | ★★★★☆☆ |

| Société Fermière du Casino Municipal de Cannes | 11.60% | 6.69% | 10.30% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

EssoF (ENXTPA:ES)

Simply Wall St Value Rating: ★★★★★★

Overview: Esso S.A.F. is engaged in refining, distributing, and marketing refined petroleum products both in France and internationally, with a market capitalization of approximately €1.65 billion.

Operations: EssoF generates revenue primarily from its refining and distribution segment, which accounts for €18.93 billion. The company's financial performance is influenced by the dynamics within this core segment.

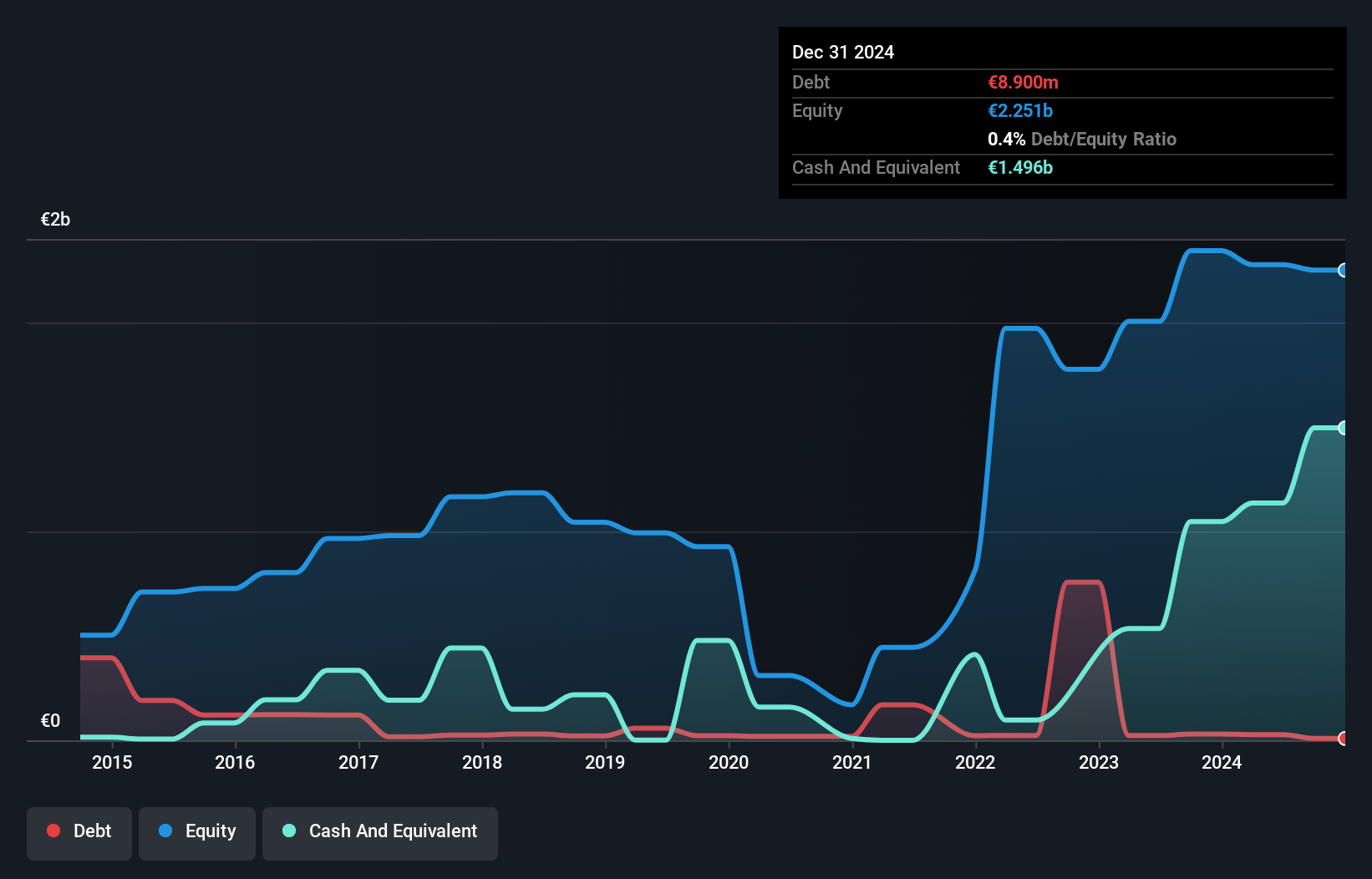

EssoF's recent performance highlights its turnaround, becoming profitable this year and surpassing the Oil and Gas industry growth of -0.5%. The debt to equity ratio has impressively dropped from 5.8 to 1.2 over five years, indicating improved financial health. Despite a volatile share price recently, EssoF trades at a significant discount of 96.7% below estimated fair value, offering potential upside for investors seeking underappreciated opportunities in the market.

- Unlock comprehensive insights into our analysis of EssoF stock in this health report.

Gain insights into EssoF's past trends and performance with our Past report.

CFM Indosuez Wealth Management (ENXTPA:MLCFM)

Simply Wall St Value Rating: ★★★★★☆

Overview: CFM Indosuez Wealth Management SA, along with its subsidiaries, offers banking and financial solutions to private investors, businesses, institutions, and professionals in Monaco and globally, with a market capitalization of €710.52 million.

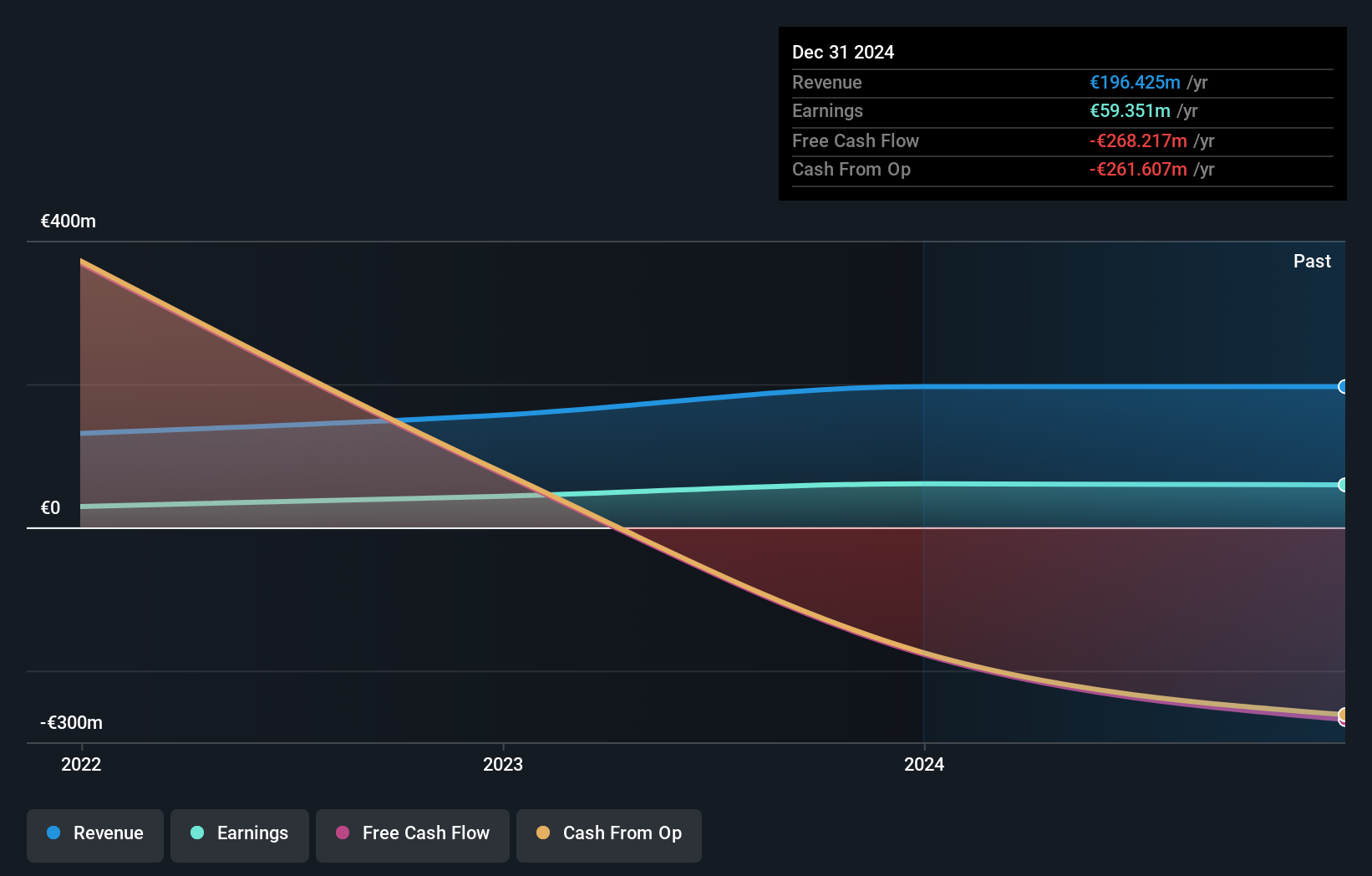

Operations: The company's primary revenue stream is derived from its Wealth Management segment, generating €196.38 million.

With total assets of €7.7 billion and equity standing at €404 million, CFM Indosuez Wealth Management showcases a solid financial foundation. Total deposits reach €6.2 billion, while loans amount to €3.2 billion, indicating a balanced approach to asset management. Impressively, earnings have surged by 40% over the past year, surpassing the industry average of 1%. The company's bad loans ratio is a low 0.8%, with an allowance for these at 34%, reflecting prudent risk management strategies.

Neurones (ENXTPA:NRO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Neurones S.A. is an IT services company offering infrastructure, application, and consulting services both in France and internationally, with a market cap of €1.08 billion.

Operations: Neurones derives its revenue primarily from infrastructure services (€483.86 million), followed by application services (€236.52 million) and consulting (€54.53 million).

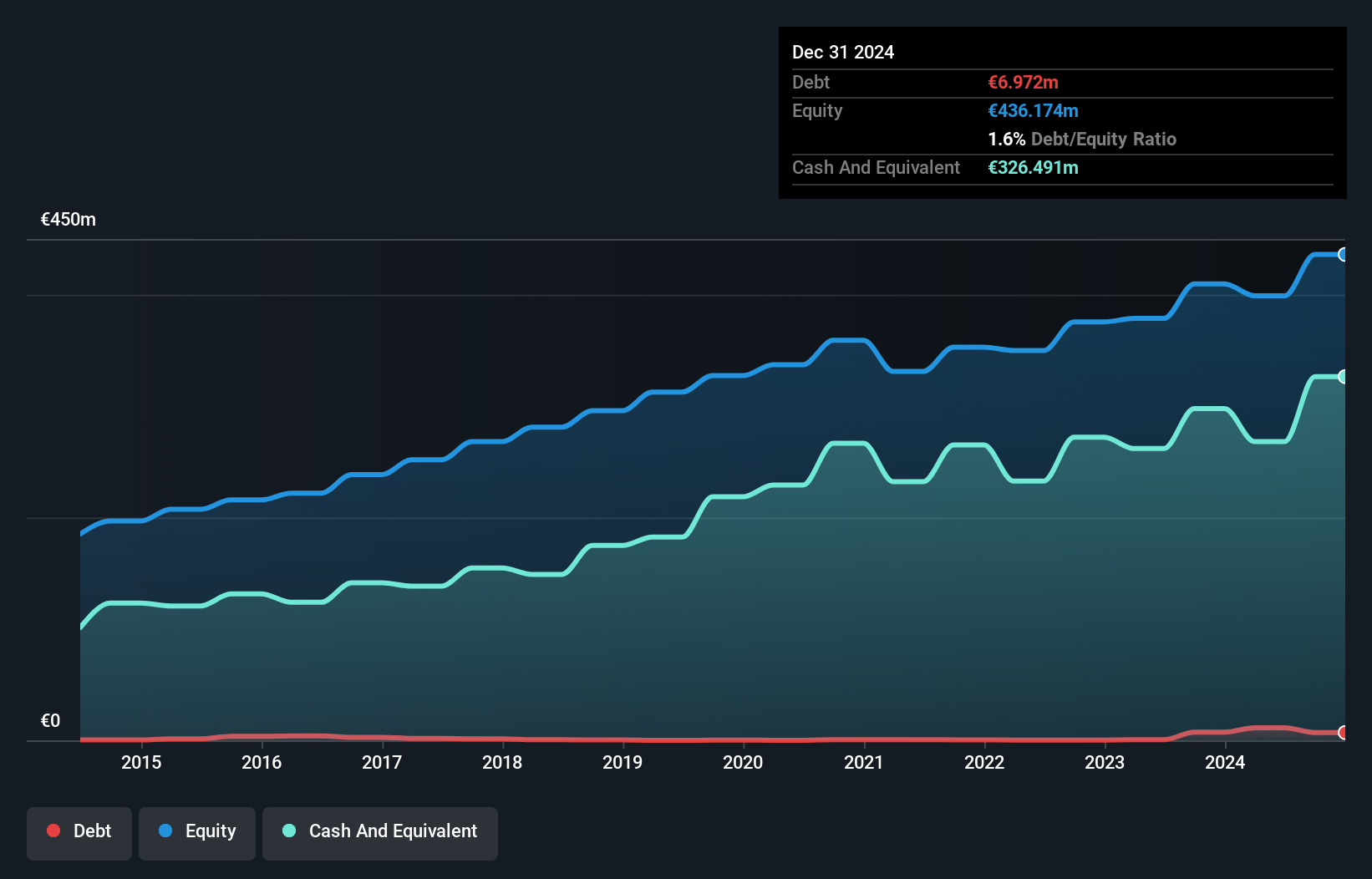

Neurones, a French IT services firm, showcases steady performance with its recent half-year revenue climbing to €402.43 million from €368.69 million the previous year, although net income slightly dipped to €24.5 million. The company remains financially robust, boasting more cash than total debt and a manageable debt-to-equity ratio of 2.8% over five years. Earnings grew by 1.8%, outpacing the sector's -5.6% trend, highlighting resilience in challenging industry conditions and solidifying its position as an intriguing investment prospect in France's market landscape.

- Get an in-depth perspective on Neurones' performance by reading our health report here.

Evaluate Neurones' historical performance by accessing our past performance report.

Make It Happen

- Dive into all 38 of the Euronext Paris Undiscovered Gems With Strong Fundamentals we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MLCFM

CFM Indosuez Wealth Management

Engages in the provision of banking and financial solutions in Monaco and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives