As European markets experience a resurgence in optimism following the de-escalation of U.S.-China trade tensions, indices such as the STOXX Europe 600 have shown notable gains, reflecting improved sentiment across the region. Against this backdrop, identifying promising small-cap stocks can be particularly rewarding, as these companies often possess unique growth potential and resilience that can thrive amid shifting economic landscapes.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Viohalco | 91.31% | 12.25% | 17.37% | ★★★★☆☆ |

| Evergent Investments | 5.59% | 5.88% | 16.36% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Caisse Régionale de Crédit Agricole Mutuel Nord de France Société coopérative (ENXTPA:CNDF)

Simply Wall St Value Rating: ★★★★★☆

Overview: Caisse Régionale de Crédit Agricole Mutuel Nord de France Société coopérative offers a range of banking products and financial services in France, with a market capitalization of approximately €1.06 billion.

Operations: The company generates revenue primarily from its retail banking segment, which contributes €632.82 million.

Crédit Agricole Nord de France stands out with its total assets of €38.2 billion and equity of €5.7 billion, reflecting a robust financial foundation. The bank's earnings growth of 26.6% over the past year surpasses the industry average of 3.2%, showcasing its competitive edge in the banking sector. With a bad loans ratio at an appropriate 1.7% and a low allowance for bad loans at 94%, it maintains strong credit management practices. Trading at nearly 26% below estimated fair value, this entity might be undervalued, offering potential upside for investors seeking opportunities in European markets.

Norconsult (OB:NORCO)

Simply Wall St Value Rating: ★★★★★★

Overview: Norconsult ASA is a consultancy firm specializing in community planning, engineering design, and architecture services across the Nordics and internationally, with a market capitalization of NOK14.09 billion.

Operations: The firm generates revenue primarily through consultancy services in community planning, engineering design, and architecture. It has a market capitalization of NOK14.09 billion.

Norconsult ASA, a notable name in the consulting engineering sector, has demonstrated impressive financial performance with earnings surging by 93.5% over the past year, outpacing the industry average of 76.3%. The company reported a net income of NOK 257 million for Q1 2025, significantly up from NOK 103 million in the previous year. Trading at nearly 28% below its estimated fair value and operating debt-free for five years enhances its investment appeal. Recent dividend approval of NOK 1.70 per share further underscores shareholder value focus amidst robust earnings growth projections at nearly 10% annually.

- Get an in-depth perspective on Norconsult's performance by reading our health report here.

Explore historical data to track Norconsult's performance over time in our Past section.

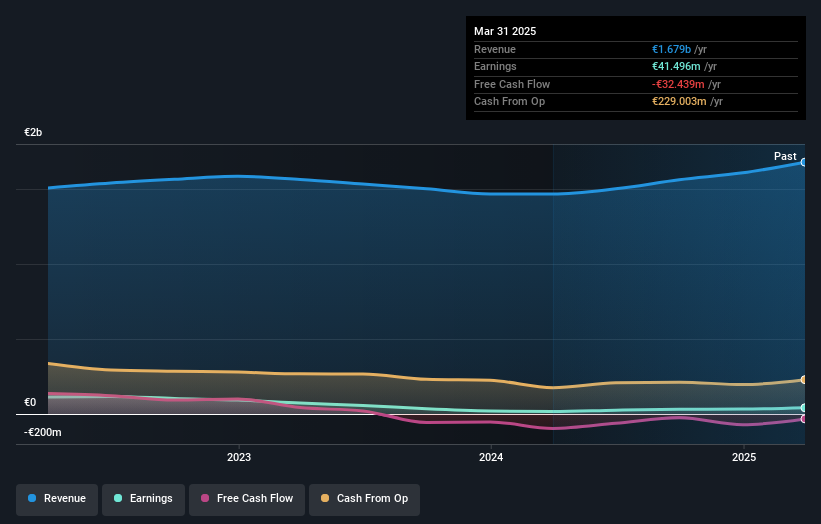

Hamburger Hafen und Logistik (XTRA:HHFA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hamburger Hafen und Logistik Aktiengesellschaft is a port and transport logistics company operating in Germany, the rest of the European Union, and internationally, with a market cap of €1.37 billion.

Operations: HHLA generates revenue primarily through its port and transport logistics operations across Germany, the EU, and international markets. The company's cost structure includes expenses related to operational activities necessary for maintaining its logistics services. A notable financial metric is the net profit margin, which reflects the efficiency of converting revenue into actual profit after all expenses are deducted.

Hamburger Hafen und Logistik (HHLA) showcases a promising blend of strategic initiatives and robust financial performance. Over the past year, earnings surged by 158%, outpacing the infrastructure sector's growth of 7%. With no debt on its books, HHLA has improved significantly from a debt-to-equity ratio of 98% five years ago. Recent quarterly results reveal sales climbing to €437.6 million from €366 million year-over-year, while net income reached €7.87 million compared to a prior loss. Despite these gains, market optimism may be high as analysts set a price target below current levels amid potential project delays and global uncertainties.

Turning Ideas Into Actions

- Reveal the 327 hidden gems among our European Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CNDF

Caisse Régionale de Crédit Agricole Mutuel Nord de France Société coopérative

Caisse Régionale de Crédit Agricole Mutuel Nord de France Société cooperative provides banking products and financial services in France.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives