A Fresh Look at Société Générale (ENXTPA:GLE) Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

Société Générale Société anonyme (ENXTPA:GLE) has seen its stock price move recently, sparking some fresh interest among investors. Looking at the bank’s performance, there are several trends that might help explain this activity.

See our latest analysis for Société Générale Société anonyme.

Société Générale’s share price has made strong headway over the year, up more than double since January, even factoring in some recent short-term pullbacks. With a one-year total shareholder return of 125.5%, momentum remains firmly on the side of long-term investors, which suggests optimism about the bank’s evolving prospects and risk profile.

If this strong banking sector performance has sparked your curiosity, now is a timely moment to branch out and discover fast growing stocks with high insider ownership

With such strong returns and recent analyst price targets still offering potential upside, the question now is whether Société Générale’s shares remain undervalued, or if the market has already factored in all the expected future growth.

Most Popular Narrative: 13.4% Undervalued

The latest analyst-driven narrative places Société Générale’s fair value well above its recent closing price. This reflects confidence in ongoing operational improvements and potential earnings growth. Attention is now focused on several core strategies expected to drive future expansion and margins.

Accelerating digital transformation, exemplified by Boursorama/BoursoBank surpassing client targets six quarters ahead of schedule and being recognized as the best digital bank in France, positions Société Générale to capture fee and commission income growth. This also supports operating leverage and lower cost-to-income ratios, bolstering future revenue and net margin expansion.

Curious how a mix of rapid digital innovation, healthy capital discipline and upbeat margin forecasts shape this bullish narrative? Find out which key projected improvements and the ambitious financial targets pinned to them make this valuation stand out among Europe’s big banks. Uncover the quantitative assumptions driving this substantial upside.

Result: Fair Value of €65.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent low interest rates or renewed macroeconomic pressures in core markets could challenge the bullish outlook and reduce the potential for future margin expansion.

Find out about the key risks to this Société Générale Société anonyme narrative.

Another View: Market Ratios Tell a Different Story

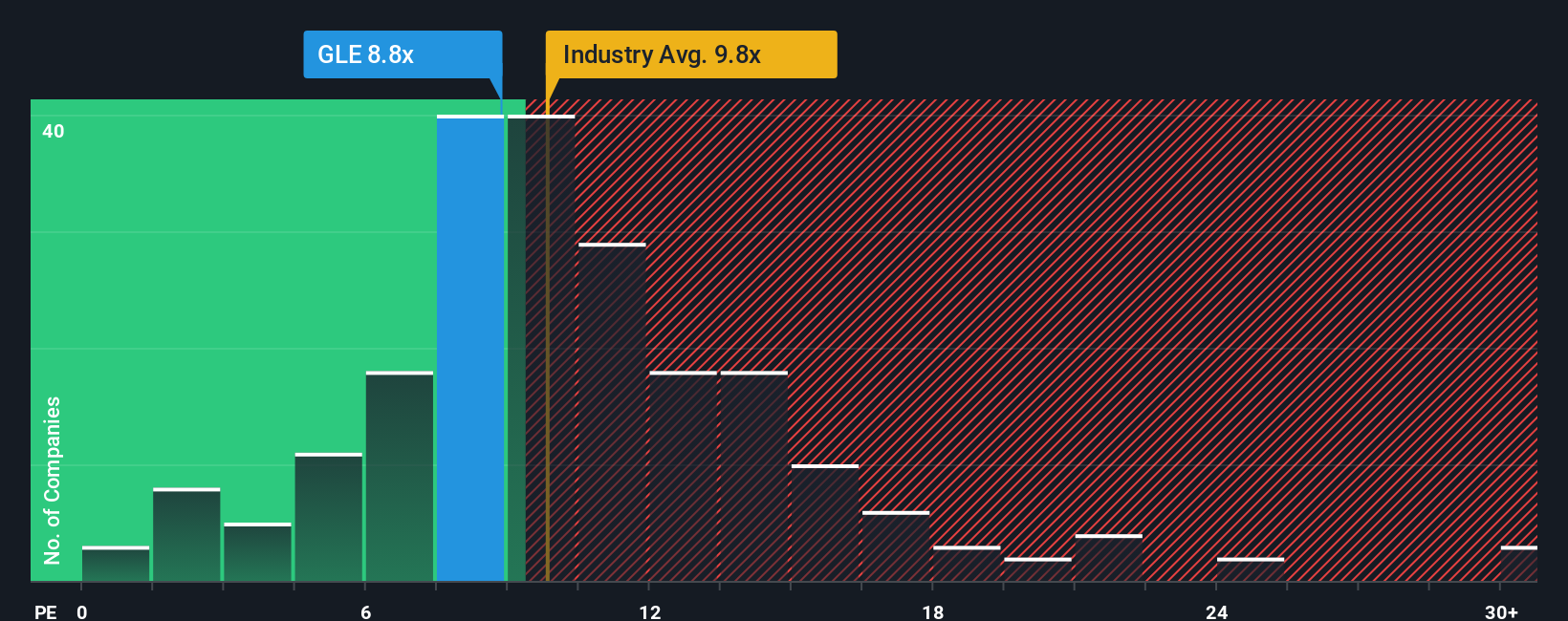

While growth prospects are encouraging, the current price-to-earnings ratio for Société Générale stands at 8.8x. This is slightly below the wider European banks average of 9.8x but it is noticeably above its own calculated fair ratio of 7.5x. In practice, this means the market is pricing in more optimism than historical fundamentals might justify, so valuation risk could be elevated if future results disappoint. Will this mark a value opportunity or expose downside in the coming quarters?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Société Générale Société anonyme Narrative

If you see things differently or want to dig deeper into the numbers yourself, it’s quick and easy to craft a Société Générale story of your own. Do it your way.

A great starting point for your Société Générale Société anonyme research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit yourself to just one opportunity. Level up your portfolio by reviewing hot trends, standout sectors and stocks poised for real-world impact right now.

- Secure passive income streams and build wealth with confidence by reviewing these 16 dividend stocks with yields > 3% that consistently pay attractive yields above 3%.

- Catch the next wave of AI disruption by tapping into these 26 AI penny stocks shaping everything from automation to personalized technology.

- Capitalize on overlooked gems unlocking value with these 925 undervalued stocks based on cash flows, where fundamental analysis highlights stocks flying under most investors’ radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:GLE

Société Générale Société anonyme

Provides banking and financial services to individuals, corporates, and institutional clients in Europe and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives