- Finland

- /

- General Merchandise and Department Stores

- /

- HLSE:PUUILO

3 Stocks That May Be Undervalued Based On Current Estimates In November 2024

Reviewed by Simply Wall St

In the wake of recent market fluctuations, global indices have been impacted by policy uncertainties and shifting economic indicators, with sectors such as financials and energy seeing varied performances. As investors navigate this complex landscape, identifying undervalued stocks can offer potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016) | CN¥16.63 | CN¥33.16 | 49.9% |

| Cambi (OB:CAMBI) | NOK15.10 | NOK30.20 | 50% |

| Insyde Software (TPEX:6231) | NT$464.50 | NT$927.39 | 49.9% |

| SeSa (BIT:SES) | €75.50 | €150.49 | 49.8% |

| Lindab International (OM:LIAB) | SEK226.20 | SEK450.07 | 49.7% |

| Accent Group (ASX:AX1) | A$2.51 | A$5.00 | 49.8% |

| GemPharmatech (SHSE:688046) | CN¥12.90 | CN¥25.73 | 49.9% |

| Advanced Energy Industries (NasdaqGS:AEIS) | US$109.84 | US$219.25 | 49.9% |

| Audinate Group (ASX:AD8) | A$8.82 | A$17.59 | 49.8% |

| St. James's Place (LSE:STJ) | £8.21 | £16.37 | 49.9% |

We're going to check out a few of the best picks from our screener tool.

Puuilo Oyj (HLSE:PUUILO)

Overview: Puuilo Oyj operates a discount retail chain in Finland and has a market cap of €768.95 million.

Operations: The company generates revenue primarily from its retail department stores segment, amounting to €364.50 million.

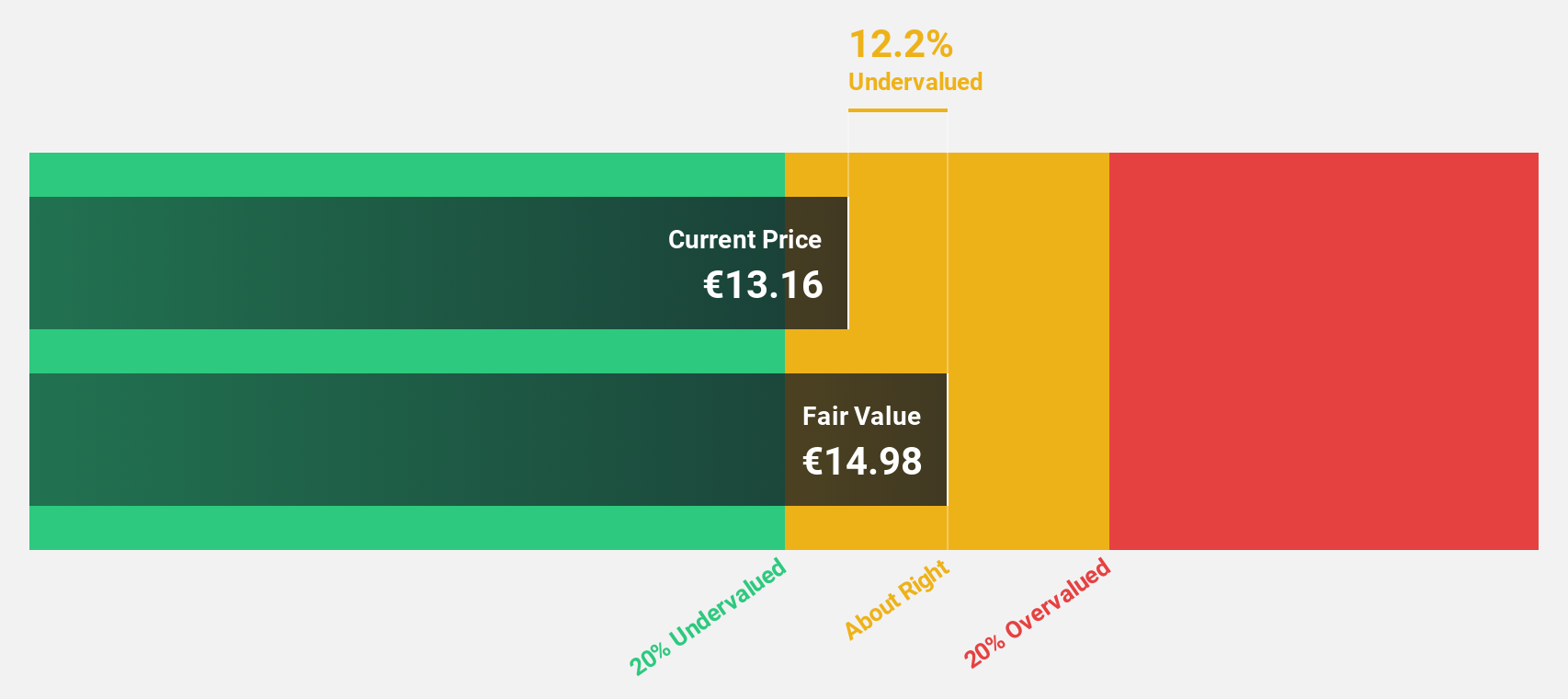

Estimated Discount To Fair Value: 32.3%

Puuilo Oyj's current trading price of €9.13 is significantly below its estimated fair value of €13.48, suggesting it is undervalued based on discounted cash flow analysis. Despite a slight revision in sales guidance for 2024, the company's earnings and revenue are forecast to grow faster than the Finnish market averages. Recent half-year results showed an increase in net income to €23.4 million from €20.2 million, reflecting solid financial performance amidst market challenges.

- Upon reviewing our latest growth report, Puuilo Oyj's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Puuilo Oyj stock in this financial health report.

Vuno (KOSDAQ:A338220)

Overview: Vuno Inc. is a medical artificial intelligence solution development company with a market cap of ₩366.65 billion.

Operations: Vuno Inc. focuses on developing medical AI solutions, contributing to its market cap of ₩366.65 billion.

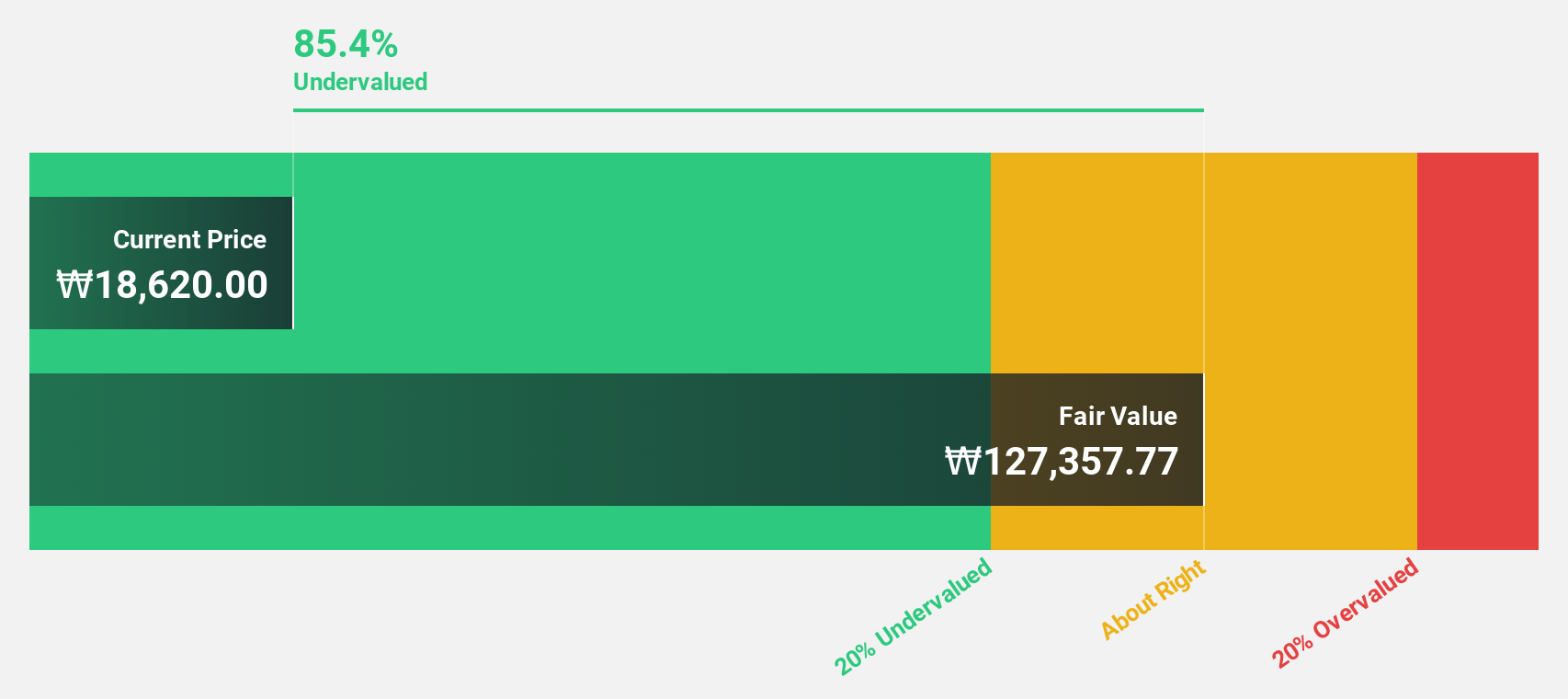

Estimated Discount To Fair Value: 23.2%

Vuno's trading price of ₩26,400 is more than 20% below its estimated fair value of ₩34,363.4, highlighting undervaluation based on discounted cash flow analysis. The company is forecast to achieve profitability within three years with earnings expected to grow at 117.58% annually. Revenue growth is projected at 44.9% per year, significantly outpacing the Korean market average of 9.8%. However, Vuno faces financial constraints with less than one year of cash runway available.

- According our earnings growth report, there's an indication that Vuno might be ready to expand.

- Navigate through the intricacies of Vuno with our comprehensive financial health report here.

Artemis Medicare Services (NSEI:ARTEMISMED)

Overview: Artemis Medicare Services Limited manages and operates multi-specialty hospitals in India and internationally, with a market cap of ₹38.54 billion.

Operations: Revenue segments for Artemis Medicare Services Limited include income from the management and operation of multi-specialty hospitals both domestically and abroad.

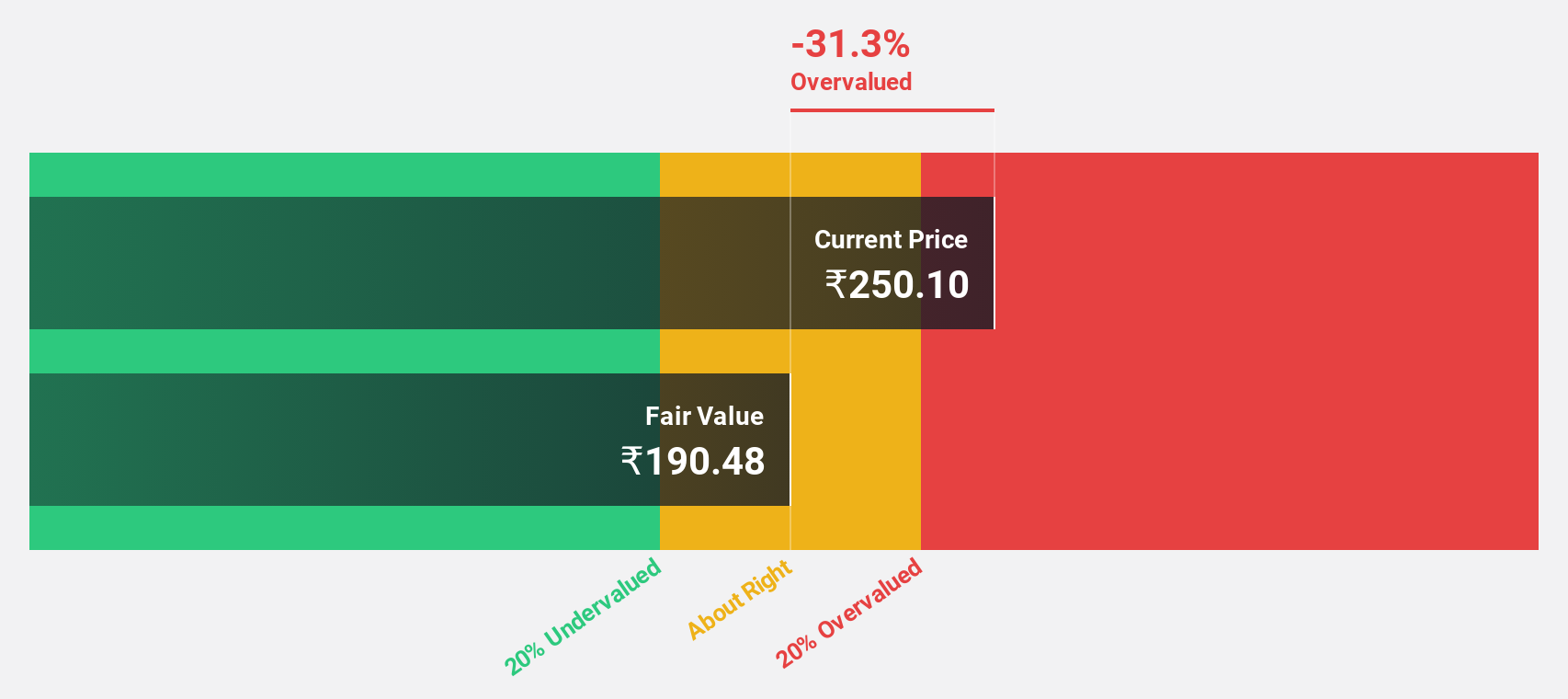

Estimated Discount To Fair Value: 42.9%

Artemis Medicare Services is currently trading at ₹280.05, significantly below its estimated fair value of ₹490.41, indicating potential undervaluation based on discounted cash flow analysis. The company reported strong earnings growth of 45.4% over the past year and is expected to maintain a robust annual profit growth rate of 35.1%, outpacing the Indian market average of 17.9%. However, its return on equity is forecasted to remain relatively low at 15.6%.

- In light of our recent growth report, it seems possible that Artemis Medicare Services' financial performance will exceed current levels.

- Get an in-depth perspective on Artemis Medicare Services' balance sheet by reading our health report here.

Turning Ideas Into Actions

- Get an in-depth perspective on all 935 Undervalued Stocks Based On Cash Flows by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:PUUILO

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives