Société Générale (ENXTPA:GLE) Net Profit Margin Surge Reinforces Bullish Value Narrative

Reviewed by Simply Wall St

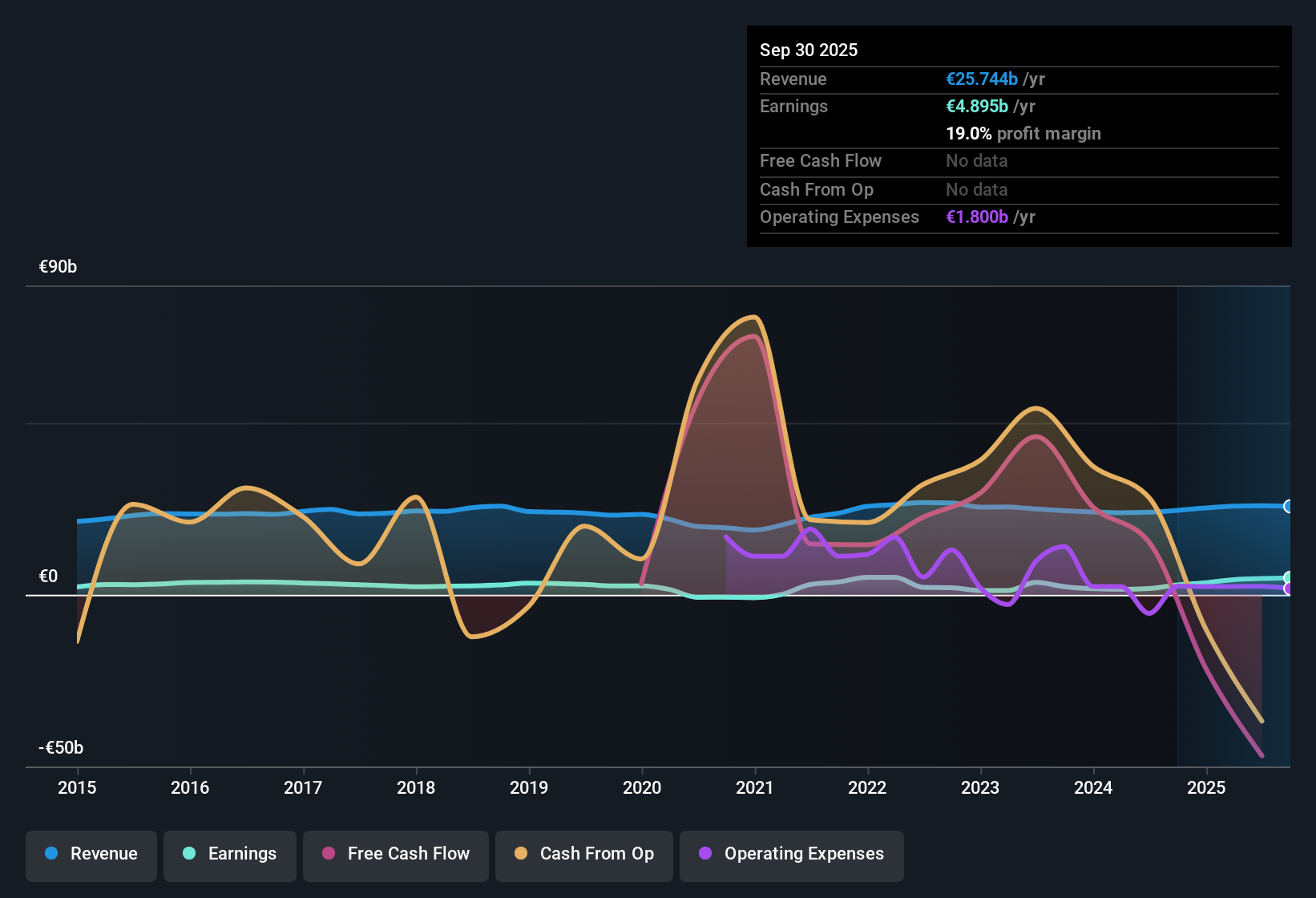

Société Générale (ENXTPA:GLE) reported net profit margins of 18.2%, a sharp jump from 7.4% a year ago, with full-year EPS growth of 164.4% compared to its five-year average of 19.8% annually. The company has maintained profitability over the past five years, with average earnings growth of 19.8% per year, and the quality of its earnings remains high. While future growth is forecasted to slow, with earnings projected to rise 4.8% per year and revenue 3.1% per year, trailing the broader French market, the current momentum places the focus on sustained profit and an attractive valuation. However, the sustainability of its dividend continues to draw attention.

See our full analysis for Société Générale Société anonyme.Next, we will see how these earnings results stand up against the current market narratives. Some long-held views may be reinforced, while others could be in for a rethink.

See what the community is saying about Société Générale Société anonyme

Digital Profit Engines Drive Margin Expansion

- Cost-to-income ratio has dropped below long-term targets, with digital platforms like BoursoBank surpassing client growth expectations six quarters ahead of schedule and earning recognition as France’s best digital bank.

- According to the analysts' consensus view, accelerating digital transformation and expanding sustainable finance initiatives are expected to create new fee and commission income, driving future profitability.

- Consensus narrative notes that recent gains in operational leverage, reflected in cost reductions that have outpaced revenue, should support higher net income and improved efficiency.

- Analysts expect profit margins to climb from 18.2% to 20.0% within three years as these digital and sustainability initiatives take effect.

Share Buybacks Enhance Future Value

- Analysts forecast the number of shares outstanding will fall by 2.27% per year over the next three years, concentrating future earnings per share upside for remaining investors.

- Under the consensus narrative, this planned reduction in share count is viewed as a key mechanism for boosting value creation, especially when paired with ongoing fee growth and efficiency gains.

- While earnings per share are forecast to reach €8.13 by 2028, consensus cautions that outperformance depends on maintaining cost controls and delivering further capital discipline.

- The scenario assumes sustained discipline in managing expenses and capital. Any reversal could put pressure on expected EPS growth.

Substantial Discount to DCF Fair Value

- With the current share price at €53.00, Société Générale is trading well below its DCF fair value of €100.30 and boasts a price-to-earnings ratio of 8.6x, undercutting both industry (9.9x) and peer (9.7x) levels.

- In analysts' consensus view, such a pronounced discount, along with a 14.5% gap between current price and the analyst price target of €63.38, signals room for re-rating if profit margins expand as forecast.

- Consensus sees ongoing revenue diversification and capital discipline as critical to closing the gap toward fair value and industry multiples.

- However, these upside cases ultimately hinge on management delivering the projected margin improvements over the next three years.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Société Générale Société anonyme on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Not seeing the story the same way? If a new angle on the numbers stands out to you, shape your own take in minutes: Do it your way.

A great starting point for your Société Générale Société anonyme research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

While Société Générale boasts margin gains and strategic cost controls, its slowing earnings and revenue growth trail the broader market outlook.

If you're seeking steadier top and bottom line trends, check out stable growth stocks screener (2110 results) for companies delivering more consistent growth through every phase of the cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:GLE

Société Générale Société anonyme

Provides banking and financial services to individuals, corporates, and institutional clients in Europe and internationally.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives