- Finland

- /

- Specialty Stores

- /

- HLSE:KAMUX

Promising Penny Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets navigate a mixed landscape with fluctuating consumer confidence and varying economic indicators, investors are keeping a close eye on potential opportunities. Despite the term "penny stocks" being somewhat outdated, it still refers to smaller or newer companies that may offer substantial growth potential at lower price points. By focusing on penny stocks with strong balance sheets and solid fundamentals, investors can uncover hidden gems that might provide both stability and upside in today's market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$141.28M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.735 | MYR434.86M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.92 | HK$43.17B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.42 | MYR1.17B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.976 | £153.96M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.84M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.55 | £67.7M | ★★★★☆☆ |

Click here to see the full list of 5,815 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Riber (ENXTPA:ALRIB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Riber S.A. specializes in providing molecular beam epitaxy (MBE) products and services for the semiconductor industry, with a market cap of €60.34 million.

Operations: The company generates revenue of €40.83 million from its Semiconductor Equipment and Services segment.

Market Cap: €60.34M

Riber S.A. has demonstrated significant earnings growth of 872.9% over the past year, far exceeding its five-year average and outperforming the semiconductor industry, which saw a decline. The company maintains high-quality earnings with a strong net profit margin improvement from last year and robust interest coverage by EBIT. Despite an increase in debt to equity ratio over five years, Riber's cash reserves exceed total debt, indicating sound financial health. Recent sales of advanced MBE systems highlight its technological edge in semiconductor equipment, contributing to revenue growth and reinforcing its strategic position within Europe's microelectronics sector.

- Click here to discover the nuances of Riber with our detailed analytical financial health report.

- Learn about Riber's future growth trajectory here.

Kamux Oyj (HLSE:KAMUX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Kamux Oyj, with a market cap of €103.67 million, operates in the wholesale and retail sectors for used cars across Finland, Sweden, and Germany.

Operations: The company generates revenue primarily from its Retail - Gasoline & Auto Dealers segment, which amounts to €1.02 billion.

Market Cap: €103.67M

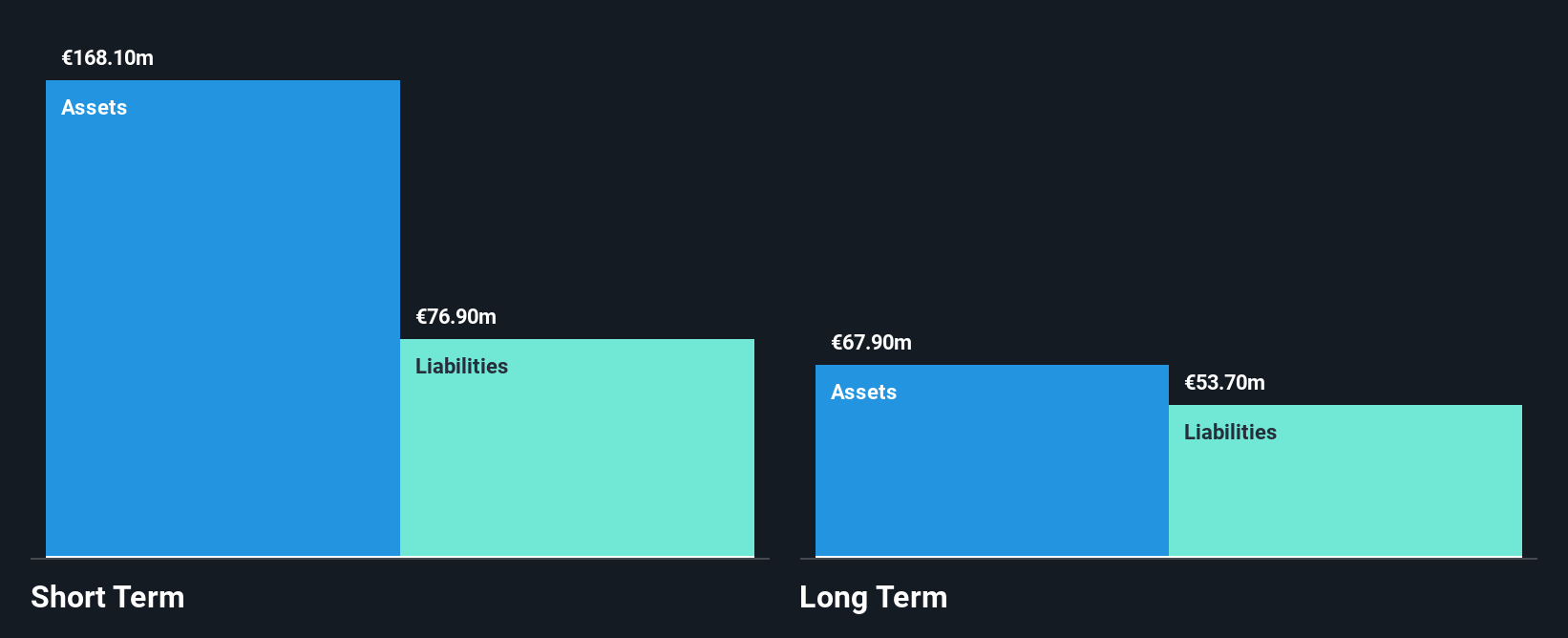

Kamux Oyj, with a market cap of €103.67 million, faces challenges as its earnings have declined by 20.6% annually over the past five years and recent net profit margins have decreased slightly from last year. Despite this, Kamux's short-term assets comfortably cover both short and long-term liabilities, indicating financial stability. The company has secured a new €50 million debt facility linked to sustainability targets which could support future growth initiatives. However, share price volatility remains high compared to Finnish stocks generally. Recent strategic expansions in Finland and Sweden aim to optimize their showroom network for better customer engagement across digital and physical channels.

- Take a closer look at Kamux Oyj's potential here in our financial health report.

- Gain insights into Kamux Oyj's future direction by reviewing our growth report.

Tai Cheung Holdings (SEHK:88)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tai Cheung Holdings Limited is an investment holding company involved in property investment, development, and management in Hong Kong and the United States, with a market cap of HK$1.82 billion.

Operations: The company generates revenue from Property Development and Leasing (HK$29.3 million) and Property Management (HK$10 million).

Market Cap: HK$1.82B

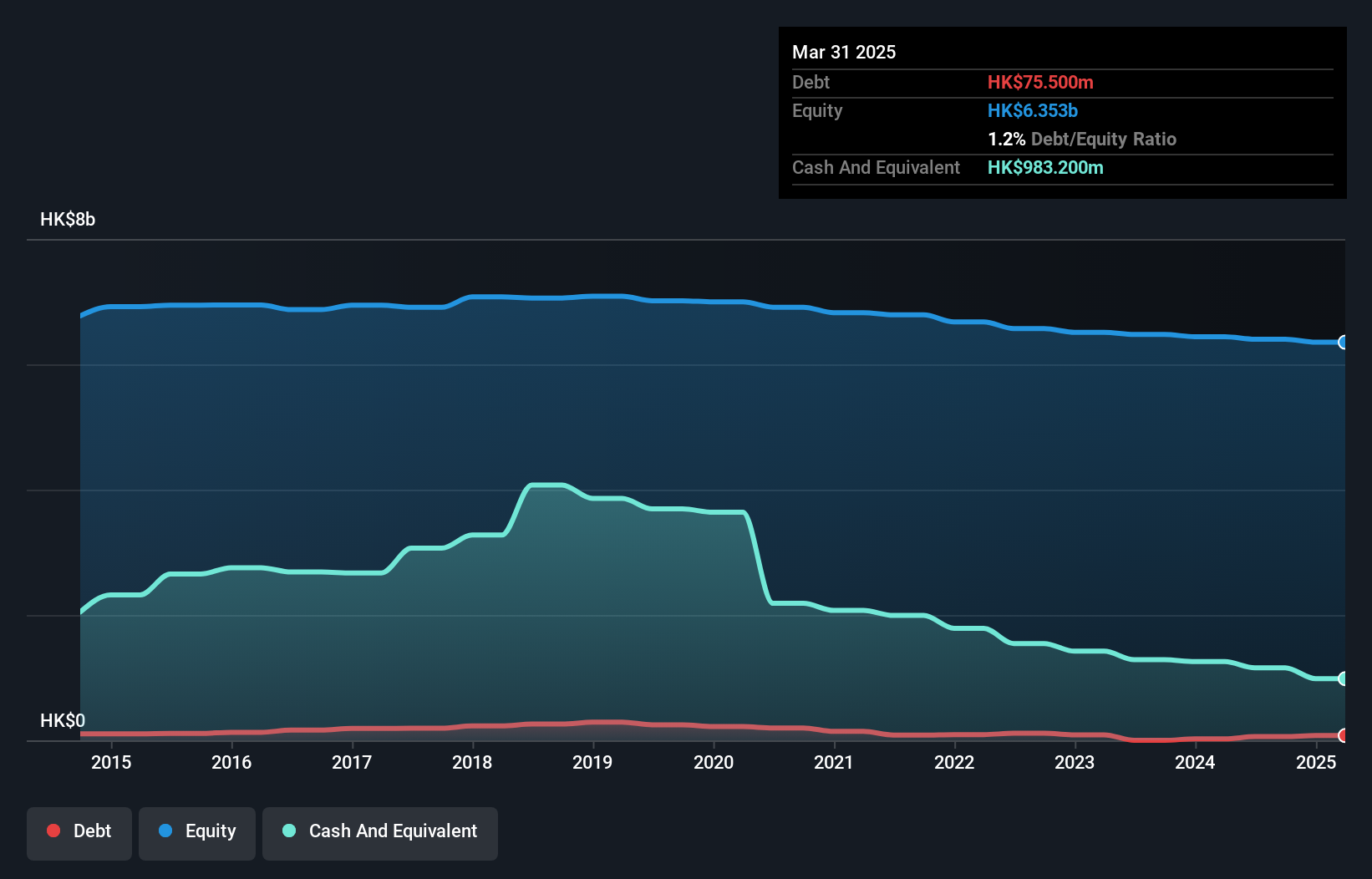

Tai Cheung Holdings, with a market cap of HK$1.82 billion, demonstrates financial robustness as its short-term assets of HK$6.4 billion significantly exceed both short and long-term liabilities. Despite a decline in sales to HK$11.8 million for the recent half-year, net income rose slightly to HK$36.6 million, showcasing improved profit margins at 34.2%. The company has reduced its debt-to-equity ratio from 3.5% to 0.9% over five years and maintains more cash than total debt, though operating cash flow remains negative affecting dividend sustainability at 8.16%. Its seasoned management team averages nearly ten years in tenure, providing stability amidst earnings volatility.

- Click here and access our complete financial health analysis report to understand the dynamics of Tai Cheung Holdings.

- Evaluate Tai Cheung Holdings' prospects by accessing our earnings growth report.

Next Steps

- Click this link to deep-dive into the 5,815 companies within our Penny Stocks screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kamux Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:KAMUX

Kamux Oyj

Engages in the wholesale and retail of used cars in Finland, Sweden, and Germany.

Excellent balance sheet and good value.

Market Insights

Community Narratives