Could Crédit Agricole’s Debt Buybacks Reveal a New Approach to Capital Structure? (ENXTPA:ACA)

Reviewed by Simply Wall St

- Crédit Agricole S.A. recently announced the early redemption of €1 billion in Senior Non-Preferred Callable Fixed to Floating Rate Social Notes and completed cash tender offers for all validly tendered GBP and USD deeply subordinated Additional Tier 1 notes, with settled repurchases totaling over US$796 million and £310 million principal amounts respectively.

- These liability management actions are designed to optimize the bank's capital structure and underscore a proactive approach to managing long-term funding and investor relations.

- We'll assess how Crédit Agricole's recent large-scale debt redemptions and buybacks may influence its long-term earnings outlook and capital efficiency.

These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Crédit Agricole Investment Narrative Recap

To be a shareholder in Crédit Agricole, you need to believe in the bank’s ability to manage capital efficiently while navigating challenges such as earnings pressure and uncertain regulatory or macroeconomic headwinds. The recent large-scale redemptions and buybacks have no material impact on the key short-term catalyst, profitability improvements in digital banking and wealth management, and do not mitigate the major risk posed by potential volatility in its Italian partnership exposure.

Among recent announcements, the finalization of over US$796 million in deeply subordinated USD note repurchases stands out, given its relevance to ongoing capital management and optimization of future funding costs. This move aligns with catalysts such as ongoing reinvestment in digital and ESG offerings, which are central to the bank’s outlook on recurring revenue and cost efficiency.

But while capital actions are getting investor attention, it’s the potential fallout from the Banco BPM accounting change that investors should also watch for...

Read the full narrative on Crédit Agricole (it's free!)

Crédit Agricole's outlook estimates €29.8 billion in revenue and €7.6 billion in earnings by 2028. This reflects a 6.2% annual revenue decline and a €1.4 billion decrease in earnings from the current €9.0 billion.

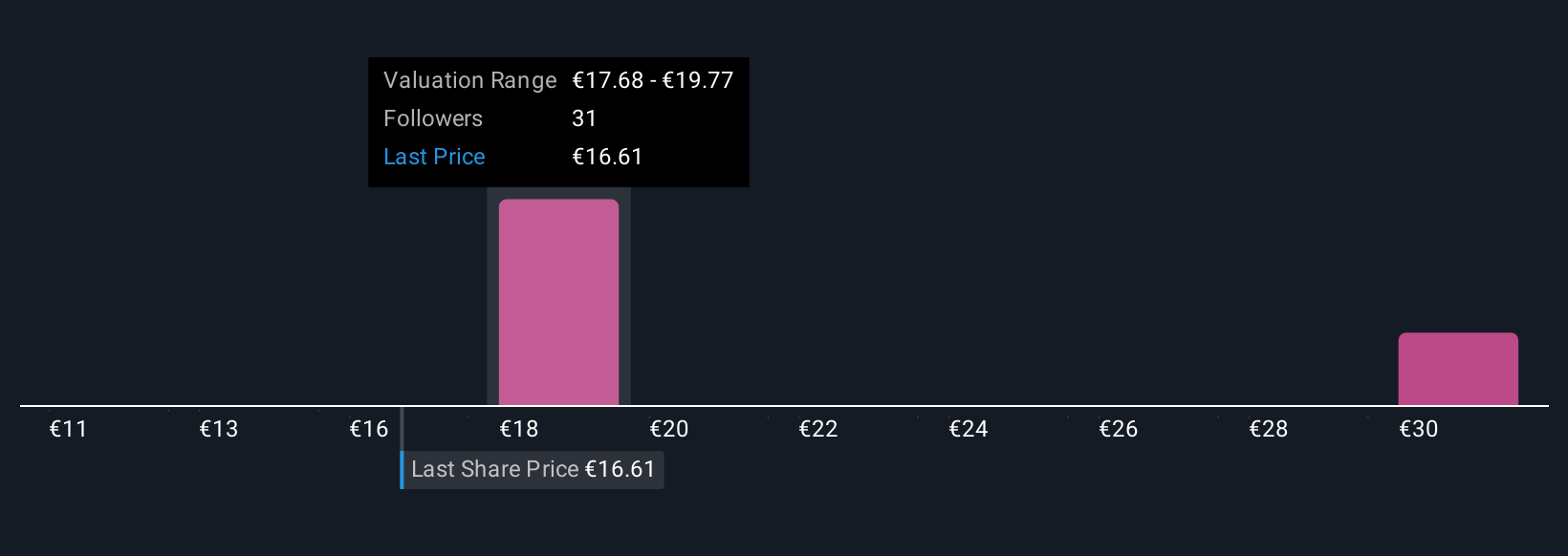

Uncover how Crédit Agricole's forecasts yield a €18.31 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community put Crédit Agricole’s worth between €11.40 and €32.30, showing significant dispersion. With such a range, weighing the effects of capital structure actions alongside ongoing uncertainties in earnings growth is crucial, consider how your own view fits against these views.

Explore 5 other fair value estimates on Crédit Agricole - why the stock might be worth as much as 99% more than the current price!

Build Your Own Crédit Agricole Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Crédit Agricole research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Crédit Agricole research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Crédit Agricole's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ACA

Crédit Agricole

Provides retail, corporate, insurance, and investment banking products and services in France and internationally.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives