- France

- /

- Auto Components

- /

- ENXTPA:FRVIA

Does Forvia’s Recent 31% Rally Signal a Shift in Market Value for 2025?

Reviewed by Bailey Pemberton

If you're considering adding Forvia to your portfolio, you're not alone. Investors are buzzing about what’s next for the stock. After a challenging stretch in recent years, Forvia has shown clear signs of regaining its footing. Year to date, shares are up a strong 31.1%, and the one-year return stands at 34.3%. Even in the past month alone, the stock has delivered an 8.0% gain, signaling renewed interest and shifting market sentiment around the company’s prospects.

Of course, the story isn’t all smooth. The five-year return still sits deep in negative territory at -65.1%. But for investors focused on recent momentum and changing risk perceptions, the turnaround is hard to ignore. The value conversation is gaining steam as well. On a scale where the value score increases by one for each method suggesting undervaluation, Forvia clocks in at an impressive 5 out of a possible 6, setting it apart from many peers.

So how should you actually assess whether Forvia is truly undervalued? Let’s break down how the most common valuation methods see the story today. Later in this article, we’ll introduce an even more insightful way of looking at Forvia’s value proposition.

Approach 1: Forvia Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model calculates what a company is worth today by forecasting its future cash flows and discounting them back to their present value. This approach gives investors a clearer picture of the business’s long-term potential and removes short-term market noise from the equation.

For Forvia, the latest reported Free Cash Flow stands at €657 million over the last twelve months. Analyst projections see this figure growing steadily, with Free Cash Flow expected to reach €885 million by the end of 2027. Beyond these analyst estimates, forecasts are extrapolated further, with ten-year projections suggesting Free Cash Flow could reach approximately €1.27 billion by 2035. All figures are reported in euro (€).

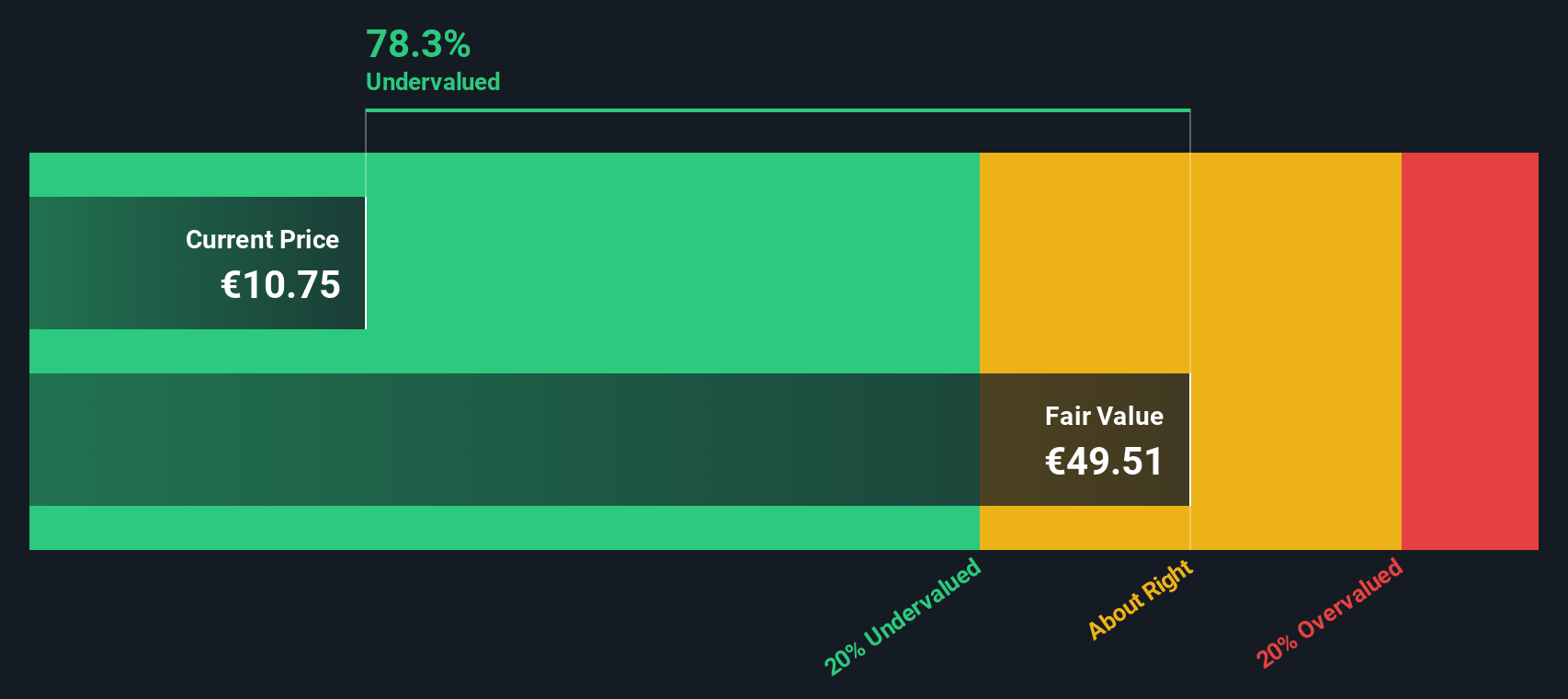

Using a two-stage Free Cash Flow to Equity model, Forvia's intrinsic value per share works out to €49.51. Considering the current market price and this estimate, the DCF model implies Forvia trades at a substantial 76.7% discount to its true value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Forvia is undervalued by 76.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Forvia Price vs Sales (P/S)

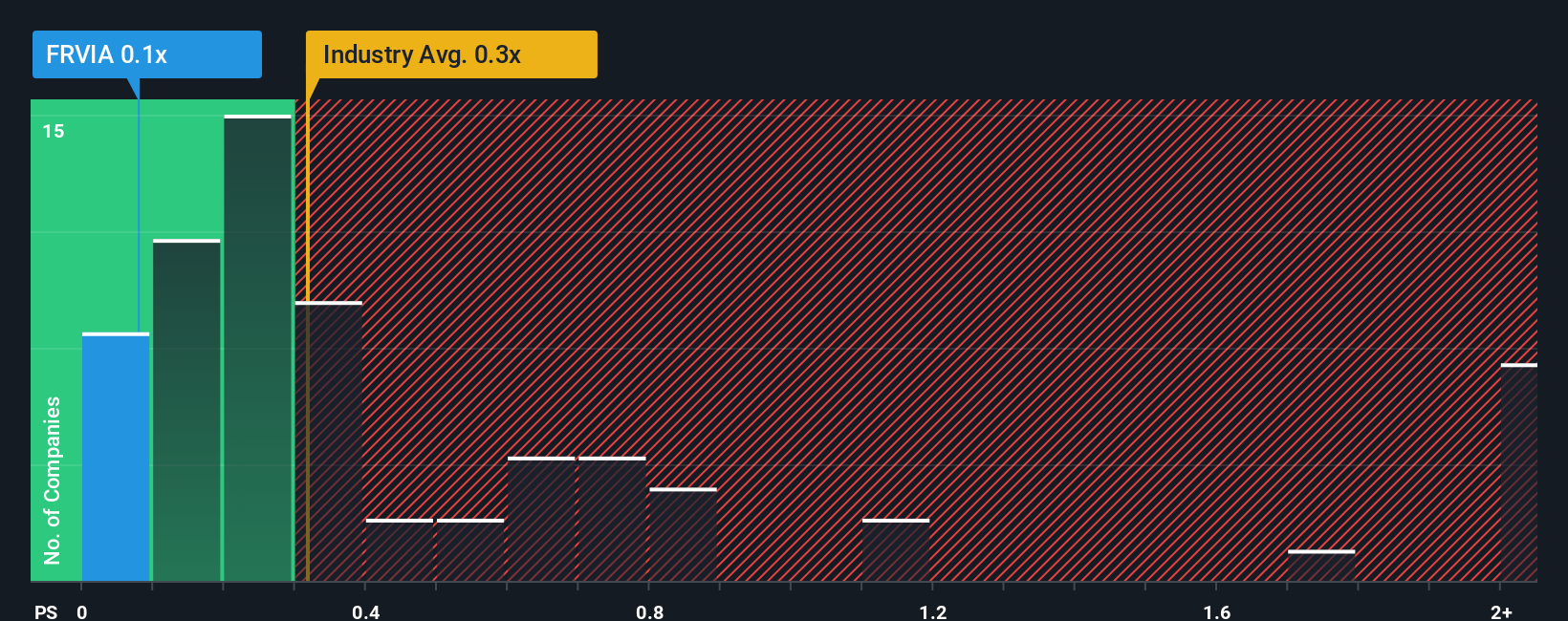

The Price-to-Sales (P/S) ratio is a practical valuation tool for companies like Forvia, especially when earnings can be volatile or affected by non-cash items. This metric evaluates a company based on its sales rather than profits, making it a more stable and transparent measure for capital-intensive sectors such as auto components.

Growth prospects and risk profile play a significant role in determining what counts as a “normal” or “fair” P/S ratio. Companies with higher expected growth or lower risk typically command a higher multiple, while those facing uncertainties tend to trade at a discount. Forvia currently trades at a P/S ratio of 0.08x, which is well below both its industry average of 0.91x and the peer group average of 0.16x.

To offer a deeper perspective, Simply Wall St’s proprietary Fair Ratio for Forvia is 0.18x. In contrast to a simple comparison with industry averages or peers, the Fair Ratio incorporates unique factors like Forvia’s growth outlook, profit margins, risk factors, industry dynamics, and market cap. This makes it a more nuanced benchmark for what the company “should” trade at right now.

Comparing the current P/S multiple of 0.08x to the Fair Ratio of 0.18x suggests Forvia is trading at a substantial discount. The stock appears undervalued by this measure.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Forvia Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a smarter, more dynamic approach to investing that allow you to craft the story you believe about a company like Forvia, tying your perspective and expectations directly to fair value estimates and future growth forecasts. Instead of just crunching numbers, a Narrative links your view of Forvia's strategy, market, and risks to a clear financial outlook. This approach bridges the gap between what’s happening in the business and what that should mean for the share price.

Using Simply Wall St’s Community page, investors, and millions already do, can easily create and update Narratives. This allows them to turn their insights into actionable fair value estimates that respond automatically when new news or earnings emerge. With Narratives, it is simple to compare your assumed fair value with the actual market price, guiding your decisions on when to buy or sell.

For example, different investors looking at Forvia might come to very different conclusions. Some see bold expansion into emerging EV markets and set a fair value as high as €39.0, while others are more cautious about transformation risks and assign a fair value as low as €8.5. By creating and comparing Narratives, you can see these perspectives side by side and decide for yourself which story you believe in most.

Do you think there's more to the story for Forvia? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:FRVIA

Forvia

Manufactures and sells automotive technology solutions in France, Germany, other European countries, the Americas, Asia, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.