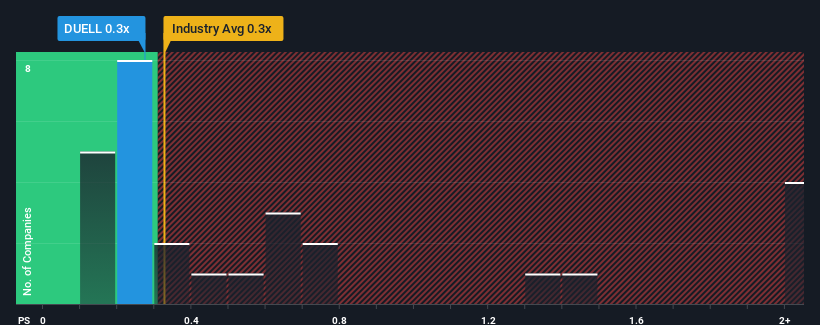

It's not a stretch to say that Duell Oyj's (HEL:DUELL) price-to-sales (or "P/S") ratio of 0.3x seems quite "middle-of-the-road" for Retail Distributors companies in Finland, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Duell Oyj

What Does Duell Oyj's Recent Performance Look Like?

Duell Oyj could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Duell Oyj will help you uncover what's on the horizon.How Is Duell Oyj's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Duell Oyj's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 4.2% decrease to the company's top line. Even so, admirably revenue has lifted 100% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 2.1% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 11% per annum, which is noticeably more attractive.

With this in mind, we find it intriguing that Duell Oyj's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Bottom Line On Duell Oyj's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Given that Duell Oyj's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

Plus, you should also learn about these 4 warning signs we've spotted with Duell Oyj (including 2 which are potentially serious).

If these risks are making you reconsider your opinion on Duell Oyj, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:DUELL

Duell Oyj

Engages in the wholesale, import, and distribution of powersports aftermarket products in Finland, Central Europe, and the Nordic countries.

Good value with adequate balance sheet.

Market Insights

Community Narratives