If You Had Bought LeadDesk Oy (HEL:LEADD) Shares A Year Ago You'd Have Earned44% Returns

If you want to compound wealth in the stock market, you can do so by buying an index fund. But investors can boost returns by picking market-beating companies to own shares in. To wit, the LeadDesk Oy (HEL:LEADD) share price is 44% higher than it was a year ago, much better than the market return of around 5.9% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! LeadDesk Oy hasn't been listed for long, so it's still not clear if it is a long term winner.

Check out our latest analysis for LeadDesk Oy

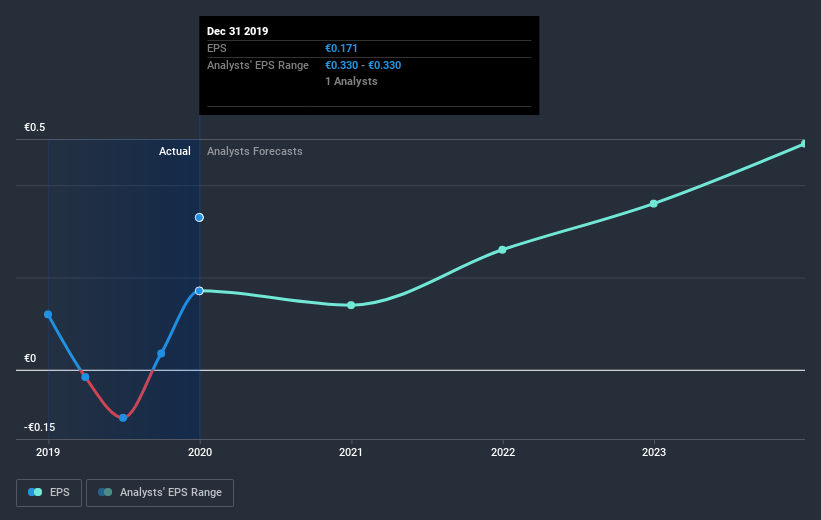

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year LeadDesk Oy grew its earnings per share, moving from a loss to a profit.

The company was close to break-even last year, so earnings per share of €0.17 isn't particularly stand out. But judging by the share price, the market is happy with the maiden profit. Some investors scan for companies that have just become profitable, since that's an important business development milestone.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that LeadDesk Oy has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

A Different Perspective

LeadDesk Oy boasts a total shareholder return of 44% for the last year. And the share price momentum remains respectable, with a gain of 59% in the last three months. This suggests the company is continuing to win over new investors. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for LeadDesk Oy you should be aware of, and 1 of them is significant.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FI exchanges.

When trading LeadDesk Oy or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About HLSE:LEADD

LeadDesk Oyj

Provides cloud-based contact center solutions for sales outreach and customer service in Finland.

Moderate growth potential with acceptable track record.

Market Insights

Community Narratives