- Finland

- /

- Communications

- /

- HLSE:NOKIA

Is Nokia Still Attractive After a 34% Rally Despite DCF and PE Concerns?

Reviewed by Bailey Pemberton

- If you are wondering whether Nokia Oyj is still a bargain or if most of the easy gains are already behind it, this breakdown will walk you through what the current price really implies.

- The stock has climbed 33.7% over the last year and 22.9% year to date, despite a recent pullback of 10.8% over the past month and a modest 1.1% gain in the last week. This pattern often reflects investors recalibrating their expectations rather than abandoning the story.

- Recently, the market has been reacting to Nokia's progress in network infrastructure, 5G rollouts and strategic contracts with major carriers, which has helped reshape perceptions of its long term growth profile. At the same time, ongoing restructuring efforts and shifting telecom spending have kept sentiment mixed, creating a tug of war between optimism about future cash flows and caution about execution risk.

- On our checklist of 6 valuation tests, Nokia scores just 1 out of 6 for being undervalued. This might sound underwhelming at first, but different methods, from multiples to cash flow models, can tell very different stories. There is also an even more insightful way to judge valuation that we will get to by the end of this article.

Nokia Oyj scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Nokia Oyj Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it can generate in the future and then discounting those cash flows back to a present value.

For Nokia Oyj, the latest twelve month Free Cash Flow is about €1.33 billion. Analysts expect cash flows to remain robust over the next few years, with projections peaking at roughly €2.24 billion in 2027. These then gradually taper off as the model extrapolates further into the future using Simply Wall St assumptions. By 2035, projected Free Cash Flow is a more modest €0.43 billion, reflecting slower long term growth as the business matures.

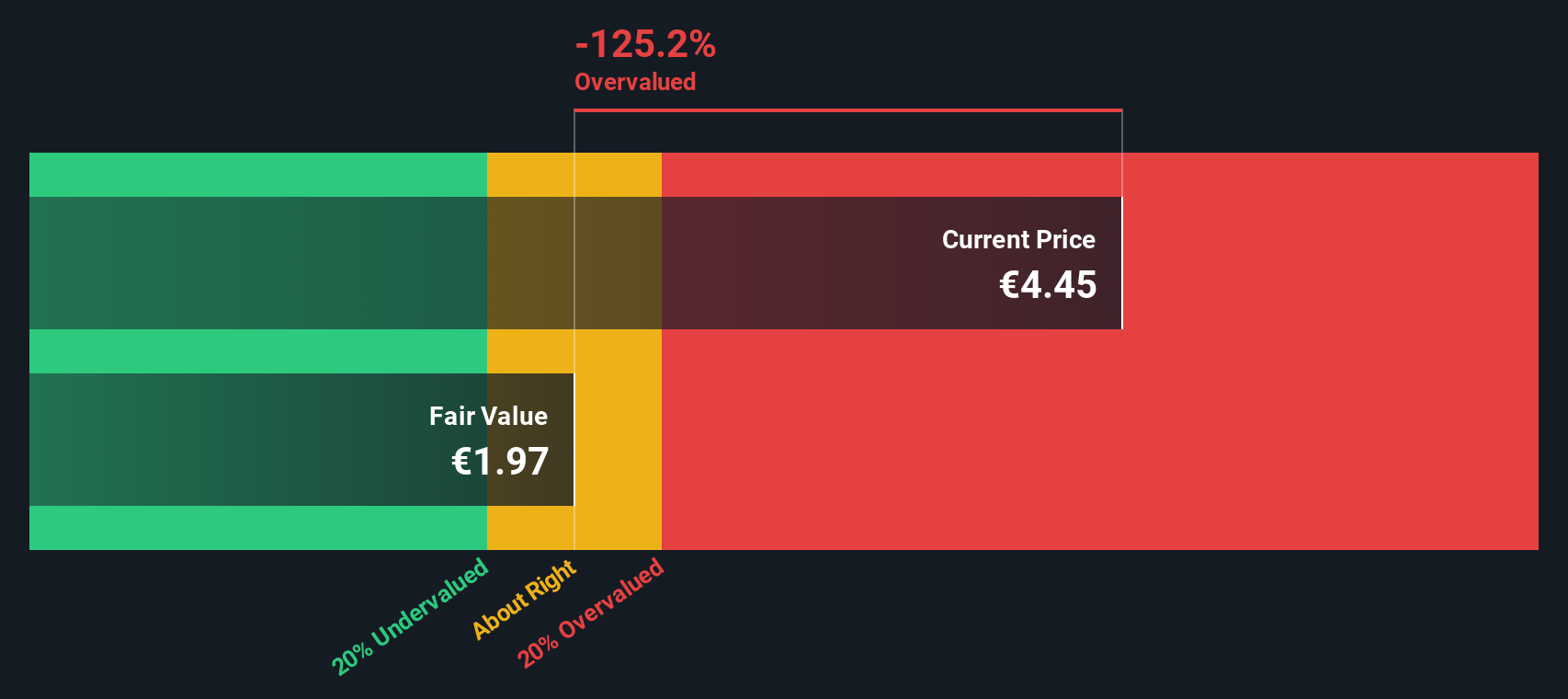

When all of these future cash flows are discounted back using a 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value comes out at about €1.99 per share. Compared with the current share price, this implies the stock is roughly 166.2% overvalued on a DCF basis.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Nokia Oyj may be overvalued by 166.2%. Discover 912 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Nokia Oyj Price vs Earnings

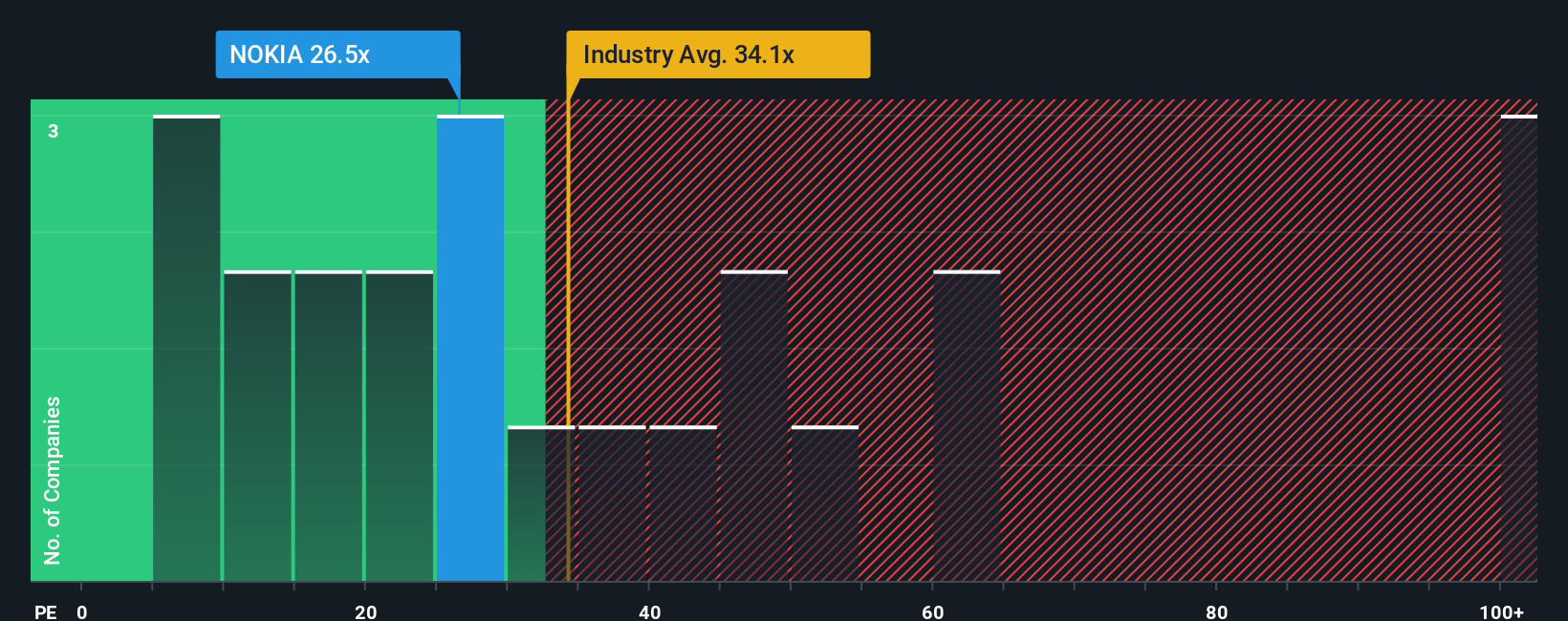

For a profitable business like Nokia, the price to earnings, or PE, ratio is a useful way to gauge how much investors are willing to pay today for each euro of current earnings. In general, companies with stronger growth prospects and lower perceived risk can justify a higher PE, while slower growing or riskier firms tend to trade on lower multiples.

Nokia currently trades on a PE of about 35.0x, which is slightly above the broader Communications industry average of around 34.6x and higher than the peer group average near 30.0x. Taken at face value, that suggests the market is paying a modest premium for Nokia relative to similar stocks.

Simply Wall St also calculates a Fair Ratio of 33.5x, a proprietary estimate of what Nokia’s PE should be once you factor in its earnings growth outlook, profitability, size, industry and company specific risks. This makes it more informative than a simple comparison with peers or the industry, which can overlook important differences in quality and risk profile. With Nokia’s actual PE sitting only slightly above this Fair Ratio, the shares look somewhat expensive on an earnings basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Nokia Oyj Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a simple way to attach your own story about Nokia Oyj to the numbers such as fair value, and your expectations for future revenue, earnings and margins, so that your view is not just a collection of ratios but a joined up picture of where the business is heading and what that should be worth today.

A Narrative on Simply Wall St links three things together: the company story you believe, the financial forecast that follows from that story, and the resulting fair value estimate. This makes it easier to see whether your assumptions really justify buying, holding or selling at the current price.

These Narratives are easy to create and explore on the Simply Wall St Community page, where millions of investors share and refine their views. The fair values inside them are continuously updated as new information such as earnings reports, news or guidance revisions comes in.

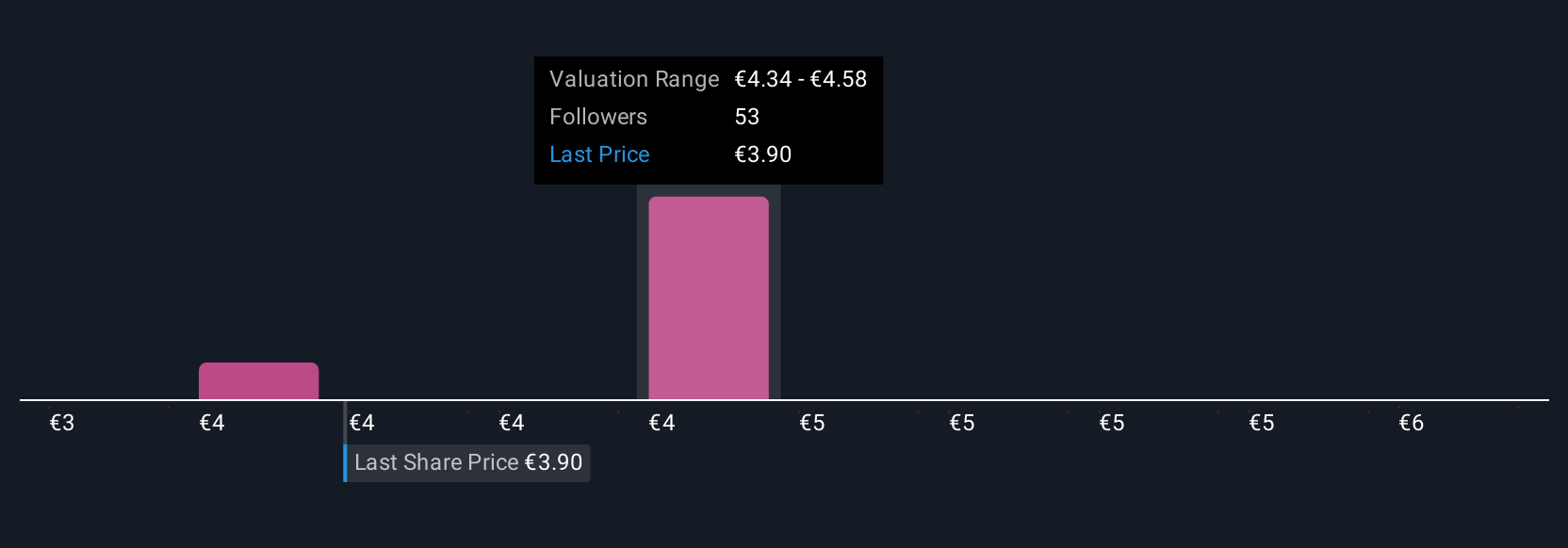

For Nokia Oyj, for example, one investor might build a bullish Narrative around strong network demand, rising margins and a fair value closer to €5.75. Another might focus on competitive and execution risks, slower growth and a fair value nearer €3.00. By comparing each Narrative’s fair value with today’s share price, you can quickly decide which story you find more convincing and how you want to position your own portfolio.

Do you think there's more to the story for Nokia Oyj? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nokia Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:NOKIA

Nokia Oyj

Provides mobile, fixed, and cloud network solutions in North and Latin America, Greater China, India, rest of the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026