TietoEVRY Oyj's (HEL:TIETO) Prospects Need A Boost To Lift Shares

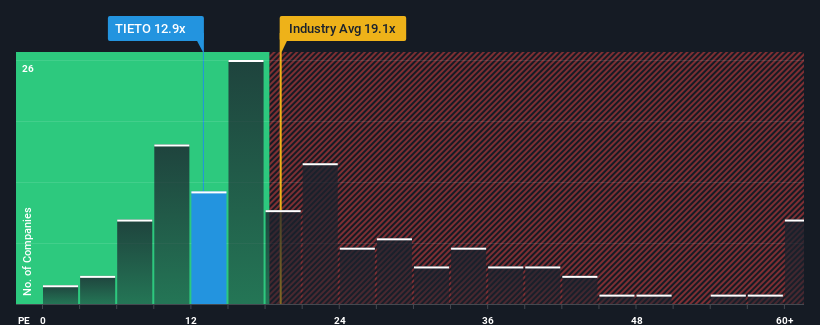

With a price-to-earnings (or "P/E") ratio of 12.9x TietoEVRY Oyj (HEL:TIETO) may be sending bullish signals at the moment, given that almost half of all companies in Finland have P/E ratios greater than 20x and even P/E's higher than 31x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With only a limited decrease in earnings compared to most other companies of late, TietoEVRY Oyj has been doing relatively well. It might be that many expect the comparatively superior earnings performance to degrade substantially, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. In saying that, existing shareholders probably aren't pessimistic about the share price if the company's earnings continue outplaying the market.

Check out our latest analysis for TietoEVRY Oyj

Does Growth Match The Low P/E?

In order to justify its P/E ratio, TietoEVRY Oyj would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 5.4%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 247% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 7.4% each year as estimated by the eleven analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 17% each year, which is noticeably more attractive.

With this information, we can see why TietoEVRY Oyj is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of TietoEVRY Oyj's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for TietoEVRY Oyj you should know about.

If you're unsure about the strength of TietoEVRY Oyj's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if TietoEVRY Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:TIETO

Undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026