Amid recent global market turbulence, European stocks have not been immune to the volatility, with significant declines observed across major indices in response to heightened trade tensions. Despite these challenges, the allure of penny stocks remains for investors seeking opportunities in smaller or emerging companies that might offer substantial value. Although the term 'penny stock' may seem outdated, it still signifies potential growth avenues within less-established firms. By focusing on those with solid financial foundations and clear growth prospects, investors can uncover promising opportunities within this niche market segment.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK1.894 | SEK1.81B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.35 | SEK221.59M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.69 | SEK276.69M | ✅ 3 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.48 | SEK211.72M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.40 | PLN115.24M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.38 | €50.2M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.929 | €31.11M | ✅ 3 ⚠️ 3 View Analysis > |

| Arcure (ENXTPA:ALCUR) | €4.20 | €24.32M | ✅ 3 ⚠️ 3 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €1.02 | €82.16M | ✅ 2 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.035 | €280.96M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 441 stocks from our European Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Innofactor Oyj (HLSE:IFA1V)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Innofactor Oyj offers software solutions for monitoring personal data files and log data management across the Nordic countries, with a market cap of €61.20 million.

Operations: The company generates revenue of €77.58 million from providing software, systems, and related services.

Market Cap: €61.2M

Innofactor Oyj, with a market cap of €61.20 million, is navigating the penny stock landscape by leveraging its software solutions across the Nordic region. Despite a decline in net income from €3.44 million to €0.263 million last year and lower profit margins, Innofactor's debt management remains strong with operating cash flow covering debt well and a satisfactory net debt to equity ratio of 12.2%. Recent strategic wins include securing contracts with Gävle Municipality and a Swedish technical university for its Dynasty system, highlighting growth potential through increased client acquisition despite challenges in earnings growth and short-term liabilities coverage.

- Get an in-depth perspective on Innofactor Oyj's performance by reading our balance sheet health report here.

- Understand Innofactor Oyj's earnings outlook by examining our growth report.

DistIT (OM:DIST)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: DistIT AB (publ) distributes accessories for IT, mobility, consumer electronics, networks, and data communications across Sweden, Finland, Denmark, Norway, and the rest of Europe with a market cap of SEK69.92 million.

Operations: The company's revenue is derived from several segments, with Aurdel contributing SEK1.02 billion, Septon generating SEK449.9 million, EFUEL accounting for SEK83.8 million, and Sominis providing SEK64.1 million.

Market Cap: SEK69.92M

DistIT AB, with a market cap of SEK69.92 million, is navigating challenges typical of penny stocks. Despite reporting a net income of SEK89.2 million for Q4 2024, the company remains unprofitable over the longer term with losses increasing significantly over five years. Trading at a substantial discount to estimated fair value and showing strong short-term asset coverage against liabilities, DistIT's financial health is mixed due to high debt levels and volatility in share price. While earnings are forecasted to grow substantially, past performance has been inconsistent amidst an experienced board steering operations through these complexities.

- Navigate through the intricacies of DistIT with our comprehensive balance sheet health report here.

- Gain insights into DistIT's outlook and expected performance with our report on the company's earnings estimates.

Kentima Holding (OM:KENH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Kentima Holding AB (publ) is a Swedish company that develops, manufactures, and sells software and hardware products for the automation and security sectors, with a market cap of SEK62.99 million.

Operations: The company generates revenue from its Electronic Security Devices segment, amounting to SEK60.31 million.

Market Cap: SEK62.99M

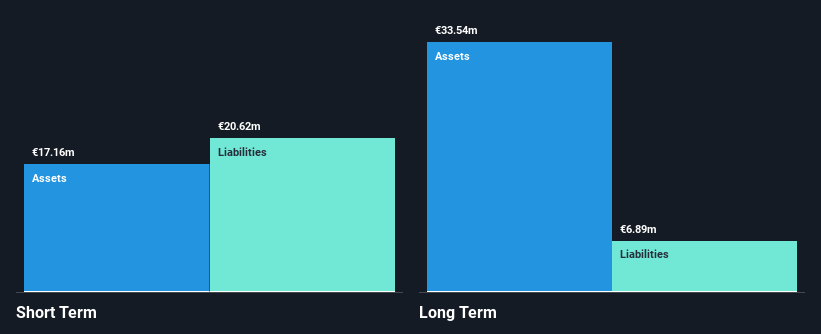

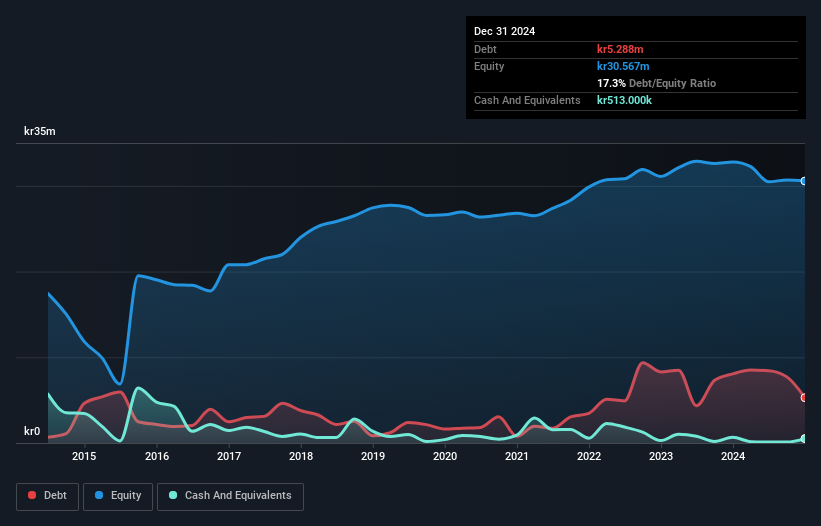

Kentima Holding AB, with a market cap of SEK62.99 million, is facing typical penny stock challenges. The company reported a net loss of SEK2.22 million for 2024, reversing from a profit the previous year, while revenue declined to SEK60.96 million from SEK67.69 million. Despite being unprofitable and experiencing increased losses over five years, Kentima maintains sufficient cash runway for more than three years due to positive free cash flow. Its short-term assets exceed both short- and long-term liabilities, offering some financial stability amidst high share price volatility and an experienced management team guiding operations forward.

- Take a closer look at Kentima Holding's potential here in our financial health report.

- Learn about Kentima Holding's historical performance here.

Make It Happen

- Unlock more gems! Our European Penny Stocks screener has unearthed 438 more companies for you to explore.Click here to unveil our expertly curated list of 441 European Penny Stocks.

- Ready To Venture Into Other Investment Styles? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kentima Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:KENH

Kentima Holding

Develops, manufactures, and sells software and hardware products for the automation and security sectors in Sweden.

Excellent balance sheet and good value.

Market Insights

Community Narratives