- Finland

- /

- Electronic Equipment and Components

- /

- HLSE:ICP1V

Most Shareholders Will Probably Find That The CEO Compensation For Incap Oyj (HEL:ICP1V) Is Reasonable

Key Insights

- Incap Oyj to hold its Annual General Meeting on 10th of May

- Total pay for CEO Otto Pukk includes €264.0k salary

- The overall pay is comparable to the industry average

- Incap Oyj's EPS grew by 19% over the past three years while total shareholder return over the past three years was 24%

Under the guidance of CEO Otto Pukk, Incap Oyj (HEL:ICP1V) has performed reasonably well recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 10th of May. Here is our take on why we think the CEO compensation looks appropriate.

See our latest analysis for Incap Oyj

Comparing Incap Oyj's CEO Compensation With The Industry

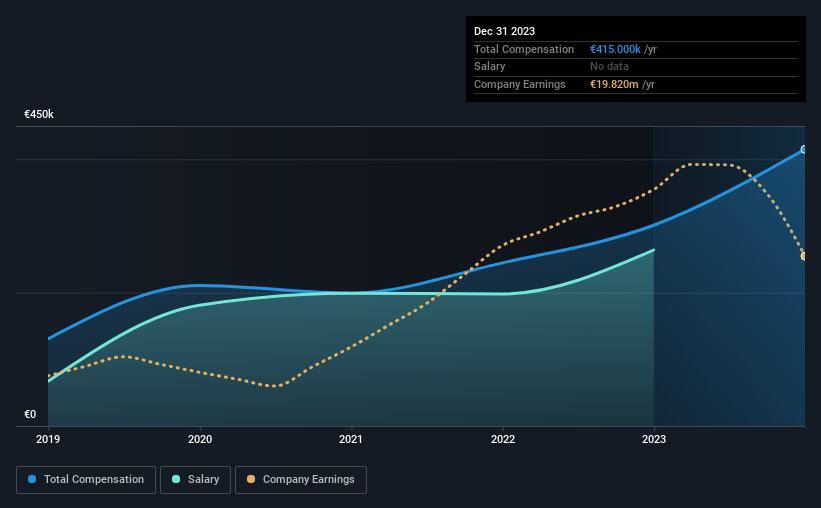

Our data indicates that Incap Oyj has a market capitalization of €272m, and total annual CEO compensation was reported as €415k for the year to December 2023. Notably, that's an increase of 38% over the year before. In particular, the salary of €264.0k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the Finnish Electronic industry with market capitalizations ranging between €93m and €372m had a median total CEO compensation of €522k. From this we gather that Otto Pukk is paid around the median for CEOs in the industry. What's more, Otto Pukk holds €370k worth of shares in the company in their own name.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | €264k | €198k | 64% |

| Other | €151k | €103k | 36% |

| Total Compensation | €415k | €301k | 100% |

On an industry level, roughly 64% of total compensation represents salary and 36% is other remuneration. Although there is a difference in how total compensation is set, Incap Oyj more or less reflects the market in terms of setting the salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Incap Oyj's Growth Numbers

Incap Oyj has seen its earnings per share (EPS) increase by 19% a year over the past three years. Its revenue is down 16% over the previous year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. While it would be good to see revenue growth, profits matter more in the end. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Incap Oyj Been A Good Investment?

Incap Oyj has served shareholders reasonably well, with a total return of 24% over three years. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

Shareholders may want to check for free if Incap Oyj insiders are buying or selling shares.

Important note: Incap Oyj is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:ICP1V

Incap Oyj

Provides electronics manufacturing services in Europe, North America, and Asia.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion