- Finland

- /

- Communications

- /

- HLSE:NOKIA

Nokia (HLSE:NOKIA): Evaluating Valuation After Recent Share Price Gains

Reviewed by Simply Wall St

Nokia Oyj (HLSE:NOKIA) shares have drawn renewed interest in recent trading, following steady gains over the past month. The stock’s performance has caught the eye of investors who are comparing its movement to broader tech peers.

See our latest analysis for Nokia Oyj.

Nokia Oyj has been building momentum, with a robust 30-day share price return of 20.78% and a 12.06% gain year-to-date. While short-term swings have fueled fresh optimism, it is the steady 13.78% total shareholder return over the past year and 51.21% over five years that stand out for investors eyeing both immediate and longer-term potential.

If you are curious about what else is taking off in the sector, keep your edge sharp by exploring the latest movers in tech and AI. See the full list for free.

The recent surge prompts a critical question: Is Nokia still trading at a discount, or have investors already priced in all of its growth prospects, making the current rally less of a bargain than it appears?

Most Popular Narrative: 7.8% Overvalued

With Nokia Oyj recently closing at €4.84 and the fair value pegged at €4.49, the prevailing narrative suggests the stock may be trading above its justified worth. This sets the tone for deeper scrutiny of what is driving analyst expectations.

Investments in innovation (such as cybersecurity, AI network solutions, and next-gen optical technology) plus expanding monetization of IP and patents should increase Nokia's high-margin revenue streams, supporting overall earnings growth.

Curious what bold assumptions power this valuation? Only by uncovering the projected margin expansion and future revenue leaps can you see how these analysts arrive at their number. Are the embedded growth bets too optimistic, or is the market missing a hidden driver? Find out the key financial leaps in the full narrative.

Result: Fair Value of €4.49 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent currency headwinds and challenging competition in mobile networks remain key risks that could undermine the momentum supporting Nokia’s bullish narrative.

Find out about the key risks to this Nokia Oyj narrative.

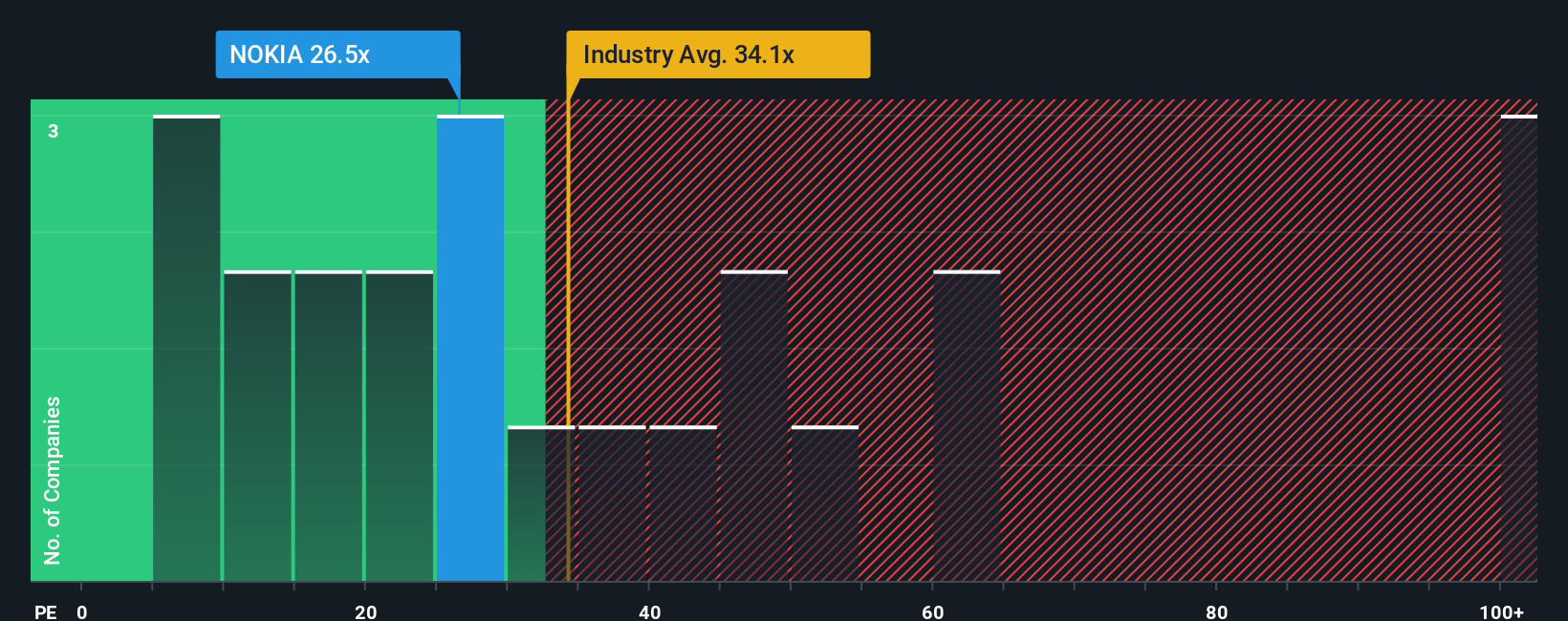

Another View: Multiples Analysis

Looking through the lens of earnings multiples, Nokia’s share price trades at 28.9 times earnings, well below the European industry average of 38.2x and peer average of 69.9x. However, it sits just above its fair ratio of 28.3x, hinting at limited further upside unless profit growth exceeds expectations. So, does this create an opportunity, or does it signal investors should tread carefully?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nokia Oyj Narrative

If you see the numbers differently or would rather dig into the facts on your own terms, crafting a unique perspective takes just a few minutes. So why not Do it your way?

A great starting point for your Nokia Oyj research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let tomorrow’s biggest opportunities slip by. Stay a step ahead by checking out fresh investment ideas tailored to bold, forward-thinking investors:

- Catch up on high-yield opportunities and boost your portfolio with steady income by checking out these 17 dividend stocks with yields > 3%.

- Pinpoint undervalued gems ready for a breakout. Start your research with these 878 undervalued stocks based on cash flows and uncover potential bargains the market may have missed.

- Accelerate your exposure to groundbreaking technology by exploring these 24 AI penny stocks and stay at the forefront of artificial intelligence trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nokia Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:NOKIA

Nokia Oyj

Provides mobile, fixed, and cloud network solutions in North and Latin America, Greater China, India, rest of the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives