Orion Oyj (HLSE:ORNBV): Valuation Insights as Steady Growth Draws Investor Attention

Reviewed by Simply Wall St

Price-to-Earnings of 24.4x: Is it justified?

Based on the company's Price-to-Earnings (P/E) ratio, Orion Oyj is trading at 24.4 times its earnings, which is above the European pharmaceuticals industry average of 21.5 times. This indicates the market may be attaching a premium to Orion’s earnings relative to sector peers, suggesting possible overvaluation on this metric.

The P/E ratio compares a company’s current share price to its per-share earnings and helps investors gauge if a stock is overvalued or undervalued relative to others in its industry. In sectors like pharmaceuticals, the P/E ratio can reflect expectations of sustained profitability, competitive advantages, or upcoming growth drivers.

The implication here is that the market may be pricing in higher confidence in Orion’s earnings quality, growth prospects, or stability compared to competitors. However, with a P/E above the industry average, investors are paying a premium and expecting the company to justify it through continued business outperformance.

Result: Fair Value of €65.55 (OVERVALUED)

See our latest analysis for Orion Oyj.However, slowing revenue growth or broader sector volatility could quickly shift sentiment and challenge the current premium investors are willing to pay for Orion.

Find out about the key risks to this Orion Oyj narrative.Another View: The SWS DCF Model

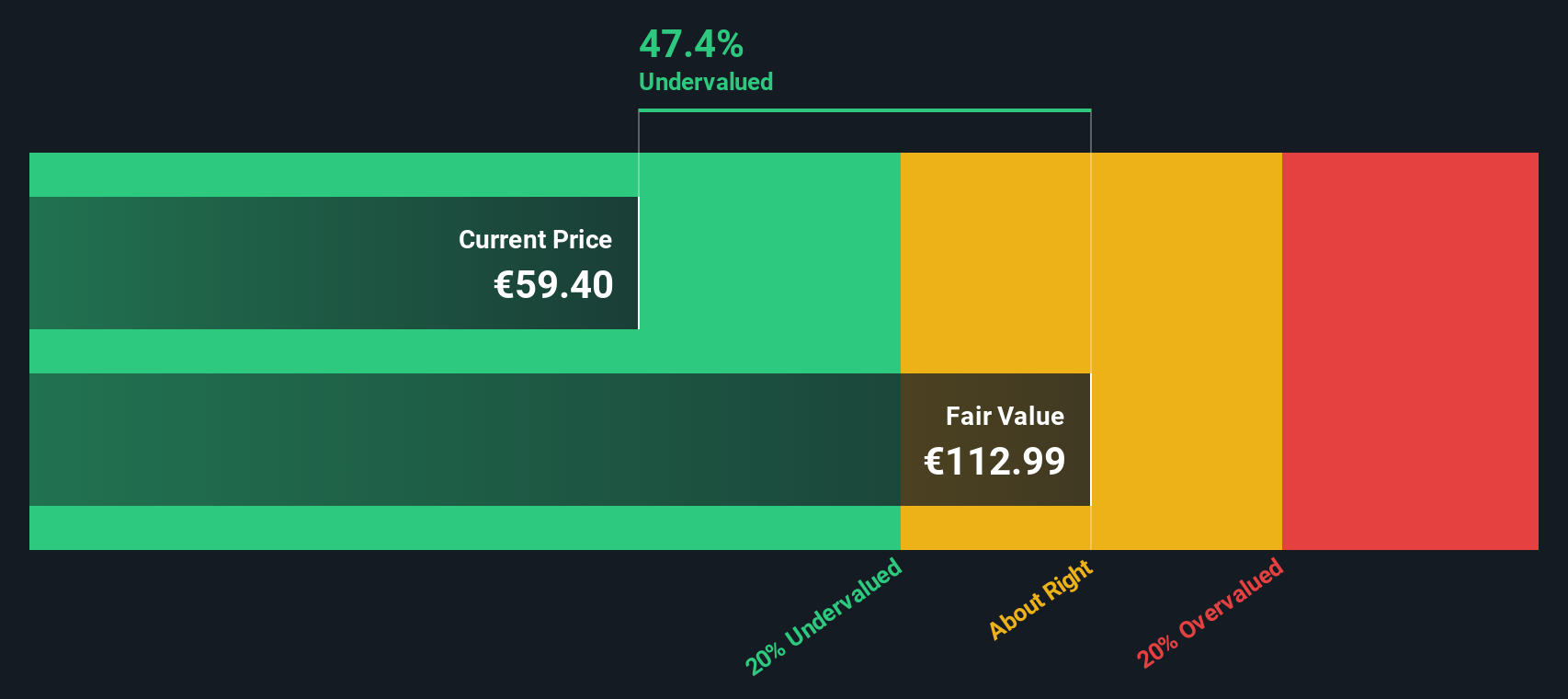

Taking a fresh angle, the SWS DCF model paints a very different picture of Orion Oyj’s valuation. Unlike the price-to-earnings method, this approach suggests the shares may actually be significantly undervalued. Which method will prove right as the story unfolds?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Orion Oyj Narrative

If you see Orion Oyj’s story differently or want to explore your own take, you can piece together your perspective in just a few minutes. Do it your way.

A great starting point for your Orion Oyj research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let a great opportunity pass you by. Use the Simply Wall Street Screener to uncover a range of stocks other investors might be missing right now.

- Spot companies handing out reliable payouts by checking out our list of dividend stocks with yields > 3% with strong yields.

- Uncover the real bargains hiding in plain sight by searching through undervalued stocks based on cash flows with compelling growth potential.

- Stay ahead of innovation and pinpoint promising healthcare AI stocks that are reshaping the future of medicine and technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About HLSE:ORNBV

Orion Oyj

Develops, manufactures, and markets human and veterinary pharmaceuticals and active pharmaceutical ingredients (APIs) in Finland, Scandinavia, rest of Europe, North America, and internationally.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives