- France

- /

- Auto Components

- /

- ENXTPA:OPM

Compagnie Plastic Omnium SE's (EPA:POM) Stock Has Seen Strong Momentum: Does That Call For Deeper Study Of Its Financial Prospects?

Most readers would already be aware that Compagnie Plastic Omnium's (EPA:POM) stock increased significantly by 21% over the past three months. Given that stock prices are usually aligned with a company's financial performance in the long-term, we decided to study its financial indicators more closely to see if they had a hand to play in the recent price move. Specifically, we decided to study Compagnie Plastic Omnium's ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

See our latest analysis for Compagnie Plastic Omnium

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Compagnie Plastic Omnium is:

8.2% = €178m ÷ €2.2b (Based on the trailing twelve months to December 2022).

The 'return' is the income the business earned over the last year. That means that for every €1 worth of shareholders' equity, the company generated €0.08 in profit.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Compagnie Plastic Omnium's Earnings Growth And 8.2% ROE

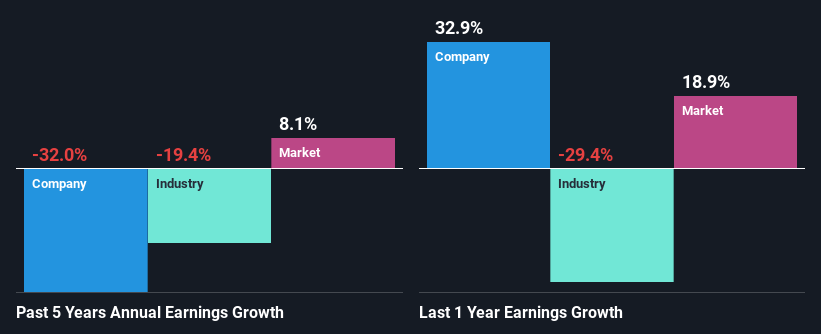

At first glance, Compagnie Plastic Omnium's ROE doesn't look very promising. Although a closer study shows that the company's ROE is higher than the industry average of 5.6% which we definitely can't overlook. But then again, seeing that Compagnie Plastic Omnium's net income shrunk at a rate of 32% in the past five years, makes us think again. Bear in mind, the company does have a slightly low ROE. It is just that the industry ROE is lower. Therefore, the decline in earnings could also be the result of this.

Furthermore, even when compared to the industry, which has been shrinking its earnings at a rate 19% in the same period, we found that Compagnie Plastic Omnium's performance is pretty disappointing, as it suggests that the company has been shrunk its earnings at a rate faster than the industry.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. Is POM fairly valued? This infographic on the company's intrinsic value has everything you need to know.

Is Compagnie Plastic Omnium Efficiently Re-investing Its Profits?

In spite of a normal three-year median payout ratio of 28% (that is, a retention ratio of 72%), the fact that Compagnie Plastic Omnium's earnings have shrunk is quite puzzling. So there could be some other explanations in that regard. For instance, the company's business may be deteriorating.

Additionally, Compagnie Plastic Omnium has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth. Based on the latest analysts' estimates, we found that the company's future payout ratio over the next three years is expected to hold steady at 30%. Still, forecasts suggest that Compagnie Plastic Omnium's future ROE will rise to 15% even though the the company's payout ratio is not expected to change by much.

Summary

On the whole, we do feel that Compagnie Plastic Omnium has some positive attributes. However, while the company does have a decent ROE and a high profit retention, its earnings growth number is quite disappointing. This suggests that there might be some external threat to the business, that's hampering growth. That being so, the latest industry analyst forecasts show that the analysts are expecting to see a huge improvement in the company's earnings growth rate. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:OPM

OPmobility

Designs and produces intelligent exterior systems, customized complex modules, lighting systems, energy storage systems, and electrification solutions for all mobility players in Europe, North America, China, rest of Asia, South America, the Middle East, and Africa.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success