- Finland

- /

- Communications

- /

- HLSE:NOKIA

Is Nokia Stock Set for Growth After Recent 6.8% Rally in 2025?

Reviewed by Bailey Pemberton

Wondering whether to buy, sell, or just watch Nokia Oyj? You are definitely not alone; this stock is popping up on radars again after a few interesting shifts. Over the past month, Nokia shares have climbed 6.8%, showing some upward momentum that might surprise investors who remember a slower start to the year. Even with a dip of 4.0% year-to-date, the one-year return is a solid 7.9%. Looking at a five-year period, there is a gain of 34.1%. This kind of long-term performance suggests a company that knows how to maneuver through ups and downs, and it has certainly benefited from strengthening demand for network infrastructure worldwide.

Lately, more analysts are taking note of how the telecom giant could capture growth as digitalization demands escalate, especially across Europe and North America. Recent market optimism, in part tied to strategic partnerships and ongoing shifts in the competitive landscape, seems to be pushing risk perceptions lower and growth bets higher for Nokia.

As for valuation, Nokia clocks in at a value score of 3 out of 6; undervalued in half of the checks commonly used by analysts. That score is right in the middle, suggesting some intriguing potential but also signaling that there is more beneath the surface to explore.

Let us dive into the most important valuation methods, from price ratios to asset values, and see why each view matters. By the end, you will also discover an even sharper way to size up Nokia’s true worth.

Why Nokia Oyj is lagging behind its peers

Approach 1: Nokia Oyj Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by projecting a company’s expected future free cash flows and then discounting those cash flows back to their present value. This method aims to estimate what Nokia Oyj is truly worth today based on its potential to generate cash in the coming years.

For Nokia Oyj, the latest reported Free Cash Flow stands at €1.51 Billion. Analyst forecasts drive cash flow projections for the next several years. Beyond that horizon, figures are extrapolated based on current trends. By 2029, Nokia’s free cash flow is projected to be €1.40 Billion, with subsequent years growing steadily according to model assumptions.

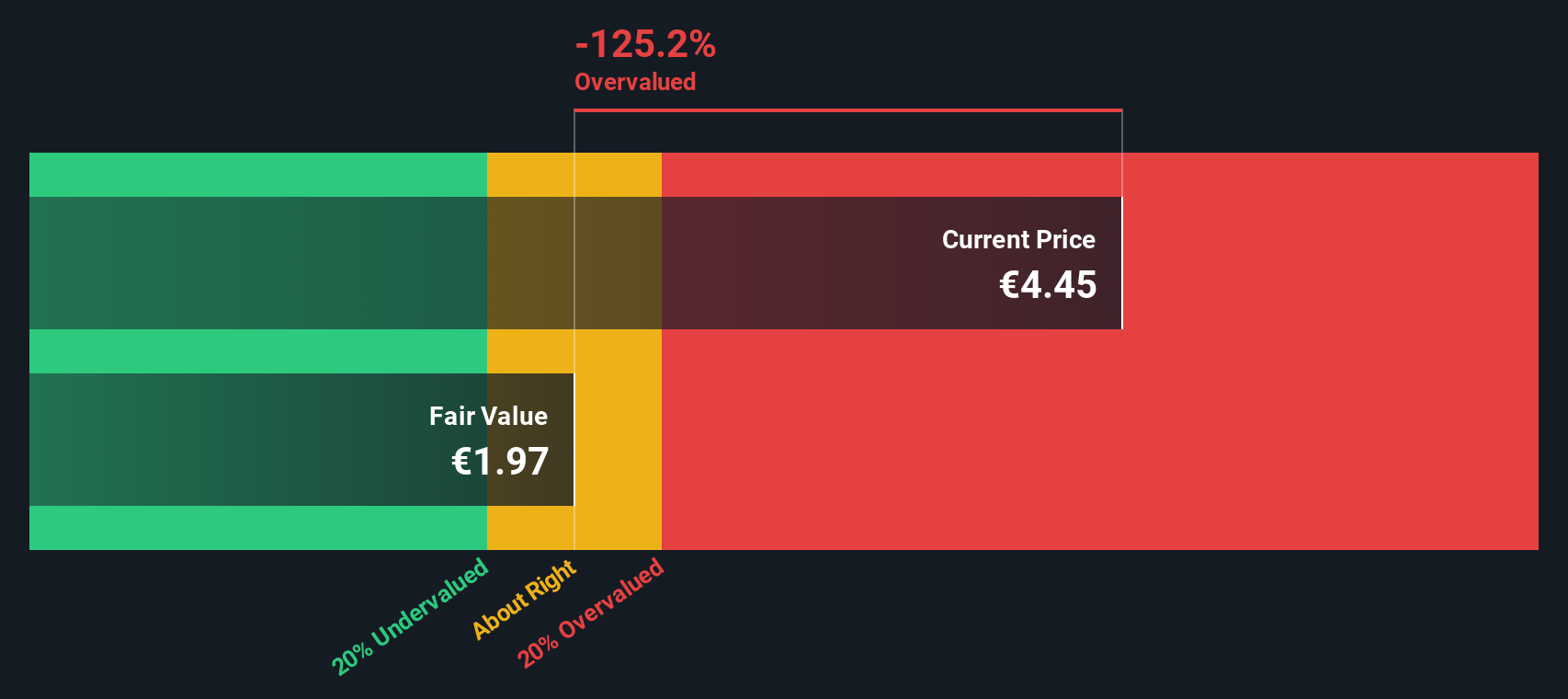

Applying the 2 Stage Free Cash Flow to Equity model, the DCF analysis arrives at an intrinsic value of €3.73 per share. Compared to the current trading price, this puts the stock at an 11.3% premium. This means it is overvalued based on these projections.

If you are considering an entry point, this analysis suggests caution. The share price may already reflect more optimism than the company’s cash flows can currently justify.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Nokia Oyj may be overvalued by 11.3%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Nokia Oyj Price vs Earnings (P/E)

When it comes to valuing profitable companies like Nokia Oyj, the Price-to-Earnings (P/E) ratio is often the preferred yardstick. The P/E ratio measures how much investors are willing to pay today for a euro of future earnings, making it a key tool for comparing companies that are generating steady profits.

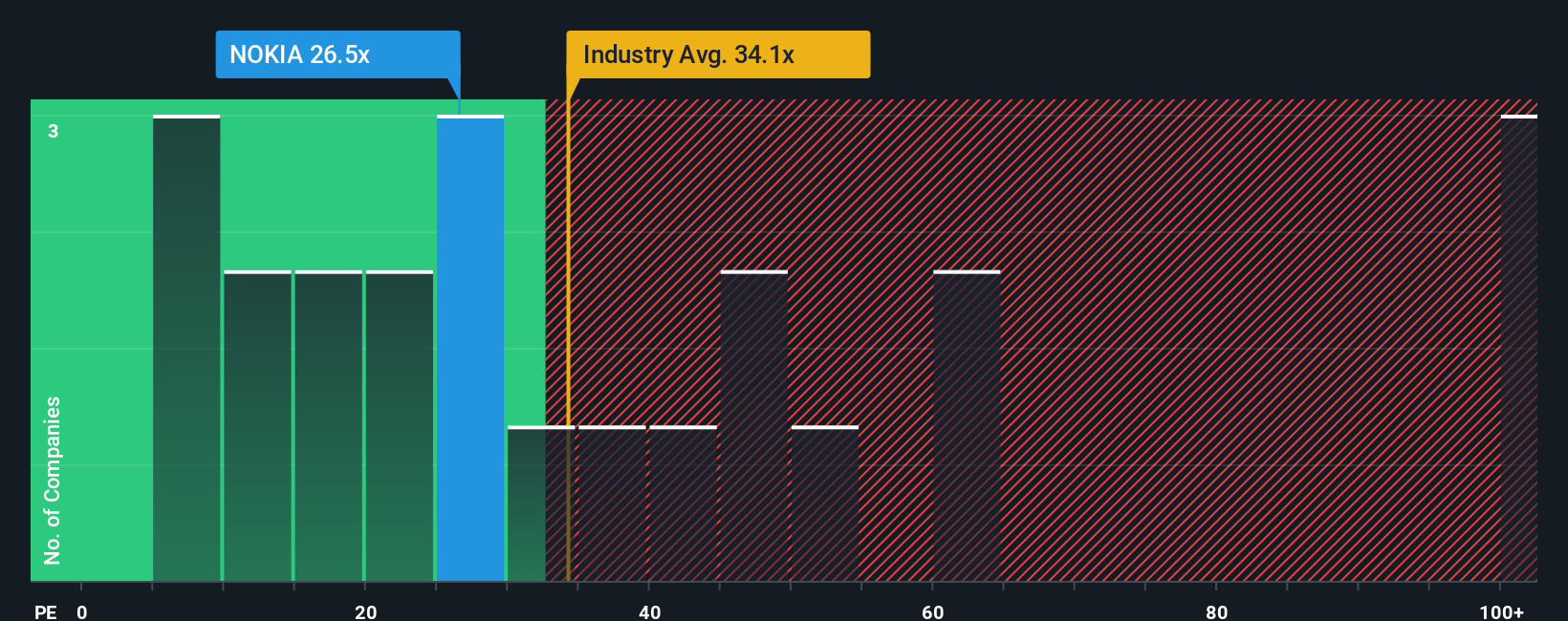

Not all P/E ratios are created equal. Companies growing faster or facing less risk generally command higher “normal” P/E multiples, while slower or riskier firms trade at lower ones. Nokia’s current P/E sits at 25x. For context, the communications industry average P/E is 36x, while its peers trade even higher at 56x. That positions Nokia as notably cheaper than many of its competitors on a headline basis.

However, industry averages and peer group comparisons do not tell the whole story. To address this, Simply Wall St uses a proprietary “Fair Ratio” which considers Nokia’s expected earnings growth, profit margins, market cap, risk profile, and industry dynamics. This nuanced approach goes beyond superficial comparisons and provides a more tailored and meaningful benchmark specific to Nokia’s situation. For Nokia, the Fair Ratio is calculated as 30x, which is slightly higher than its current P/E.

With a P/E of 25x compared to a Fair Ratio of 30x, Nokia appears attractively valued. The difference is meaningful and suggests the market is not fully pricing in the company’s strengths relative to its sector and prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Nokia Oyj Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a far more powerful and dynamic tool available on Simply Wall St’s Community page. A Narrative is simply your story about the company: you combine your own view of Nokia’s business prospects by setting your fair value and making your own forecasts for future revenue, earnings, or margins. This means the numbers are based on your expectations, not just market averages.

This approach ties together the company’s story, focusing on what you believe will actually drive Nokia’s future, with logical financial forecasts and a calculated fair value, all in one place. Narratives empower investors to see how their perspective compares to the current share price, helping you decide whether Nokia is a buy, sell, or hold right now. Every time new news or earnings are released, Narratives automatically update, giving you a real-time edge over traditional valuation tools.

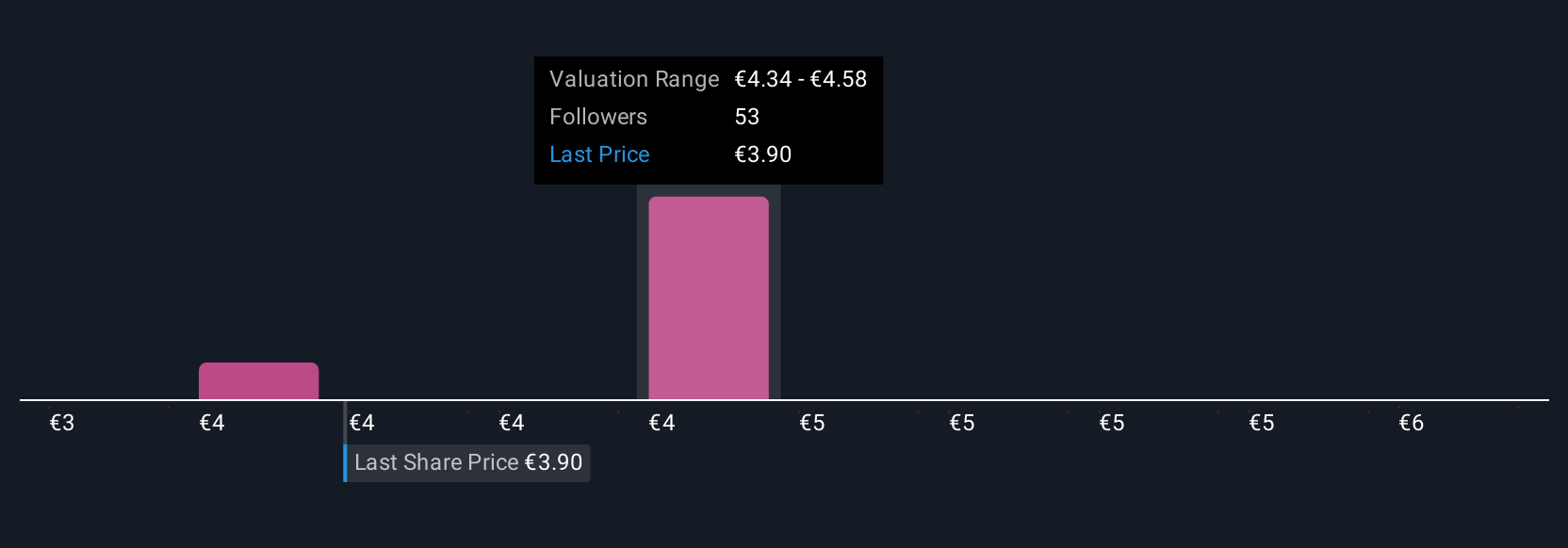

For example, one investor’s Narrative on Nokia might be highly optimistic, based on robust demand from hyperscalers and new broadband rollouts, setting a high fair value of €5.75 per share. Another might see risks from intense competition and set their fair value at just €3.00. This demonstrates how Narratives let you invest according to your own beliefs and evidence, all clearly tracked and updated dynamically.

Do you think there's more to the story for Nokia Oyj? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nokia Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:NOKIA

Nokia Oyj

Provides mobile, fixed, and cloud network solutions in North and Latin America, Greater China, India, rest of the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives