Amidst escalating geopolitical tensions in the Middle East and fluctuating oil prices, the French market has seen a notable decline, with the CAC 40 Index dropping by over 3% recently. As investors navigate these turbulent times, identifying promising small-cap stocks can be crucial for those looking to uncover potential opportunities in France's diverse economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In France

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Nord de France Société coopérative | 10.84% | 3.22% | 6.38% | ★★★★★★ |

| EssoF | 1.19% | 11.14% | 41.41% | ★★★★★★ |

| Gévelot | 0.25% | 10.64% | 20.33% | ★★★★★★ |

| ADLPartner | 82.84% | 9.86% | 16.18% | ★★★★★☆ |

| VIEL & Cie société anonyme | 54.02% | 5.66% | 19.86% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| La Forestière Equatoriale | 0.00% | -50.76% | 49.41% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative | 391.01% | 4.67% | 17.31% | ★★★★☆☆ |

| Société Fermière du Casino Municipal de Cannes | 11.60% | 6.69% | 10.30% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Axway Software (ENXTPA:AXW)

Simply Wall St Value Rating: ★★★★★☆

Overview: Axway Software SA is an infrastructure software publisher operating across France, the rest of Europe, the Americas, and the Asia Pacific with a market cap of €723.26 million.

Operations: Axway Software generates revenue primarily from subscription services (€201.19 million), followed by maintenance (€77.04 million), services excluding subscription (€35.49 million), and licenses (€8.46 million). The company's cost structure and profitability are reflected in its net profit margin, which offers insight into its financial efficiency and overall performance relative to revenue generation.

Axway Software, a notable player in the French market, has seen its debt to equity ratio rise from 12.5% to 24.6% over five years, yet it remains satisfactory with a net debt to equity ratio of 19.9%. The company’s EBIT covers interest payments by 10 times, indicating strong financial health. Despite recent shareholder dilution and a dip in net income to €2.8 million for the half year ending June 2024, Axway's price-to-earnings ratio of 20.7x suggests good value compared to industry peers at 27.8x.

- Navigate through the intricacies of Axway Software with our comprehensive health report here.

Review our historical performance report to gain insights into Axway Software's's past performance.

Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative (ENXTPA:CRBP2)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative offers a variety of banking and financial services to diverse clients in France, with a market cap of approximately €970 million.

Operations: The company's primary revenue stream is retail banking, generating approximately €626 million. It has a market capitalization of around €970 million.

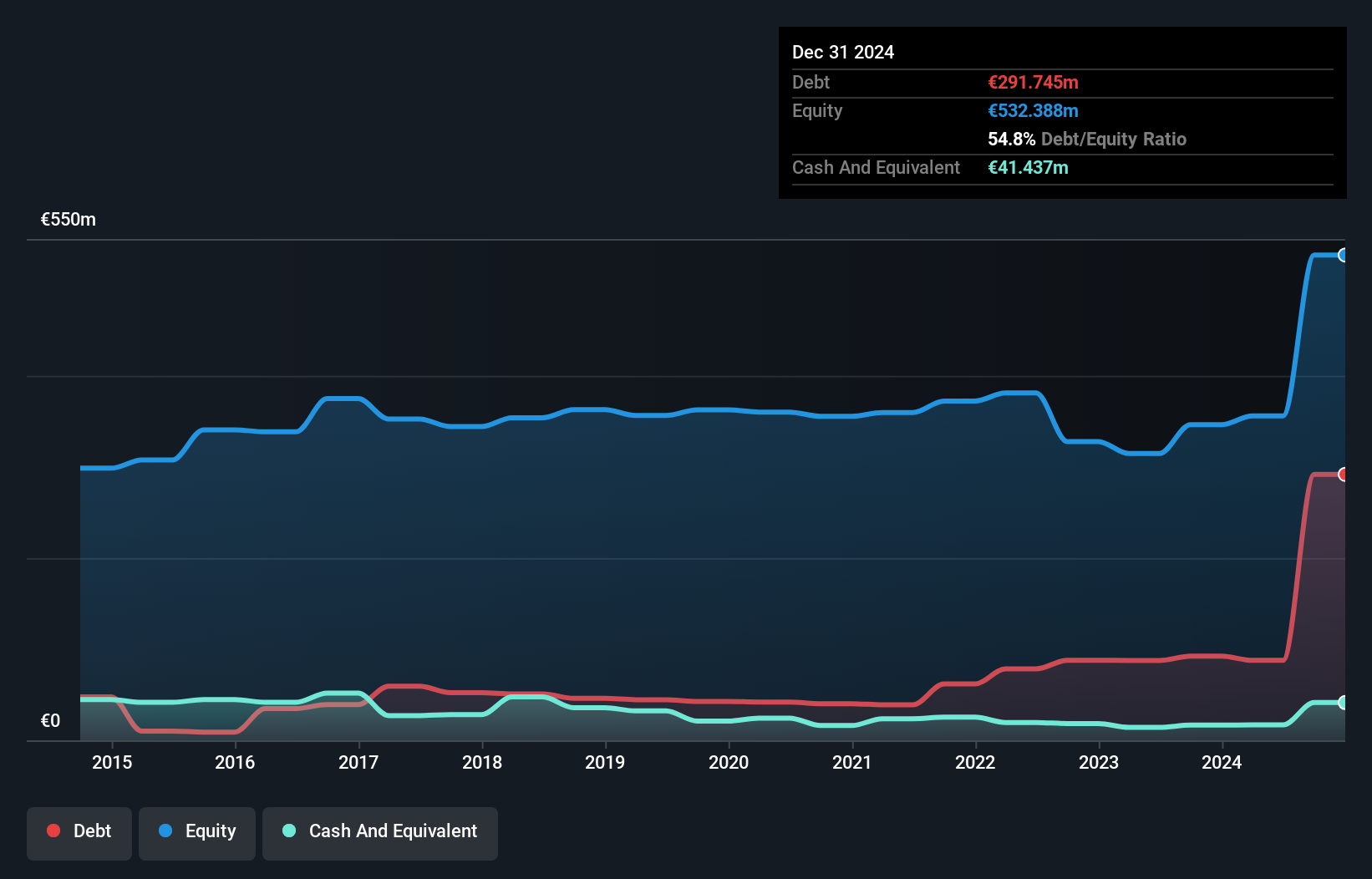

Caisse Régionale de Crédit Agricole Mutuel Brie Picardie, with total assets of €42.2 billion and equity of €5 billion, stands out for its robust financial health. The bank's deposits amount to €33.8 billion, while loans total €34.1 billion, supported by a sufficient allowance for bad loans at 115%. Impressively, 91% of its liabilities are low-risk customer deposits. Earnings grew by 6.2% last year, outperforming the industry average growth rate of 4%.

EssoF (ENXTPA:ES)

Simply Wall St Value Rating: ★★★★★★

Overview: Esso S.A.F. refines, distributes, and markets refined petroleum products in France and internationally with a market cap of €1.70 billion.

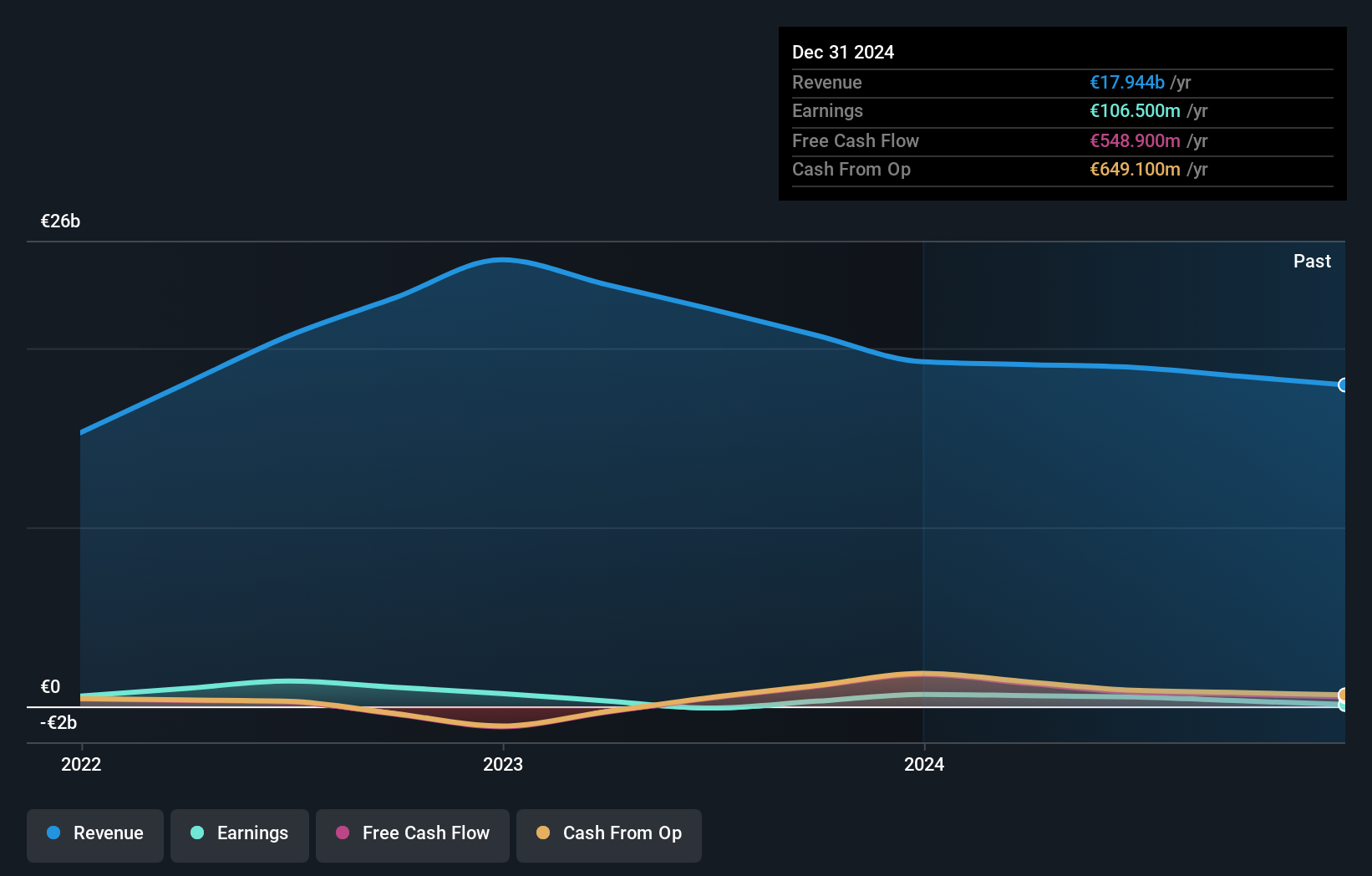

Operations: Esso S.A.F. generates revenue primarily from its refining and distribution segment, which accounted for €18.93 billion.

EssoF, a noteworthy player in the French market, has seen its debt to equity ratio improve significantly from 5.8% to 1.2% over five years, reflecting better financial health. Despite recent volatility in its share price and a drop in net income from €265.6 million to €116 million, EssoF remains free cash flow positive with high-quality earnings. The company is trading at 96.5% below estimated fair value, suggesting potential for undervaluation amidst industry challenges.

- Click here to discover the nuances of EssoF with our detailed analytical health report.

Examine EssoF's past performance report to understand how it has performed in the past.

Key Takeaways

- Discover the full array of 37 Euronext Paris Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CRBP2

Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative

Provides a range of banking and financial products and services to individuals, farmers, professionals, businesses, and public authorities in France.

Flawless balance sheet with solid track record.