Is There Still Room for BNP Paribas After Its 22% Rally in 2025?

Reviewed by Bailey Pemberton

- Curious if BNP Paribas is a hidden gem or already priced for perfection? You are in the right place to break down what really drives its value.

- The stock has been making waves lately, jumping 7.9% over the past week and up a hefty 22.1% year-to-date. This suggests investors are seeing something promising.

- Recent news around BNP Paribas has highlighted their strategic expansions in European lending and positive regulatory developments, which investors see as brightening the long-term outlook. Analysts have also taken note of the company’s efforts to lead in sustainable finance, adding further fuel to the latest rally.

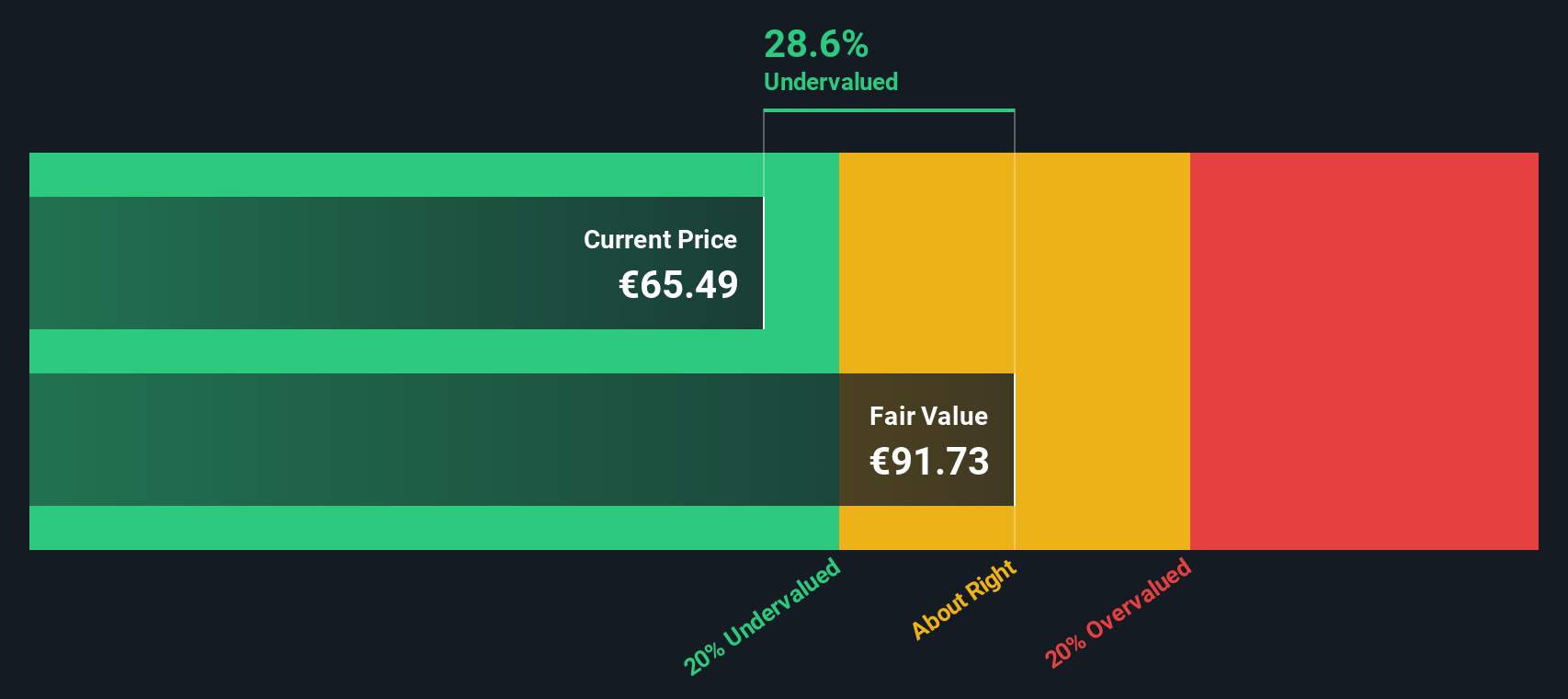

- Here is a key point: BNP Paribas scores a 6 out of 6 on our valuation checks, showing signs of broad-based undervaluation. In the next section, we will break down these valuation approaches and share an even smarter way to think about what the shares are truly worth.

Find out why BNP Paribas's 43.1% return over the last year is lagging behind its peers.

Approach 1: BNP Paribas Excess Returns Analysis

The Excess Returns model is designed to evaluate whether a company’s investments are generating returns above or below the expected cost of equity. Instead of just examining cash flows or dividends, it focuses on how efficiently BNP Paribas converts its invested capital into shareholder value, factoring in future growth projections and the sustainability of current returns.

The key metrics used in this approach include a Book Value of €111.07 per share and a Stable Earnings Per Share (EPS) of €11.80, based on forecasts from 14 analysts. BNP Paribas carries a Cost of Equity at €14.10 per share, resulting in an Excess Return of €-2.30 per share. This indicates the company's incremental returns on new investments are just below the required rate, but not significantly so. The average Return on Equity is 10.30%, and the Stable Book Value is projected at €114.60 per share, as estimated by 9 analysts.

After compiling these metrics, the model estimates an intrinsic value for BNP Paribas that is 21.4% higher than its current trading price. This suggests the stock may be undervalued at present levels.

Result: UNDERVALUED

Our Excess Returns analysis suggests BNP Paribas is undervalued by 21.4%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

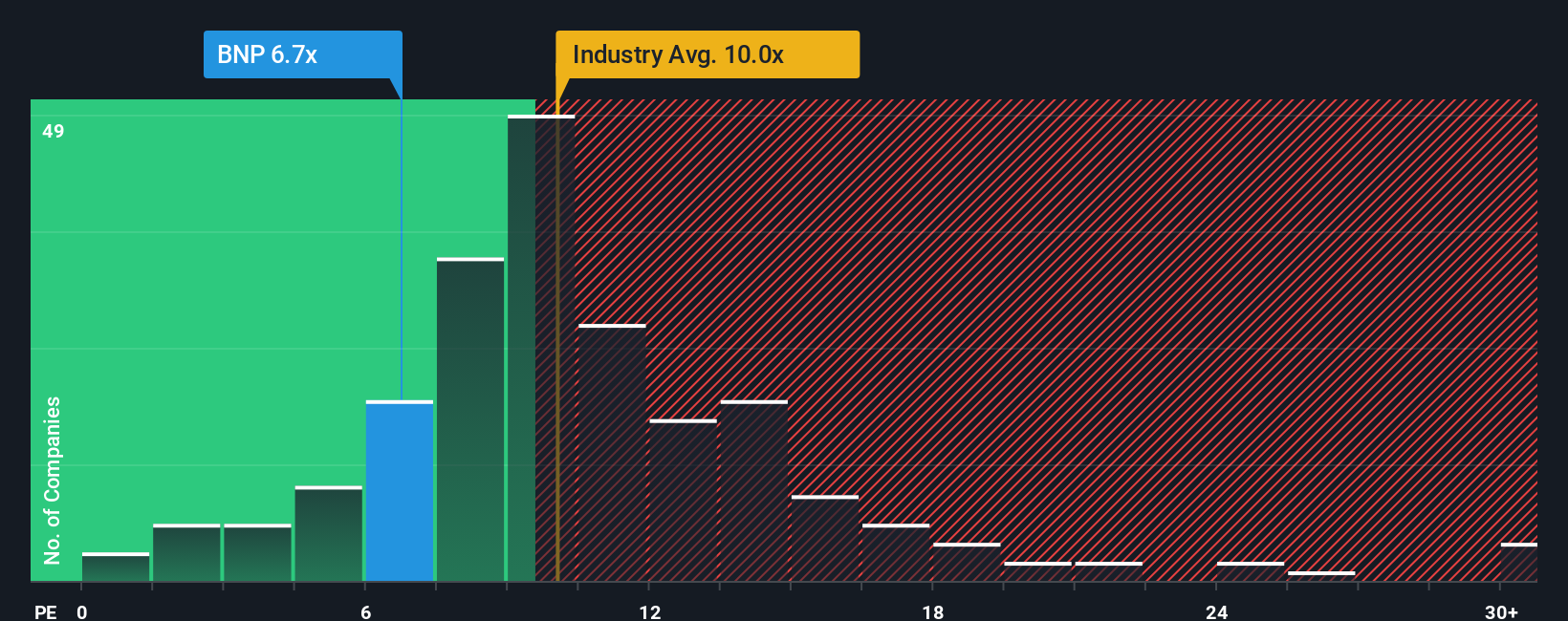

Approach 2: BNP Paribas Price vs Earnings

The Price-to-Earnings (PE) ratio is often the go-to metric for valuing profitable companies like BNP Paribas. It offers a straightforward way to gauge how much investors are willing to pay today for a euro of the company’s earnings, making it especially relevant for banks with steady profits.

Growth prospects, profitability, and risk levels all help shape what a "normal" or "fair" PE ratio should look like for a stock. Companies with higher earnings growth or more stable earnings can usually command a higher PE, while higher risk or slowing growth tends to justify a lower figure.

Right now, BNP Paribas trades at a PE ratio of 7.4x. This is lower than the average peer at 8.8x and below the wider industry average of 10.4x. On the surface, this makes BNP appear undervalued compared to its competition.

However, Simply Wall St's proprietary Fair Ratio offers a more tailored benchmark. It calculates the appropriate PE by factoring in company-specific details such as growth outlook, profit margins, size, and risk profile. This makes it a more precise gauge than just comparing to generic industry averages or peers, which may not reflect BNP Paribas’ particular strengths or risks.

For BNP Paribas, the Fair Ratio stands at 7.7x, which is almost identical to its actual multiple. The minimal gap suggests the market has BNP Paribas priced about right on current fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your BNP Paribas Narrative

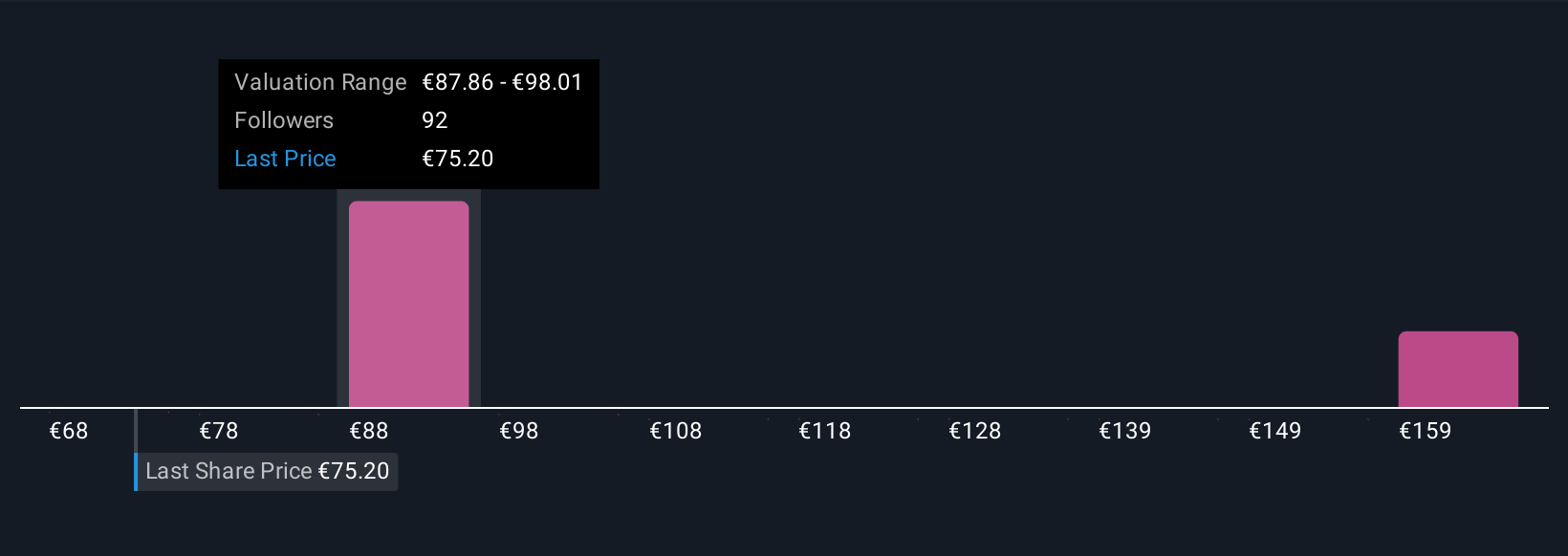

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives, a dynamic, story-driven approach that helps investors connect their unique view of a company’s future with a financial forecast and an estimated fair value.

A Narrative is not just about numbers; it is about putting your perspective into practice. You can outline how you believe BNP Paribas will perform, explain the reasoning behind your revenue growth, margins, and risks, and then see what the shares should be worth based on your scenario.

On Simply Wall St’s Community page, Narratives let you easily create, share, or follow these stories. They are automatically updated as new earnings or news emerge, ensuring your view stays relevant.

This empowers you to compare your personal Fair Value to the current market price, so you can more confidently decide when it is time to buy, hold, or sell.

For example, some investors might see digital expansion and resilient fee income as the route to a fair value above €100. Others may be concerned that Eurozone headwinds could cap the share price closer to €77. Narratives let you test both stories, make your own call, and invest accordingly, all in one intuitive place.

Do you think there's more to the story for BNP Paribas? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BNP Paribas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BNP

BNP Paribas

Provides various banking and financial products and services in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success