Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative (ENXTPA:CRAP) Reports Strong Earnings

Reviewed by Simply Wall St

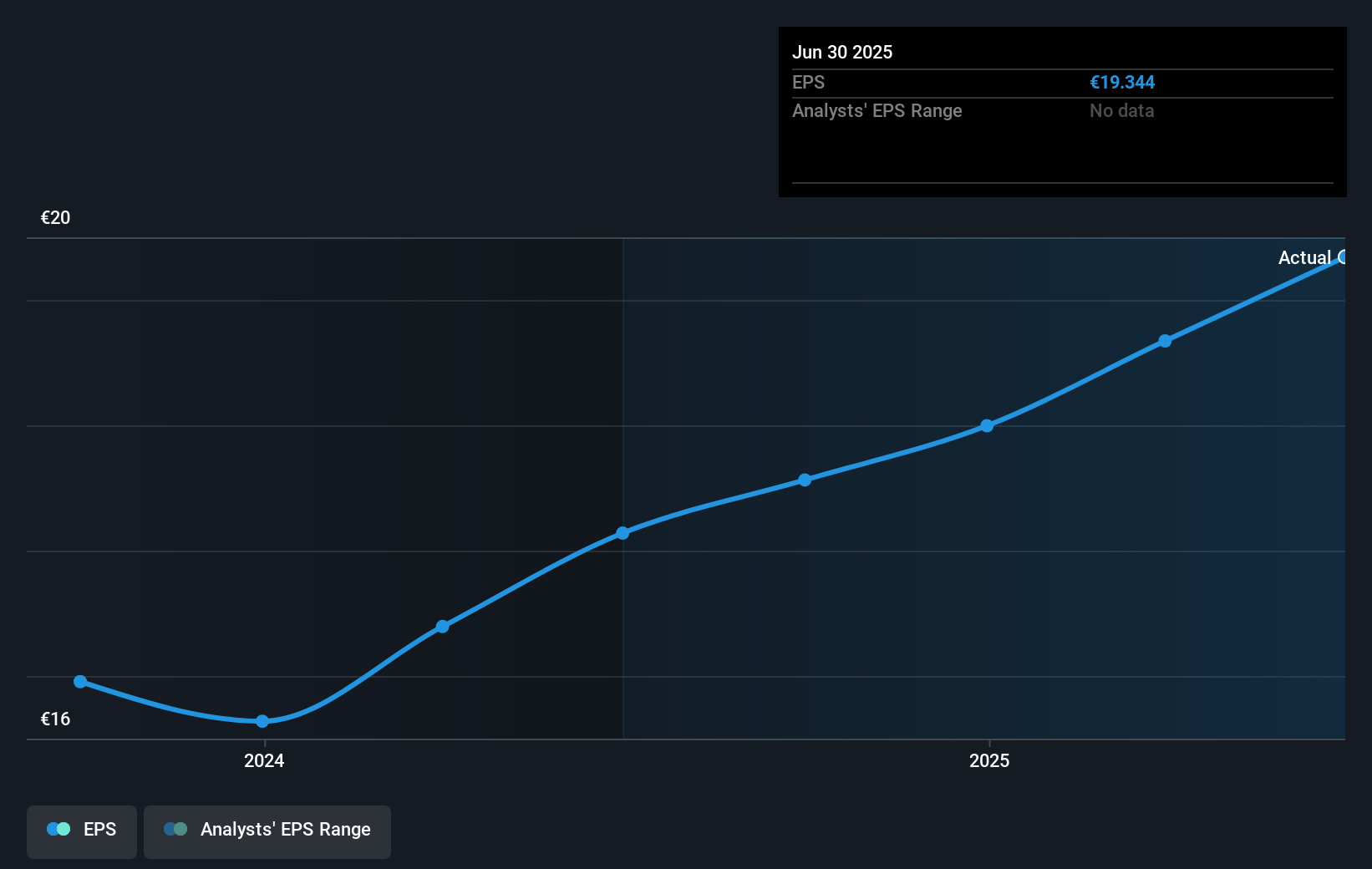

Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative (ENXTPA:CRAP) recently experienced a notable price move of 45% over the last quarter. This substantial increase aligns with the broader market trend where the S&P 500 and Nasdaq hit all-time highs, reflecting positive investor sentiment. During this period, the company announced strong half-year earnings results, highlighted by a rise in net interest income and net income, further bolstering investor confidence. While the market was buoyed by a general anticipation of rate cuts and a decrease in producer price index data, the company's robust earnings played a role in its significant share price appreciation.

Over the past three years, Caisse Régionale de Crédit Agricole Mutuel Alpes Provence has delivered a total shareholder return, including share price gains and dividends, of 141.24%. This long-term performance reflects a strong period of growth, particularly in the context of the last year's performance where CRAP's earnings growth of 12.9% outpaced both the French market and the Banks industry at 3.3% and 3.2% respectively. The share's current price is €140.50, and it's trading at a discount to the fair value estimate of €171.37, suggesting potential room for upward movement.

The recent positive earnings announcement, which detailed increased net interest income and net income, could impact revenue and earnings forecasts positively. The anticipation of further rate cuts might influence the company's future interest income as well. Analyst consensus on price targets remains indeterminate, but the significant share price increase in recent months indicates investor confidence, possibly driven by the earnings uptick and dividend announcements. Overall, while past performance has been strong, future developments will be critical in determining whether this trajectory can be maintained or improved.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CRAP

Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative

Provides banking products and services in France.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives