- France

- /

- Auto Components

- /

- ENXTPA:OPM

OPmobility (EPA:OPM) sheds €62m, company earnings and investor returns have been trending downwards for past five years

We think intelligent long term investing is the way to go. But unfortunately, some companies simply don't succeed. For example the OPmobility SE (EPA:OPM) share price dropped 64% over five years. We certainly feel for shareholders who bought near the top. We also note that the stock has performed poorly over the last year, with the share price down 25%.

Since OPmobility has shed €62m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

View our latest analysis for OPmobility

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the five years over which the share price declined, OPmobility's earnings per share (EPS) dropped by 19% each year. This change in EPS is remarkably close to the 19% average annual decrease in the share price. That suggests that the market sentiment around the company hasn't changed much over that time. Rather, the share price has approximately tracked EPS growth.

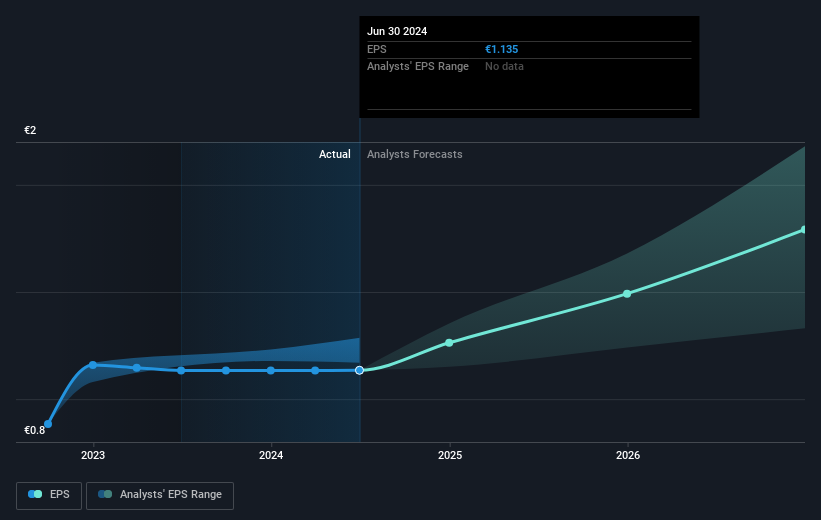

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on OPmobility's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for OPmobility the TSR over the last 5 years was -59%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While the broader market gained around 0.8% in the last year, OPmobility shareholders lost 20% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 10% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for OPmobility that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:OPM

OPmobility

Engages in the manufacture and sale of exterior vehicle lighting systems, batteries, and electrification systems for electric mobility in Europe, North America, China, rest of Asia, South America, the Middle East, and Africa.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives