BNP Paribas (ENXTPA:BNP) Earnings Growth Misses Long-Term Trend, Underscoring Margin Pressure Concerns

Reviewed by Simply Wall St

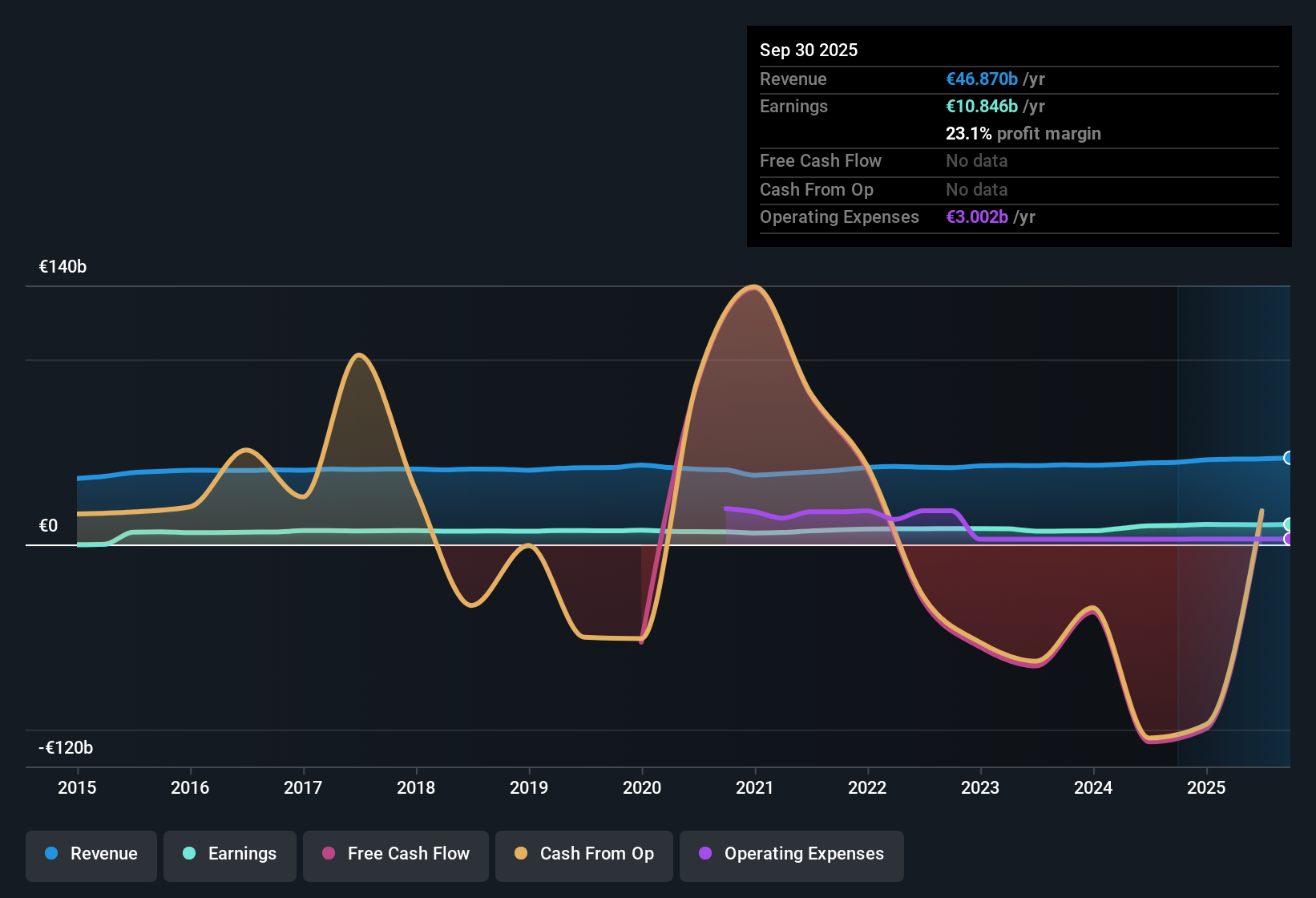

BNP Paribas (ENXTPA:BNP) reported earnings growth of 2.4% over the past year, falling short of its five-year average of 9.4% per year. Net profit margins slipped slightly to 23% from 23.6%, pointing to softer profitability. Looking ahead, earnings are forecast to grow at 7.9% per year, trailing the broader French market's 12.3% annual pace. However, revenue is expected to outpace the market at 7.2% per year. With shares trading at €66.94, well below both fair value estimates and analyst price targets, and with a price-to-earnings ratio materially lower than industry averages, BNP Paribas stands out for its relative value and strong historical profit growth, even as margin trends show some caution for investors.

See our full analysis for BNP Paribas.Now, let's see how these results stack up against the dominant narratives shaping BNP Paribas’s outlook. We're looking for points where consensus gets confirmed or challenged by the latest numbers.

See what the community is saying about BNP Paribas

Cost-Saving Initiatives Set to Add €600 Million Annually

- BNP Paribas is targeting €600 million in cost savings per year through 2026, driven by investments in digital banking and technology harmonization across Eurozone operations.

- According to the analysts' consensus view, these structural efficiency moves are expected to directly improve return on equity and deliver sustained margin expansion.

- Consensus narrative notes that building on digital platforms and operational streamlining not only cuts costs but increases recurring fee income, supporting both margin improvement and earnings durability.

- Strengthening digital infrastructure also helps buffer against competitive threats from fintechs and digital banks, positioning BNP Paribas for greater resilience even in a slow-growth Eurozone market.

- To see how these operating changes shape BNP Paribas’s future and what analysts expect, check out the full narrative breakdown in the consensus view. 📊 Read the full BNP Paribas Consensus Narrative.

High Cost Structure Remains a Concern for Margins

- Despite cost-saving programs, BNP Paribas continues to face a high cost base and operational complexity. Critics point out this could limit net margin gains even as new efficiency efforts roll out.

- Bears highlight that the bank's heavy reliance on mature Eurozone markets such as France, Belgium, and Italy, where margin pressure is persistent, amplifies the risks of not meeting long-term profitability targets.

- Asset Management headwinds, particularly from real estate exposure and currency effects, are flagged as likely to persist until at least late 2026 or 2027, further constraining fee-based income.

- Additionally, potential regulatory tightening such as Basel IV rules could lead to higher capital requirements and pressure returns on equity, threatening the sustainability of dividends and buybacks.

Trading at a 31% Discount to DCF Fair Value

- At €66.94, BNP Paribas trades 31% below the DCF fair value estimate of €96.05 and 25% below the analyst price target of €89.48, signaling significant upside versus both intrinsic and market-based benchmarks.

- Analysts' consensus view ties this valuation discount to the group’s strong historical earnings quality and profit growth, arguing that while risks to margins and regulation exist, the current share price more than compensates for these factors.

- The price-to-earnings ratio of 7x not only undercuts both industry and peer averages, but it also provides a margin of safety for new investors entering at current levels.

- Consensus notes that for the price target to be reached by 2028, BNP must deliver on forecasted margin and growth improvements and see investor willingness for a higher PE multiple.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for BNP Paribas on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something in the figures others might have missed? Shape your perspective into a narrative in just a few minutes. Do it your way

A great starting point for your BNP Paribas research is our analysis highlighting 5 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

BNP Paribas faces headwinds from persistent margin pressure, high operating costs, and regulatory risks. These factors may hamper its ability to deliver consistent long-term growth.

If you want to prioritize stability and smoother earnings, focus on steady performers by filtering for stable growth stocks screener (2122 results) that reliably expand regardless of market cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BNP Paribas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BNP

BNP Paribas

Provides various banking and financial products and services in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives