- Finland

- /

- Electronic Equipment and Components

- /

- HLSE:ICP1V

Exploring Three Undiscovered European Gems For Your Investment Portfolio

Reviewed by Simply Wall St

As the European market navigates a landscape of mixed returns with the pan-European STOXX Europe 600 Index remaining relatively flat, investors are keeping a watchful eye on economic indicators such as inflation and labor market stability. In this environment, identifying stocks that demonstrate resilience and potential for growth amidst these conditions can be crucial for enhancing an investment portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 5.39% | 5.24% | ★★★★★★ |

| Flügger group | 30.11% | 1.55% | -30.01% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Koninklijke Heijmans (ENXTAM:HEIJM)

Simply Wall St Value Rating: ★★★★★★

Overview: Koninklijke Heijmans N.V. operates in the real estate, construction, and infrastructure sectors both within the Netherlands and internationally, with a market capitalization of approximately €1.49 billion.

Operations: The company generates revenue primarily from its Living (€994.30 million), Connect (€996.60 million), and Work (€634.60 million) segments.

Heijmans, a notable player in the construction sector, has seen its earnings skyrocket by 50.8% over the past year, outpacing industry growth of 5.2%. With a debt-to-equity ratio falling from 29.9% to 1.9% over five years and interest payments well-covered at 17.8 times EBIT, financial stability is evident. The company trades at an attractive valuation, about 51% below fair value estimates, suggesting potential upside for investors who can handle volatility as its share price has been highly volatile recently. Heijmans’ strategic focus on energy transition projects and sustainability initiatives positions it well for future growth opportunities in evolving markets.

Incap Oyj (HLSE:ICP1V)

Simply Wall St Value Rating: ★★★★★★

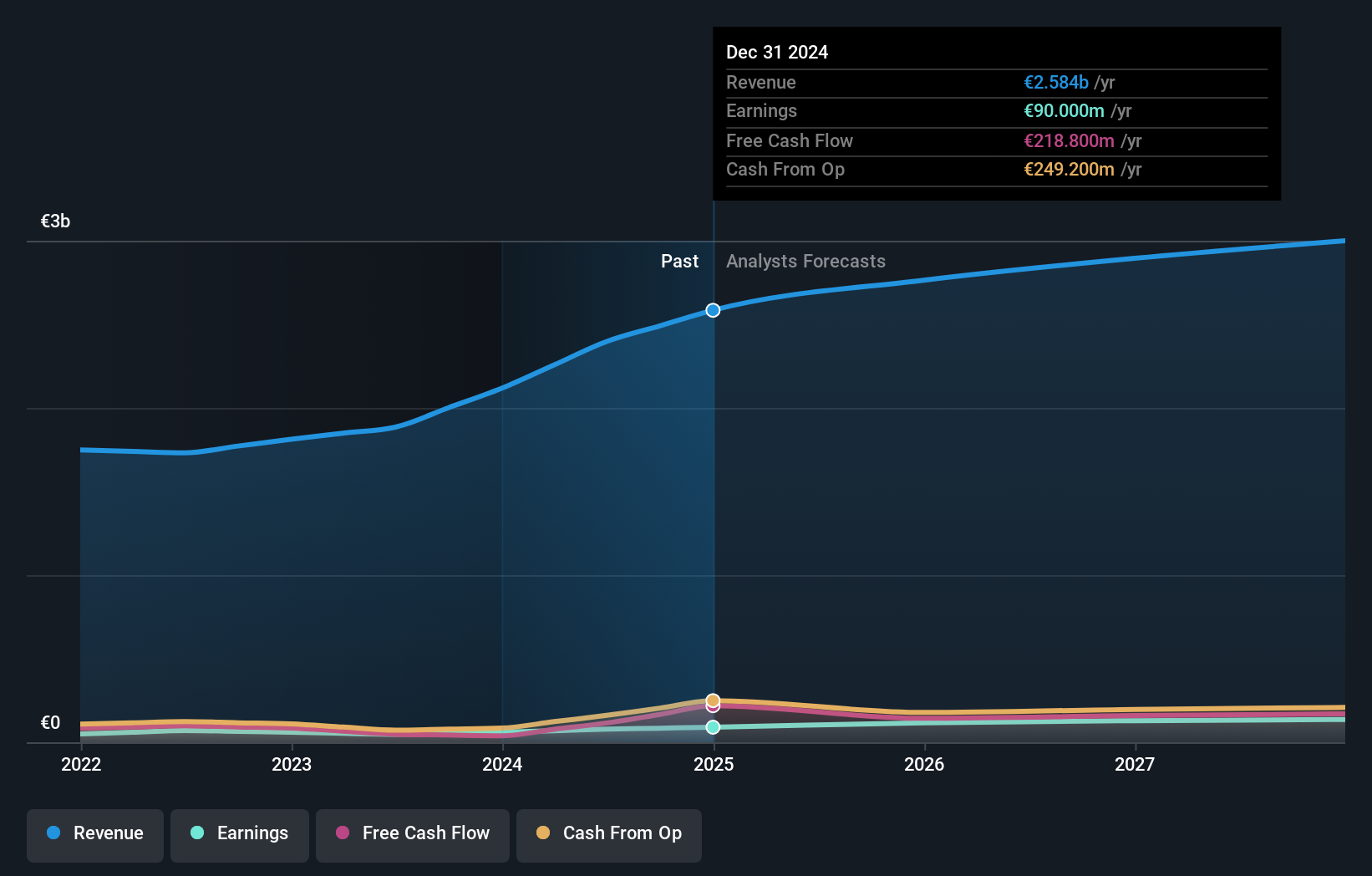

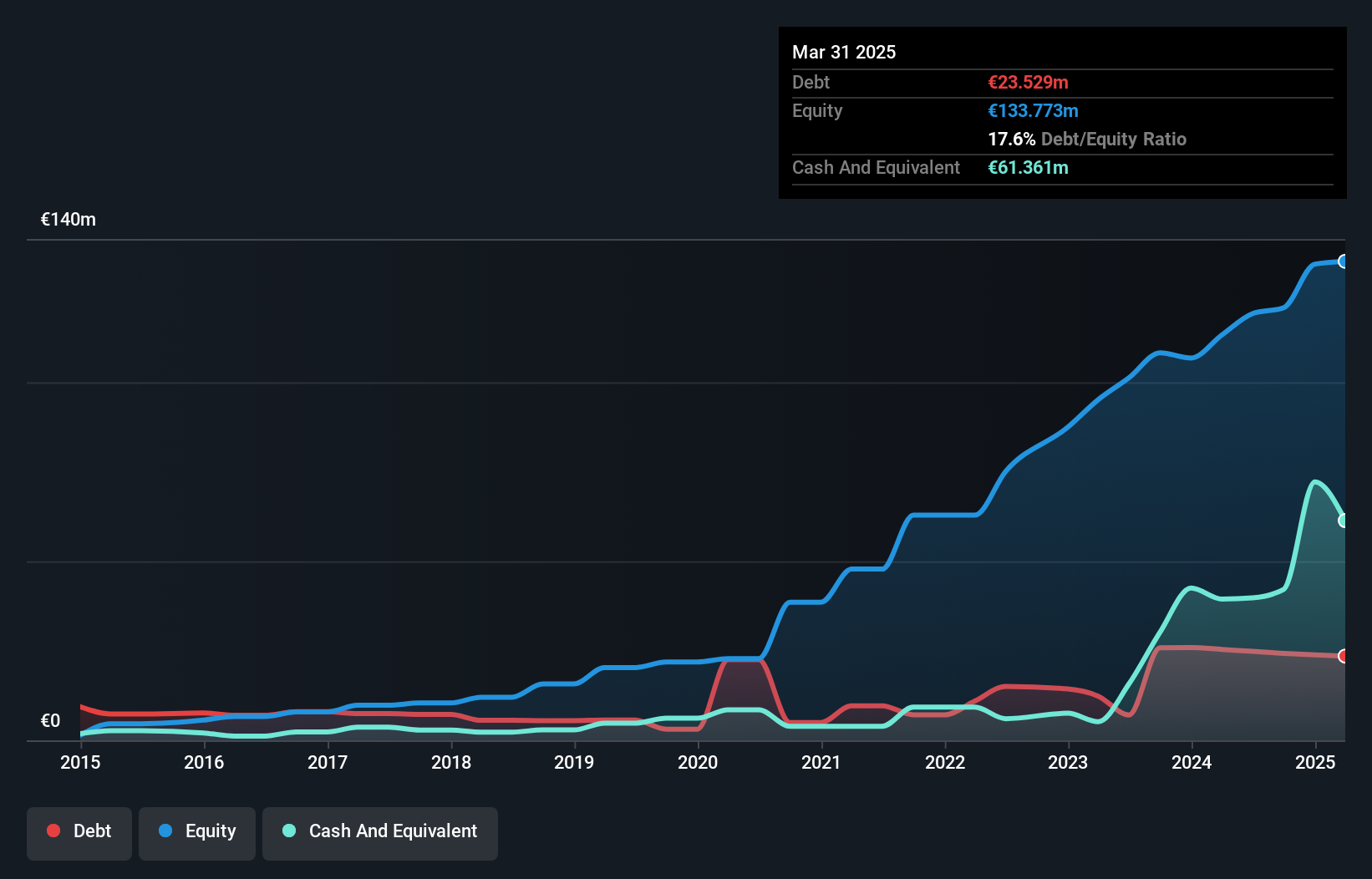

Overview: Incap Oyj, along with its subsidiaries, offers electronics manufacturing services across Europe, North America, and Asia with a market capitalization of €349.13 million.

Operations: Incap Oyj generates revenue primarily from its Electronics Manufacturing Services, amounting to €232.02 million. The company's market capitalization is €349.13 million, reflecting its financial stature in the industry.

Incap Oyj, a nimble player in the electronics manufacturing services sector, has been making strategic moves to bolster its global footprint. Recent investments of approximately €1.9 million in the UK and $2 million in the US for advanced SMT production lines highlight its commitment to efficiency and capacity expansion. Despite a dip in Q1 2025 net income to €3.78 million from €4.95 million last year, Incap's debt-to-equity ratio impressively dropped from 98.6% to 17.6% over five years, showcasing financial prudence. With earnings growth outpacing industry averages at 31.5%, Incap appears well-positioned for future growth amid potential geopolitical headwinds.

Idun Industrier (OM:IDUN B)

Simply Wall St Value Rating: ★★★★☆☆

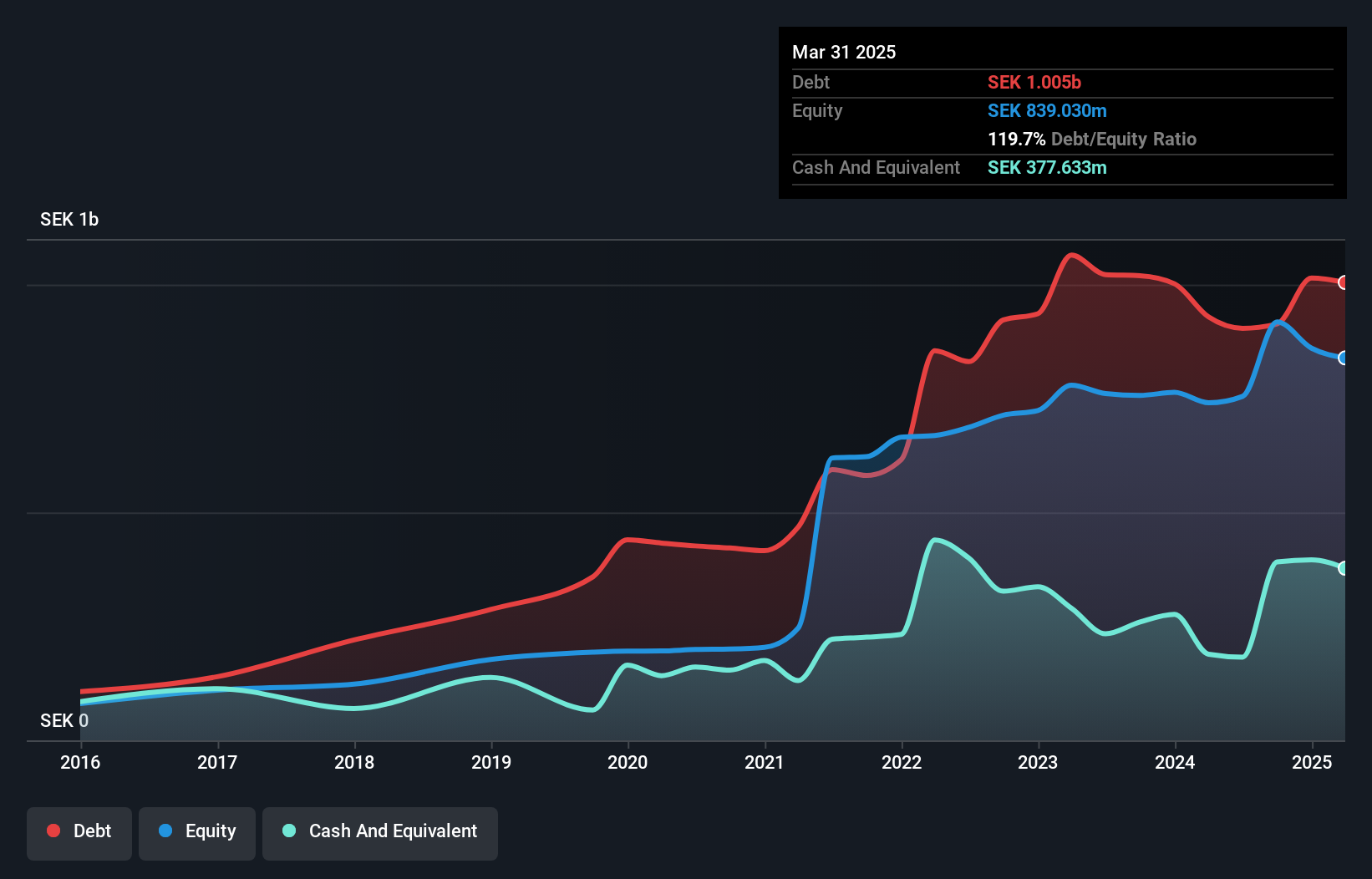

Overview: Idun Industrier AB (publ) is an investment holding company that focuses on the manufacture and sale of glass fiber reinforced fat- and oil separators in Sweden, with a market capitalization of approximately SEK4.20 billion.

Operations: Idun's revenue primarily comes from its Manufacturing segment, contributing SEK1.35 billion, followed by Service & Maintenance at SEK863.34 million.

Idun Industrier, a promising player in the European market, has shown notable financial resilience. Their net income for Q1 2025 jumped to SEK 10.65 million from SEK 3.47 million the previous year, highlighting strong earnings growth of 25.6%, outpacing the Industrials industry average of -0.4%. Despite trading at a value 10% below its estimated fair value, Idun's high net debt to equity ratio of 74.7% and insufficient EBIT coverage for interest payments (2.8x) suggest financial leverage concerns remain significant. However, with positive free cash flow and no immediate cash runway worries, the company seems poised for potential growth ahead.

- Click here to discover the nuances of Idun Industrier with our detailed analytical health report.

Evaluate Idun Industrier's historical performance by accessing our past performance report.

Summing It All Up

- Navigate through the entire inventory of 325 European Undiscovered Gems With Strong Fundamentals here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:ICP1V

Incap Oyj

Provides electronics manufacturing services in Europe, North America, and Asia.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)