As global markets navigate a landscape marked by record highs in U.S. indices and robust economic indicators, smaller-cap stocks have shown remarkable resilience and outperformance against their larger counterparts. In this dynamic environment, identifying promising opportunities often involves looking beyond the well-trodden paths to uncover stocks with strong fundamentals and growth potential that align with current market sentiments.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA)

Simply Wall St Value Rating: ★★★★★★

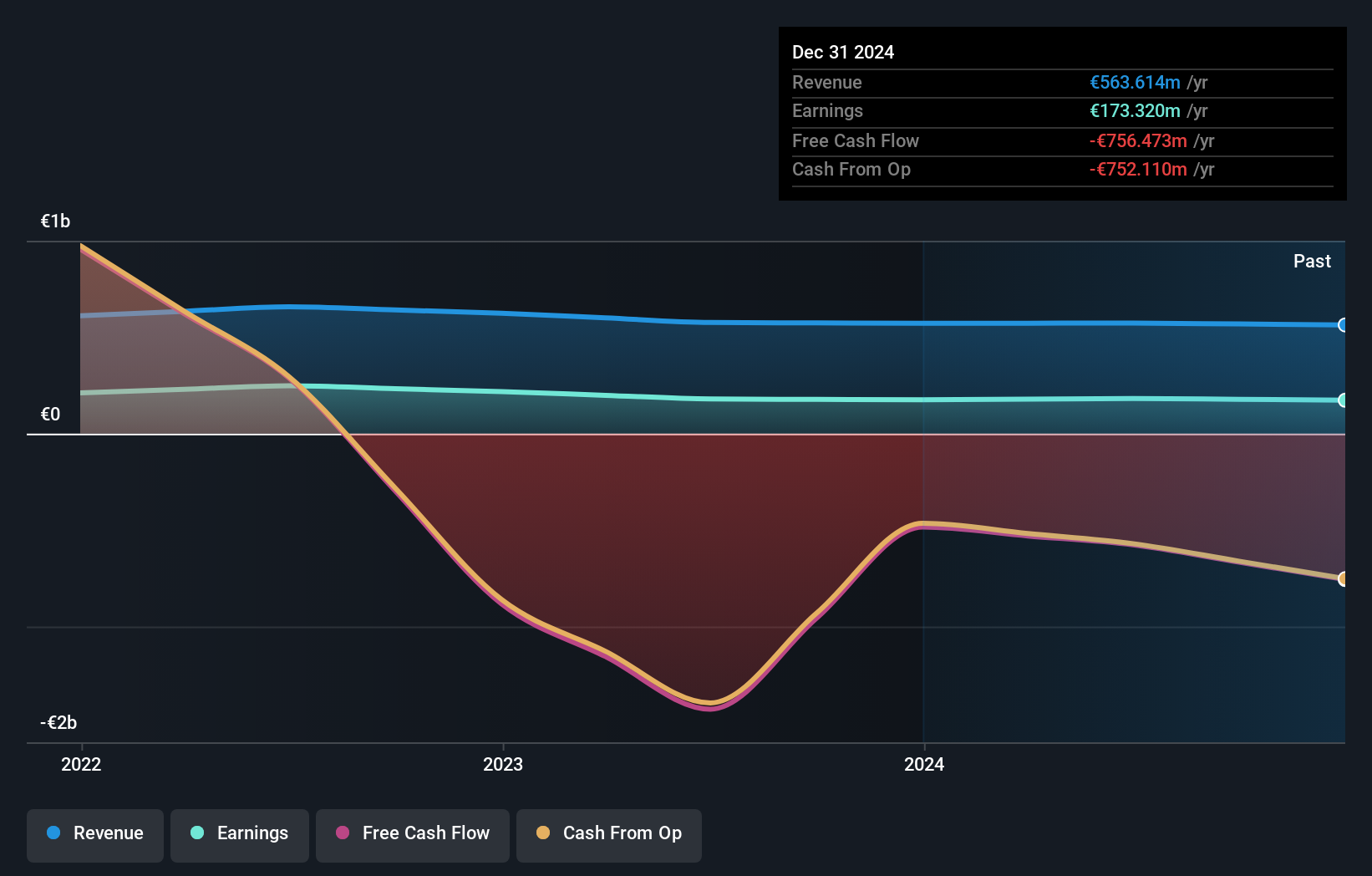

Overview: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative offers a range of banking products and services to diverse client segments in France, with a market cap of approximately €1.02 billion.

Operations: Caisse Régionale de Crédit Agricole Mutuel du Languedoc generates revenue through its diverse banking products and services portfolio aimed at various client segments, including individuals and businesses. The company's net profit margin reflects its financial efficiency in managing costs relative to income.

Caisse Régionale de Crédit Agricole Mutuel du Languedoc, a cooperative bank with €35.3 billion in assets and €5.2 billion in equity, shows promise as an investment candidate. It has a sufficient allowance for bad loans at 133% and maintains an appropriate level of bad loans at 1.4%. The bank's liabilities are primarily low-risk, with 94% sourced from customer deposits, enhancing its financial stability. Although earnings growth over the past year was just 1.3%, trailing the industry’s 5.3%, its five-year average earnings growth stands at a solid 4.2%. Trading at a significant discount to estimated fair value adds to its potential appeal.

Plasson Industries (TASE:PLSN)

Simply Wall St Value Rating: ★★★★★★

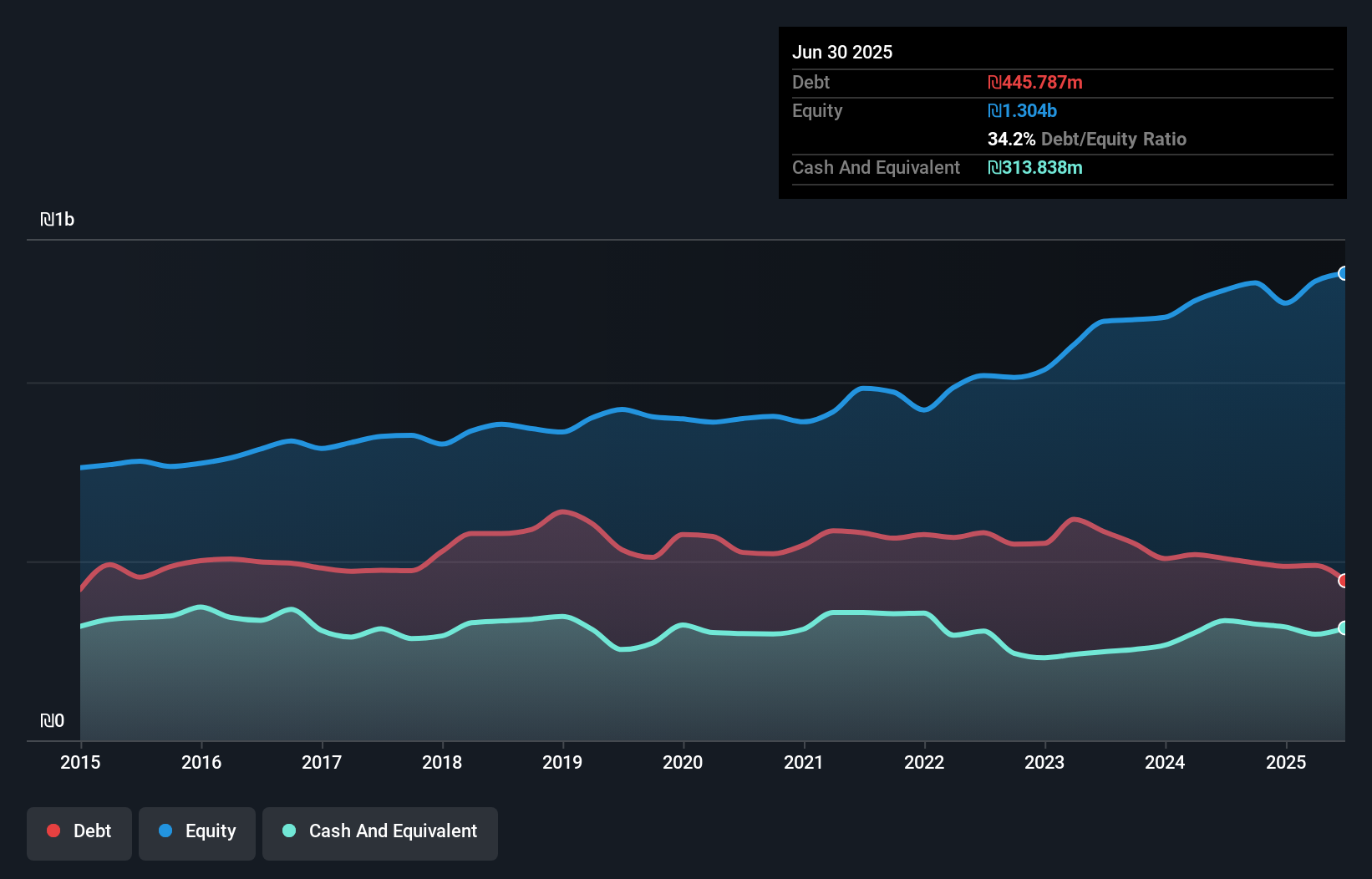

Overview: Plasson Industries Ltd develops, produces, and markets technical products across various regions including Israel, Europe, Brazil, Oceania, Asia, Africa, and the Americas with a market cap of ₪1.62 billion.

Operations: Plasson Industries generates revenue primarily through the sale of its technical products across multiple global regions. The company's financial performance is influenced by various factors, including production costs and regional market dynamics.

Plasson Industries, a nimble player in its sector, has shown impressive financial resilience. Its debt to equity ratio has improved significantly from 56.5% to 38.7% over the past five years, showcasing prudent financial management. The company’s earnings growth of 14.3% outpaced the Machinery industry average of 4.8%, highlighting its competitive edge. Trading at a substantial discount of 51.7% below estimated fair value suggests potential upside for investors seeking undervalued opportunities. Recent earnings reports reveal robust performance with net income rising from ILS 22 million to ILS 49 million year-on-year for Q3, reflecting strong operational execution and profitability improvements.

- Navigate through the intricacies of Plasson Industries with our comprehensive health report here.

Explore historical data to track Plasson Industries' performance over time in our Past section.

Morinaga&Co (TSE:2201)

Simply Wall St Value Rating: ★★★★★☆

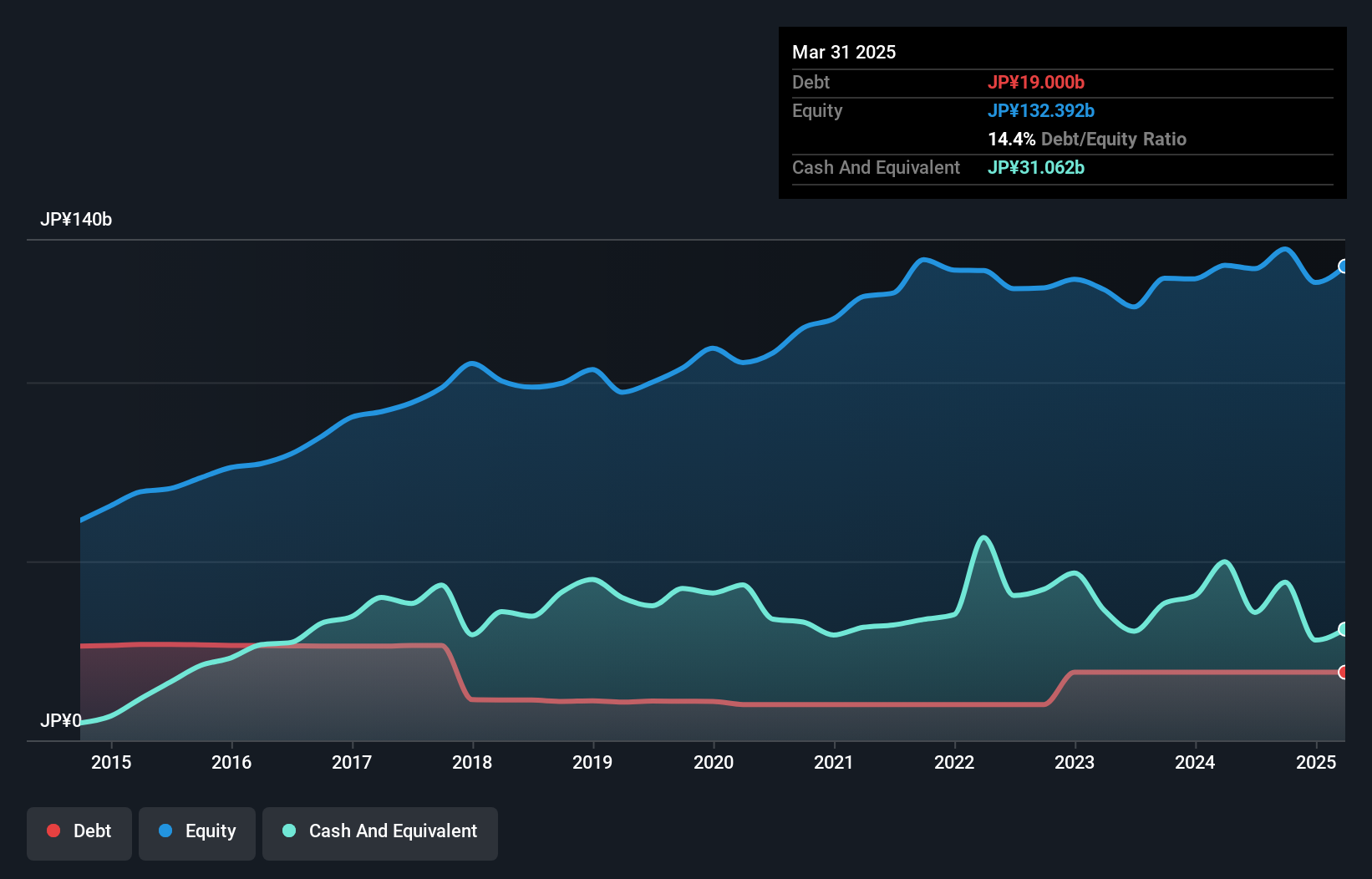

Overview: Morinaga&Co., Ltd. is a company engaged in the manufacturing, purchasing, and selling of confectionaries, food stuffs, frozen desserts, and health products both domestically in Japan and internationally with a market cap of ¥235.25 billion.

Operations: Morinaga&Co generates revenue through the sale of confectionaries, food stuffs, frozen desserts, and health products. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

Morinaga&Co. stands out with a 5-year earnings growth of 5.9% annually, although its recent year growth at 13% lagged behind the food industry's 20.1%. Trading at a significant discount of about 42.8% below its estimated fair value, Morinaga seems to offer potential upside for investors seeking undervalued opportunities. The company recently completed a share buyback program, repurchasing approximately 3.86 million shares for ¥10 billion, which may enhance shareholder returns and capital efficiency. With operating income projected to reach ¥21.3 billion by March 2025, up from previous guidance, Morinaga's outlook appears promising in the near term.

- Get an in-depth perspective on Morinaga&Co's performance by reading our health report here.

Examine Morinaga&Co's past performance report to understand how it has performed in the past.

Next Steps

- Click this link to deep-dive into the 4621 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2201

Morinaga&Co

Manufactures, purchases, and sells confectionaries, food stuffs, frozen desserts, and health products in Japan and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives