Trigano (ENXTPA:TRI) Profit Margin Miss Undercuts Bullish Narratives Despite Deep Value Discount

Reviewed by Simply Wall St

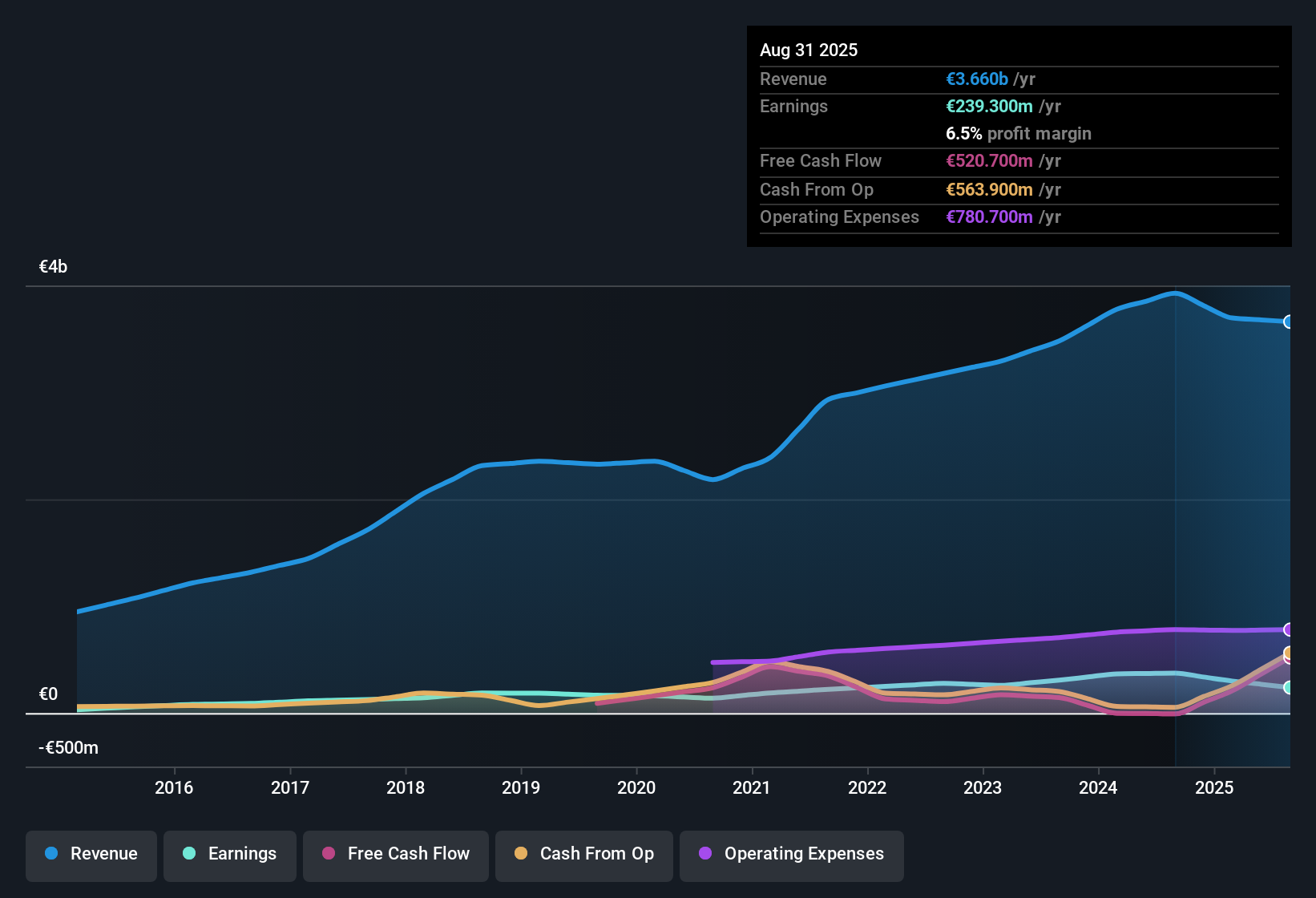

Trigano (ENXTPA:TRI) just posted its first half FY 2025 results, with revenue coming in at €1.7 billion and EPS at €5.47. Looking back, the company saw revenue move from €1.9 billion in 1H FY 2024 to €2.0 billion in 2H FY 2024, while EPS swung between €9.34 and €10.05 for those periods. Margins showed signs of compression this year, giving investors plenty to dig into as they look at profits in context.

See our full analysis for Trigano.Next up, we’re lining these headline numbers against the dominant narratives to see where the market consensus still matches reality and where it does not.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Drops to 8.1%

- Net profit margin for the last twelve months landed at 8.1%, a drop from the prior year's 9.7% and below levels seen in the recent five-year period.

- What jumps out from the prevailing market opinion is that, while Trigano’s margin compression looks concerning at first, the company still displays quality earnings rooted in a five-year average EPS growth of 17.2%.

- Bulls would likely call out this history of high EPS growth as support that the brand can bounce back from a year of slowed profits.

- However, current year earnings actually fell versus that strong longer-term trend, directly reflecting the margin squeeze arithmetic.

Stock Trades 21.9% Below Fair Value

- With a price-to-earnings ratio at 9.5x and shares changing hands at €171.40, Trigano trades at a 21.9% discount to its DCF fair value estimate of €212.11 and well below the sector median of 17x to 18x.

- Market-watchers note valuation is now a clear bright spot for anyone focused on bargains, as supported by analyst consensus pointing to possible share price appreciation near 22.3%.

- This disconnect between price and fair value stands out given margins have weakened and future growth is expected to lag the French market average.

- That gap makes Trigano a value pick within a sector where many competitors look more expensive on the same metrics.

Dividend Yield Steady at 2.37%

- Trigano’s dividend yield holds at 2.37%, which is notable for investors looking for income in the auto sector alongside capital appreciation possibilities.

- The market view is that, even as near-term earnings growth moderates, the steady dividend delivers a cushion, especially with no material risk factors called out in the most recent review.

- Unlike many cyclicals that may slash payouts in rough years, Trigano’s dividend stability can help support overall shareholder returns during periods of muted EPS growth.

- Combined with discounted valuation, this supports the argument for patient investors who want to balance growth and income angles in the portfolio.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Trigano's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Trigano’s sharp margin compression and earnings dip highlight how inconsistent profit growth can limit upside, even when shares are attractively valued.

If steadier results matter, use our stable growth stocks screener (2075 results) to quickly spot companies with reliable earnings and consistent expansion when others are struggling.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trigano might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:TRI

Trigano

Designs, manufactures, and distributes leisure vehicles for individuals and professionals in France, Germany, the United Kingdom, Benelux, Italy, Spain, Northern Europe, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion