Reflecting on Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative's (EPA:CRBP2) Share Price Returns Over The Last Year

Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative (EPA:CRBP2) shareholders should be happy to see the share price up 11% in the last quarter. But that doesn't change the fact that the returns over the last year have been less than pleasing. In fact the stock is down 39% in the last year, well below the market return.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

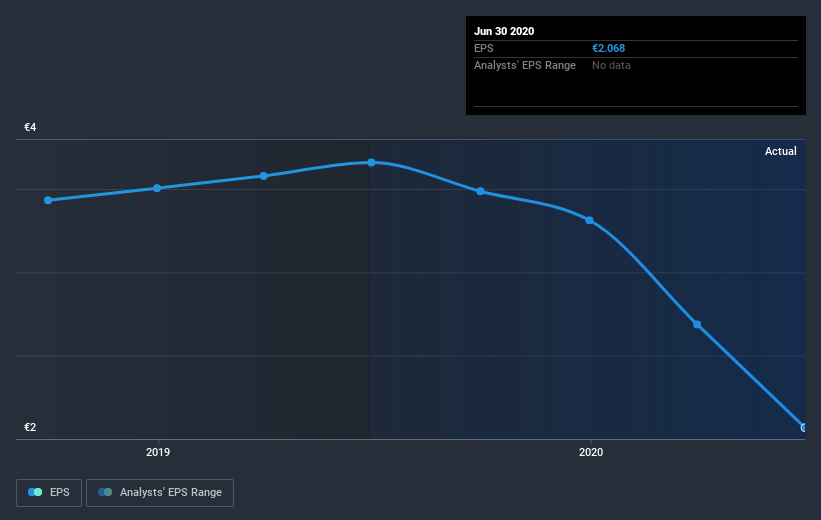

Unhappily, Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative had to report a 43% decline in EPS over the last year. This proportional reduction in earnings per share isn't far from the 39% decrease in the share price. Therefore one could posit that the market has not become more concerned about the company, despite the lower EPS. Instead, the change in the share price seems to reduction in earnings per share, alone.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative the TSR over the last year was -36%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We regret to report that Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative shareholders are down 36% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 0.2%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 3% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you decide to trade Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:CRBP2

Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative

Provides a range of banking and financial products and services to individuals, farmers, professionals, businesses, and public authorities in France.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives