- France

- /

- Auto Components

- /

- ENXTPA:ML

Compagnie Générale des Établissements Michelin Société en commandite par actions (EPA:ML) Is Increasing Its Dividend To €1.35

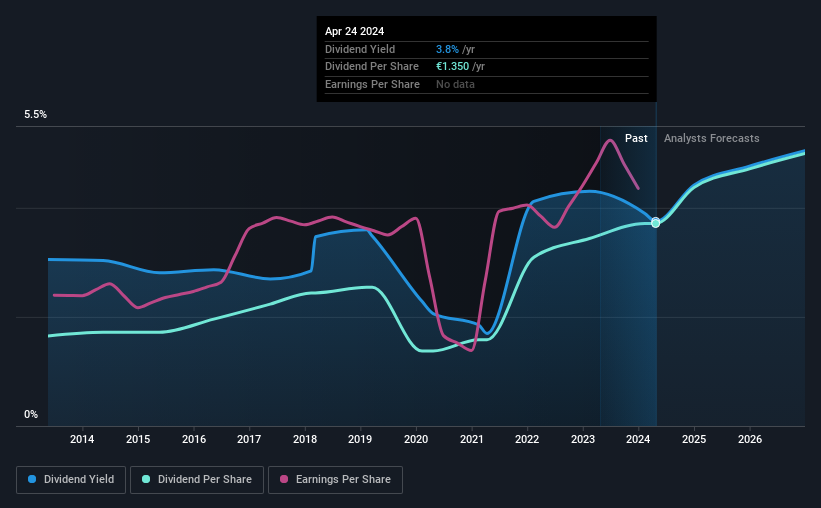

The board of Compagnie Générale des Établissements Michelin Société en commandite par actions (EPA:ML) has announced that it will be paying its dividend of €1.35 on the 24th of May, an increased payment from last year's comparable dividend. Based on this payment, the dividend yield for the company will be 3.8%, which is fairly typical for the industry.

Compagnie Générale des Établissements Michelin Société en commandite par actions' Payment Has Solid Earnings Coverage

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. Prior to this announcement, Compagnie Générale des Établissements Michelin Société en commandite par actions' dividend was comfortably covered by both cash flow and earnings. This indicates that quite a large proportion of earnings is being invested back into the business.

Looking forward, earnings per share is forecast to rise by 38.1% over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 37%, which is in the range that makes us comfortable with the sustainability of the dividend.

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. The annual payment during the last 10 years was €0.60 in 2014, and the most recent fiscal year payment was €1.35. This works out to be a compound annual growth rate (CAGR) of approximately 8.4% a year over that time. It's good to see the dividend growing at a decent rate, but the dividend has been cut at least once in the past. Compagnie Générale des Établissements Michelin Société en commandite par actions might have put its house in order since then, but we remain cautious.

Compagnie Générale des Établissements Michelin Société en commandite par actions May Find It Hard To Grow The Dividend

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Earnings have grown at around 3.6% a year for the past five years, which isn't massive but still better than seeing them shrink. Compagnie Générale des Établissements Michelin Société en commandite par actions is struggling to find viable investments, so it is returning more to shareholders. This isn't necessarily bad, but we wouldn't expect rapid dividend growth in the future.

In Summary

In summary, it's great to see that the company can raise the dividend and keep it in a sustainable range. While the payout ratios are a good sign, we are less enthusiastic about the company's dividend record. The payment isn't stellar, but it could make a decent addition to a dividend portfolio.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 2 warning signs for Compagnie Générale des Établissements Michelin Société en commandite par actions that you should be aware of before investing. Is Compagnie Générale des Établissements Michelin Société en commandite par actions not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ML

Compagnie Générale des Établissements Michelin Société en commandite par actions

Engages in the manufacture and sale of tires worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion