Does Tecnotree Oyj (HEL:TEM1V) Deserve A Spot On Your Watchlist?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Tecnotree Oyj (HEL:TEM1V). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Tecnotree Oyj

How Fast Is Tecnotree Oyj Growing Its Earnings Per Share?

In the last three years Tecnotree Oyj's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like a wedge-tailed eagle on the wind, Tecnotree Oyj's EPS soared from €0.028 to €0.046, in just one year. That's a commendable gain of 66%.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Tecnotree Oyj shareholders can take confidence from the fact that EBIT margins are up from 28% to 32%, and revenue is growing. That's great to see, on both counts.

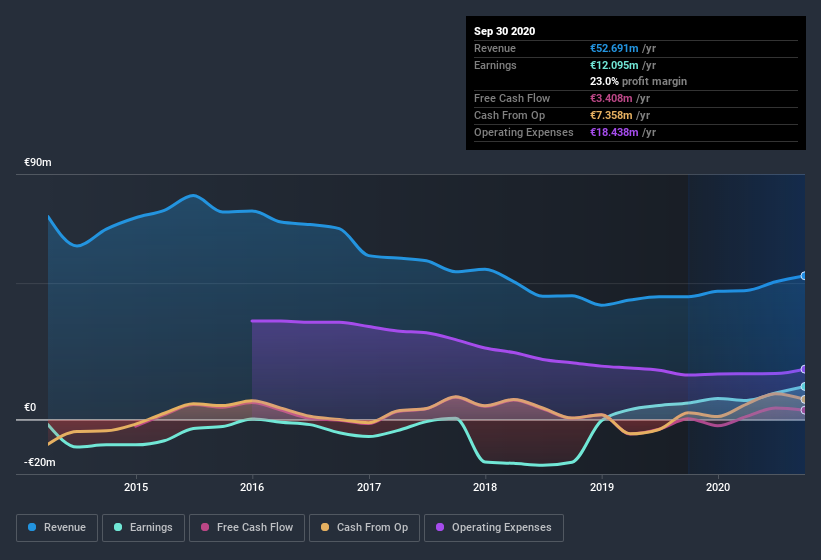

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Tecnotree Oyj is no giant, with a market capitalization of €137m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Tecnotree Oyj Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. As a result, I'm encouraged by the fact that insiders own Tecnotree Oyj shares worth a considerable sum. To be specific, they have €16m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. That amounts to 12% of the company, demonstrating a degree of high-level alignment with shareholders.

Should You Add Tecnotree Oyj To Your Watchlist?

For growth investors like me, Tecnotree Oyj's raw rate of earnings growth is a beacon in the night. Further, the high level of insider ownership impresses me, and suggests that I'm not the only one who appreciates the EPS growth. So this is very likely the kind of business that I like to spend time researching, with a view to discerning its true value. You still need to take note of risks, for example - Tecnotree Oyj has 2 warning signs we think you should be aware of.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Tecnotree Oyj or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tecnotree Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About HLSE:TEM1V

Tecnotree Oyj

Provides telecommunication IT solutions for charging, billing, customer care, and messaging and content services in Europe, the Americas, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026