- Finland

- /

- Electronic Equipment and Components

- /

- HLSE:ICP1V

The total return for Incap Oyj (HEL:ICP1V) investors has risen faster than earnings growth over the last five years

The Incap Oyj (HEL:ICP1V) share price has had a bad week, falling 10%. But in stark contrast, the returns over the last half decade have impressed. It's fair to say most would be happy with 283% the gain in that time. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. Of course, that doesn't necessarily mean it's cheap now.

Since the long term performance has been good but there's been a recent pullback of 10%, let's check if the fundamentals match the share price.

Check out our latest analysis for Incap Oyj

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

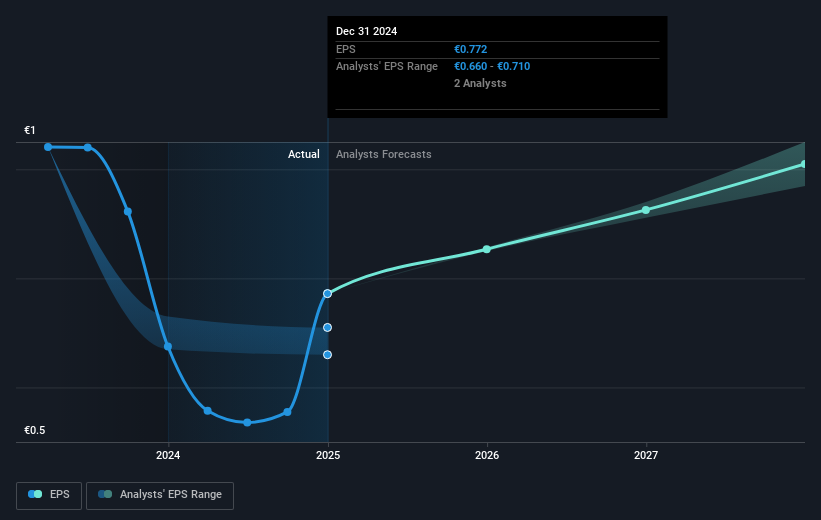

During five years of share price growth, Incap Oyj achieved compound earnings per share (EPS) growth of 22% per year. This EPS growth is slower than the share price growth of 31% per year, over the same period. So it's fair to assume the market has a higher opinion of the business than it did five years ago. That's not necessarily surprising considering the five-year track record of earnings growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Incap Oyj has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Incap Oyj will grow revenue in the future.

A Dividend Lost

The value of past dividends are accounted for in the total shareholder return (TSR), but not in the share price return mentioned above. Many would argue the TSR gives a more complete picture of the value a stock brings to its holders. Over the last 5 years, Incap Oyj generated a TSR of 347%, which is, of course, better than the share price return. Although the company had to cut dividends, it has paid cash to shareholders in the past.

A Different Perspective

It's good to see that Incap Oyj has rewarded shareholders with a total shareholder return of 17% in the last twelve months. However, the TSR over five years, coming in at 35% per year, is even more impressive. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Finnish exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:ICP1V

Incap Oyj

Provides electronics manufacturing services in Europe, North America, and Asia.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives