WithSecure Oyj (HEL:WITH) Not Doing Enough For Some Investors As Its Shares Slump 26%

WithSecure Oyj (HEL:WITH) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 14% in that time.

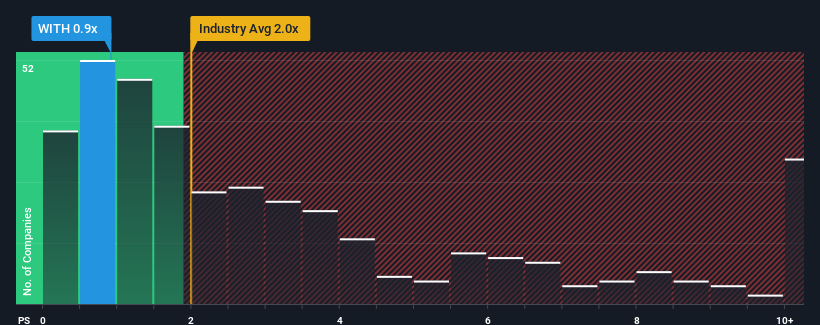

After such a large drop in price, considering around half the companies operating in Finland's Software industry have price-to-sales ratios (or "P/S") above 1.7x, you may consider WithSecure Oyj as an solid investment opportunity with its 0.9x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for WithSecure Oyj

How WithSecure Oyj Has Been Performing

Recent times haven't been great for WithSecure Oyj as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think WithSecure Oyj's future stacks up against the industry? In that case, our free report is a great place to start.How Is WithSecure Oyj's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like WithSecure Oyj's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 4.2%. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 4.0% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 4.9% per year as estimated by the five analysts watching the company. With the industry predicted to deliver 15% growth each year, the company is positioned for a weaker revenue result.

With this information, we can see why WithSecure Oyj is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

WithSecure Oyj's P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of WithSecure Oyj's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for WithSecure Oyj with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on WithSecure Oyj, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if WithSecure Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:WITH

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026