Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative And 2 Reliable Dividend Stocks For Income Growth

Reviewed by Simply Wall St

As global markets experience fluctuations driven by easing U.S. inflation and robust bank earnings, investors are keenly observing the shifts in value stocks, particularly within the financials and energy sectors. With major indices like the S&P 500 and Dow Jones Industrial Average showing gains, there's an increased interest in stocks that can offer both stability and income growth through dividends. In this context, identifying reliable dividend stocks becomes crucial for those seeking to capitalize on current market dynamics while securing a steady income stream.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.11% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.32% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.48% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.49% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.13% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.47% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.93% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.89% | ★★★★★★ |

Click here to see the full list of 1981 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

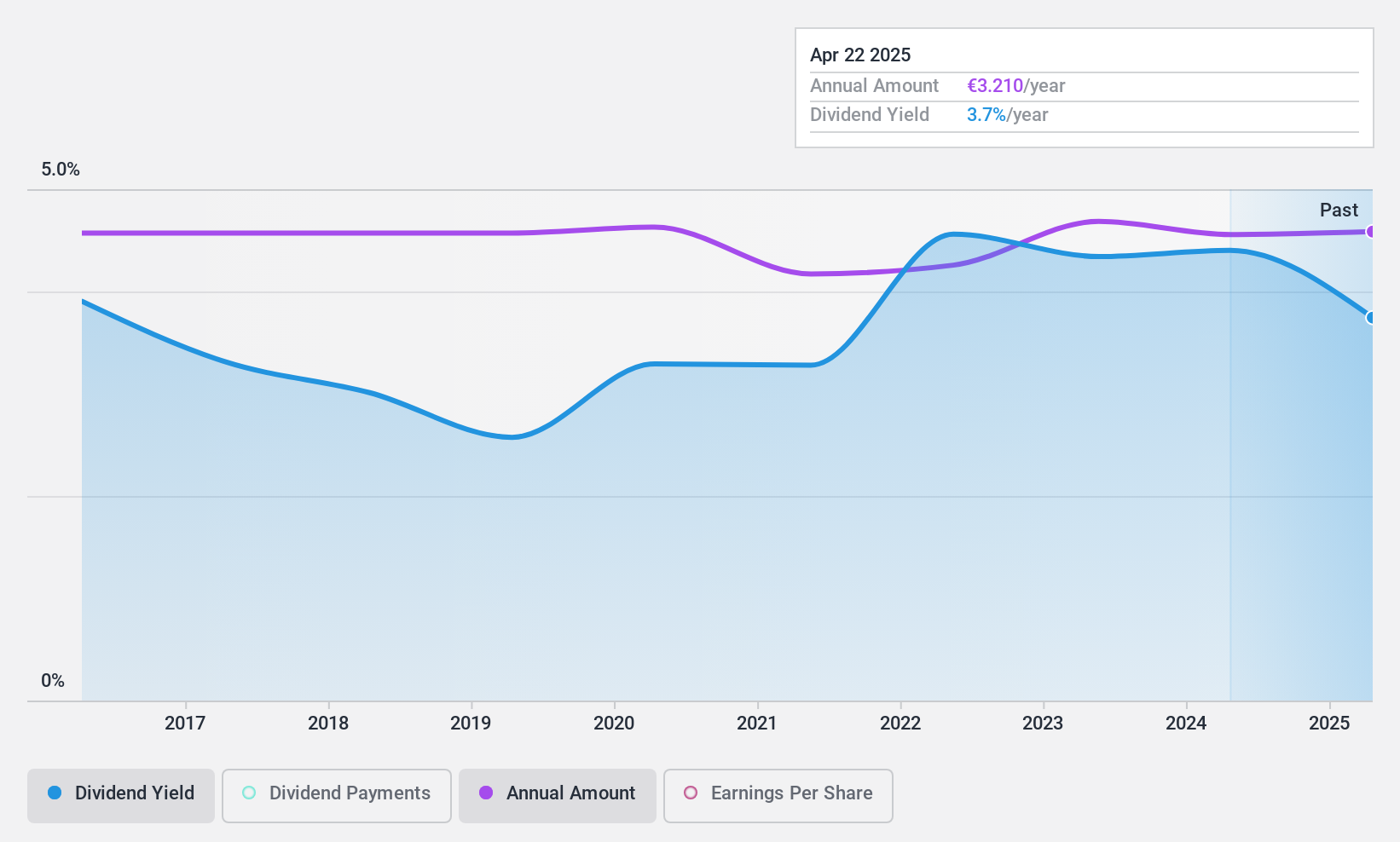

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative (ENXTPA:CRTO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel de La Touraine et du Poitou Société Coopérative offers a range of banking products and services in France, with a market cap of €476.31 million.

Operations: The company's revenue is primarily derived from its Proximity Bank segment, which generates €254.46 million, and Management for Own Account and Miscellaneous activities, contributing €94.09 million.

Dividend Yield: 4.1%

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou offers a stable and reliable dividend, with a current yield of 4.07%, though this is lower than the top 25% of French dividend payers. The company has maintained consistent dividend growth over the past decade, supported by strong earnings growth of 9.3% last year and a low payout ratio of 17.9%, indicating dividends are well-covered by earnings despite trading below estimated fair value.

- Unlock comprehensive insights into our analysis of Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative stock in this dividend report.

- Upon reviewing our latest valuation report, Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative's share price might be too pessimistic.

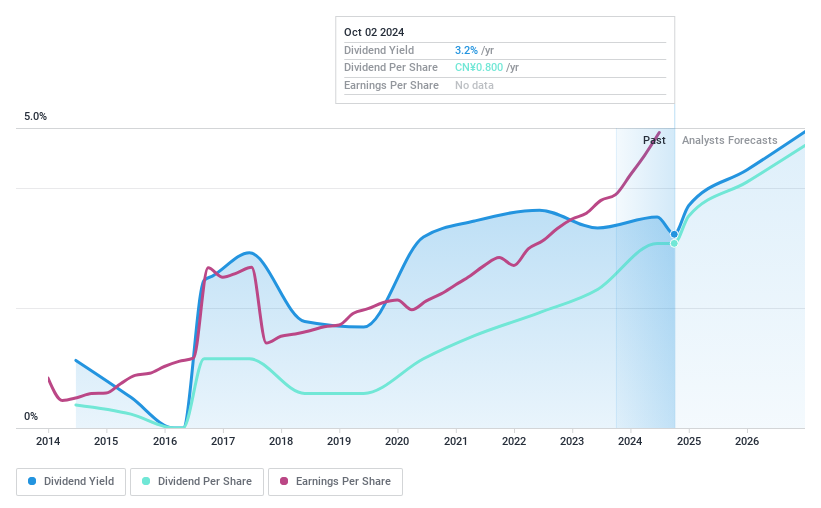

Henan Lingrui Pharmaceutical (SHSE:600285)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Henan Lingrui Pharmaceutical Co., Ltd. is a company that produces and sells medicines in China, with a market cap of approximately CN¥12.22 billion.

Operations: Henan Lingrui Pharmaceutical Co., Ltd. generates its revenue from the production and sale of medicines in China.

Dividend Yield: 3.7%

Henan Lingrui Pharmaceutical's dividend yield of 3.69% ranks in the top 25% of Chinese dividend payers, supported by a payout ratio of 66.3%, indicating dividends are covered by earnings. However, its dividend history has been volatile over the past decade despite recent increases. The company reported strong earnings growth, with net income rising to CNY 573.87 million for the first nine months of 2024, suggesting potential for continued dividend support amidst valuation concerns trading below estimated fair value.

- Click here to discover the nuances of Henan Lingrui Pharmaceutical with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Henan Lingrui Pharmaceutical's current price could be quite moderate.

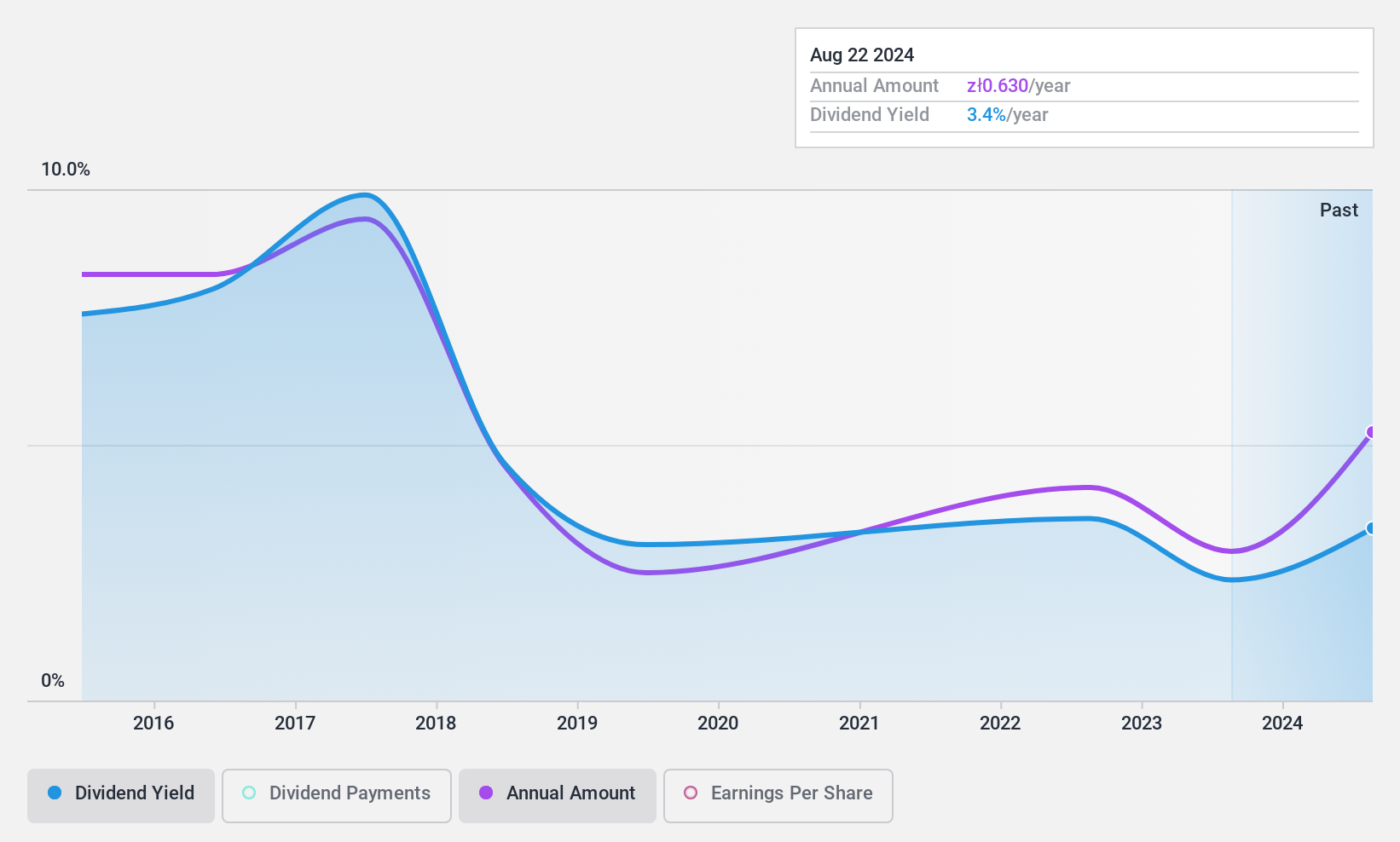

Kino Polska TV Spolka Akcyjna (WSE:KPL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kino Polska TV Spolka Akcyjna is a media company operating in Poland and internationally, with a market cap of PLN414.27 million.

Operations: Kino Polska TV Spolka Akcyjna generates revenue through segments including Zoom TV (PLN31.65 million), Freeze TV (PLN56.52 million), Kino Polska Channels (PLN35.35 million), Sale of License Rights (PLN17.51 million), Production of TV Channels (PLN7.61 million), and Filmbox Movie Channels and Thematic Channels (PLN158.00 million).

Dividend Yield: 3%

Kino Polska TV Spolka Akcyjna's dividend payments are well-covered, with a low payout ratio of 17.6% and a cash payout ratio of 18.2%, but the dividend history has been volatile over the past decade. Despite this, dividends have grown over ten years. The stock trades at 86.3% below its estimated fair value, offering potential value despite a relatively low yield of 3.03%. Recent earnings growth supports ongoing dividend sustainability with net income rising to PLN 51.64 million for the first nine months of 2024.

- Click here and access our complete dividend analysis report to understand the dynamics of Kino Polska TV Spolka Akcyjna.

- Our valuation report here indicates Kino Polska TV Spolka Akcyjna may be undervalued.

Summing It All Up

- Reveal the 1981 hidden gems among our Top Dividend Stocks screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Henan Lingrui Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600285

Outstanding track record with flawless balance sheet and pays a dividend.