- France

- /

- Auto Components

- /

- ENXTPA:OPM

Is OPmobility's (ENXTPA:OPM) Focus on Margins and Debt the Key to Long-Term Resilience?

Reviewed by Sasha Jovanovic

- In October 2025, OPmobility SE reported third-quarter consolidated revenue of €2.36 billion, down from €2.46 billion a year earlier, and confirmed its earnings outlook for the full year 2025 with plans to improve operating margin and net results while reducing net debt.

- Despite lower recent revenues, the company's emphasis on boosting profitability and strengthening its balance sheet signals a continued focus on operational efficiency and financial resilience.

- We'll examine how OPmobility's reaffirmed commitment to margin improvement and debt reduction may influence its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

OPmobility Investment Narrative Recap

Owning shares in OPmobility means believing in the company's ability to improve profitability and manage its balance sheet, even in periods of lower revenue. The recent confirmation of its full-year guidance, despite a dip in third-quarter sales, suggests management remains focused on increasing operating margins and reducing debt. This steady outlook supports its short-term catalyst of margin improvement, while the biggest risk remains potential disappointment if regional market gains or vehicle production do not recover, this news does not materially change these core dynamics.

Among OPmobility’s recent announcements, the issuance of a new €300 million bond in July 2025 is closely tied to the latest focus on financial aggregates. This move may enable further operational flexibility as the company seeks to enhance margins and reduce debt, aligning with management's stated priorities and supporting near-term objectives even as slower revenue growth persists.

But while the company’s guidance sounds optimistic, investors should still be aware that regional market weakness could...

Read the full narrative on OPmobility (it's free!)

OPmobility's outlook anticipates €11.0 billion in revenue and €291.9 million in earnings by 2028. This implies a 1.8% annual revenue growth rate and a €131.9 million increase in earnings from the current €160.0 million.

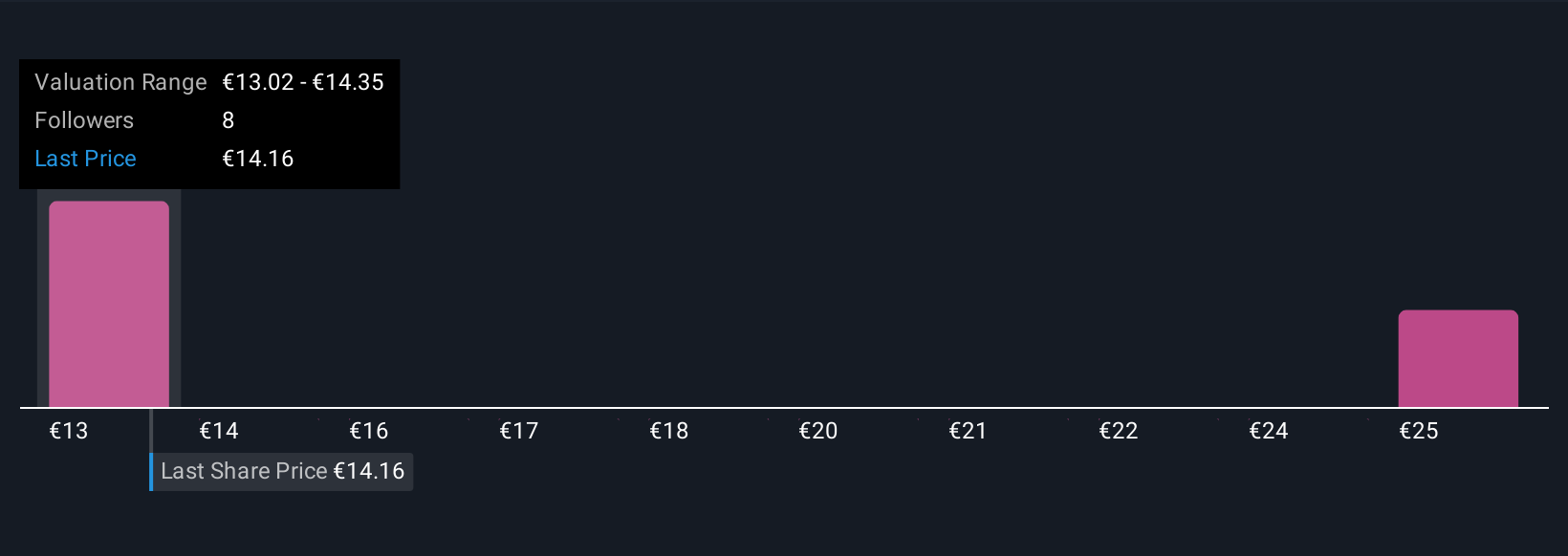

Uncover how OPmobility's forecasts yield a €13.02 fair value, a 14% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided three fair value estimates for OPmobility shares, ranging significantly from €13.02 to €26.89. Opinions differ widely, especially as some participants continue to cite concerns about weak regional production trends affecting the company’s ability to deliver sustained top-line growth.

Explore 3 other fair value estimates on OPmobility - why the stock might be worth 14% less than the current price!

Build Your Own OPmobility Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OPmobility research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free OPmobility research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OPmobility's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:OPM

OPmobility

Designs and produces intelligent exterior systems, customized complex modules, lighting systems, energy storage systems, and electrification solutions for all mobility players in Europe, North America, China, rest of Asia, South America, the Middle East, and Africa.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives